Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

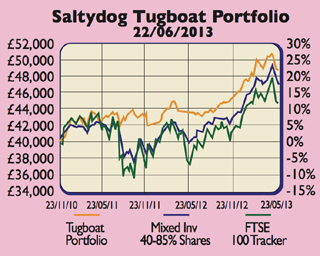

Saltydog's Richard Webb updates us on its cautious portfolio, the Tugboat.

As momentum investors, we are always seeking patterns in the markets. The picture right now is quite clear. Over the last four weeks, the only sector to have gained is the Absolute Returns' sector (remember, we're only looking at the top funds in each sector plenty of absolute-return' funds have turned out to deliver anything but). All others are now negative. The good news is that by monitoring the trends, we've been able to react.

Week by week, the downward trend has become stronger. We've responded by raising our cash holding from less than 25% to more than 70% of the total portfolio. Last week we talked about the emotional difficulties involved in selling in a falling market and realising a loss. But the benefits of acting quickly are now clear to see. In a month where the FTSE 100 has fallen by 10%, we have limited our losses, and increased our outperformance against our benchmark. We've made no changes this week.The 20th-century author William Arthur Ward said: "The pessimist complains about the wind; the optimist expects the wind to change; the realist adjusts the sails". In the last four weeks we have put away the spinnaker, trimmed the sails, and are now safely in port awaiting fairer weather.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Assuming that the American recovery continues, and quantitative easing is reduced or pulled, both stock and bond markets are likely to be in for more turmoil. It looks as though we are going into a period where finding positive returns could be a significant challenge. But as private investors, there's no need to be invested all the time, and if no obvious gains can be made there's nothing wrong with staying clear of the markets and preserving your capital it gives you the ability to reinvest when the next good buying opportunity appears.

Saltydog Investor aims to boost fund investors' returns via a simple strategy: buy what's rising, avoid what's falling. Read more here.

To sign up for Saltydog's free trial, go to www.saltydoginvestor.com.

| Safe Haven | Cash | 72% | 72% |

| Slow Ahead | CF Odey UK Absolute Return | 21% | 21% |

| Steady As She Goes | PFS Chelverton UK Equity Inc | 7% | 7% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI will change our world in more ways than we can imagine'

'AI will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China