Gamble of the week: Hidden value in support services

Despite having disappointed investors in recent months, this provider of support services offers great value for money, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

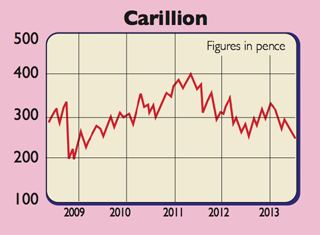

Early last year, I tipped Carillionas a buy at 315p. Sadly, the shares have fallen 18% since then. I liked the shares for their big dividend yield and thought they were cheap on seven times earnings with a yield of 5.8%. But the market has taken a dim view of the firm's prospects. The shares are now even cheaper. At 260p, they trade on 6.8 times 2013 forecast profits with a prospective dividend yield of 6.5%. So what's in store next?

The bulk of the value in Carillion (LSE: CLLN) rests with its support-services business, where it does a lot of work for the government alongside delivering projects for utilities, offering energy-efficiency services and looking after companies' properties. It also has a decent portfolio of private finance initiative (PFI) investments.

But it's still tarnished by its construction business in Britain and the Middle East. Construction projects tend to have lots of revenue and wafer-thin profit margins and are therefore given low values by the stock market. A series of profit warnings from rival Balfour Beatty has shown how tough it is to make money from this sector. Some City analysts also question the quality of Carillion's profits, especially as big construction projects give some companies the potential to be quite creative with how and when they book profits.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's also a concern that the growth in support services, and with it Carillion's dividend, has slowed to a trickle. Governments in its main markets of Britain and Canada are still outsourcing plenty of work, but future payment rates remain uncertain. A pension fund deficit of £270m is an issue too. All in all, there's plenty to worry about with Carillion. Yet I am still tempted by the shares.

Analysts expect Carillion to earn 38p per share this year and pay a dividend of 17p per share implying dividend cover of 2.2 times. Construction is a pretty volatile activity when it comes to securing dividends and sure enough it drained a lot of cash out of Carillion last year. Nonetheless, it's hard to forsee a dividend cut unless support-services profits collapse.

If I assume that the construction business is worth just four times taxed profits, then adjusting for debt, pensions and taking the directors' value of the PFI portfolio of £173m, I reckon that the current share price values that support-services business at ten times reported taxed operating profits.

Compare this with distressed peer G4S whose shares are trading at a 52-week low on an equivalent multiple of 13.7 times and I think there could be some hidden value in Carillion shares.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?