Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

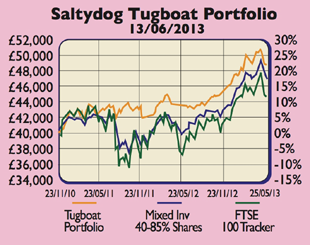

Saltydog Investor aims to boost fund investors' returns via a simple strategy: buy what's rising, avoid what's falling. Here, Saltydog's Richard Webb updates on its cautious portfolio, the Tugboat.

This week we've sold the Baillie Gifford Global Discovery and Neptune US Opportunities funds. That takes the cash position in the portfolio to over 70%. Selling into a falling market isn't easy no one likes to take a loss, and it is often easier to convince yourself that you should hang on until markets recover. But you shouldn't.

Regular readers will know we are fans of Jesse Livermore, the great American momentum trader. His view? "Losing money is the least of my troubles. A loss never bothers me after I take it. I forget it overnight. But being wrong not taking the loss that is what does the damage to the pocketbook and to the soul." We are with him!

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We have lost money in the last month. But we have still beaten both of our benchmarks and are still up 22% since our launch (a FTSE 100 tracker would be up around 11% while the benchmark we use is up 17%). As far as we are concerned, that means what we are doing is working. What next? Let's see where the trend takes us. We are ready to invest as soon as the numbers tell us conditions have become more favourable.

For more on Saltydog Investor, and to sign up for our two-month free trial, go to www.saltydoginvestor.com.

| Cash | 72% | 46% |

| CF Odey UK Absolute Return | 21% | 21% |

| PFS Chelverton UK Equity Inc | 7% | 7% |

| Baillie Gifford Global Disc. (SOLD) | 0% | 20% |

| Neptune US Opportunities (SOLD) | 0% | 6% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets