Gamble of the week: A generous insurer

With a dividend yield at over 10%, this is one insurer that will pay out. Brave investors should buy in now, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Success in insurance is all about taking more money in from premiums than you pay out in claims, and investing well to make extra money. But getting this right year in, year out isn't easy. Quantifying the risks you're insuring and charging the right price for them is critical. On top of this, insurance is a classic cyclical market; every few years a catastrophe sees insurance companies making big losses. This can unnerve investors, who then avoid the sector. That's a pity as far as one firm, Lancashire Holdings (LSE: LRE), is concerned.

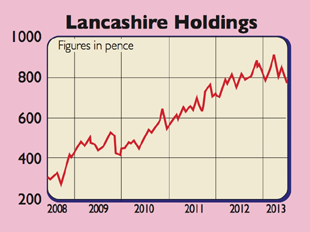

Lancashire is arguably the most successful specialist insurer quoted on the London Stock Exchange. It provides insurance in areas such as aviation, energy, shipping, property and terrorism. Over the last five years it has made the best returns on its shareholders money (return on equity, or ROE) in the sector. Moreover, those returns have been remarkably consistent. High returns coupled with low risk is what every investor should be looking for. So what are the secrets of Lancashire's success?

I'd sum them up as simplicity and discipline. It is not obsessed with becoming bigger every year. In fact, it is quite happy to shrink if that means it makes profits rather than losses. It looks after its capital very carefully indeed. If it doesn't like the prices for insurance relative to their risk it will not waste its money writing insurance; instead, it will give money back to shareholders.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

At the moment, many of its markets are quite soft there is too much money chasing too little insurance business. So Lancashire is concentrating on its core clients and preserving profits. It's also taking a very low-risk approach to investing its money, with most of it in short-dated bonds.

However, what I particularly like about this company is that it pays out most of its profits every year by way of dividends. The average dividend yield on the shares over the last five years has been more than 10% (on a rising share price) and this year should be fairly similar. On just over nine times earnings, these shares look good value.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how