Gold: why it could be time to take profits

Gold is going great guns, hitting fresh record highs in almost every currency. And in the long-term it can only go higher. But as Dominic Frisby explains, the growing mainstream interest in the yellow metal suggests that now could be a good time to take some short-term profits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You know I'm a diehard goldbug. Given the ever-deteriorating global financial situation, I think you'd be crazy to do anything with your physical gold but hoard it at the moment.

But sometimes it's good to think with the other hat on.

The debt drama in Eastern Europe (where loans have been made in stronger Western currencies, while local currencies are collapsing), is enough, wrote Ambrose Evans-Pritchard in The Telegraph at the weekend, "to shatter the fragile banking systems of Western Europe and set off Round 2 of our financial Gotterdammerung". We could have "global systemic crisis within days".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Well, last time we had global systemic crisis in October - gold actually sold off...

Now, I don't believe there's much of a case to be made for selling your physical gold, particularly if you're a UK investor and you'd be taking sterling in exchange. The bull market in gold is far from over. It looks like the last bull market left.

But I do feel some kind of intermediate-term top could be looming. And for those of you who trade some kind of gold derivative, be it a future, Exchange Traded Fund, warrant or stock, there might be an argument to be made for selling a portion for now. Here are some reasons why.

Why gold might be about to head south

Let's start with the time of year. As you can see from this seasonal chart from Dimitri Speck, gold typically makes a high in mid-to-late February.

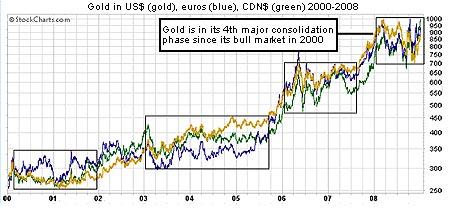

Pulling back and looking at the bigger picture (see below) we can see gold's repeating pattern of making a move up, then consolidating for a year or more before embarking on its next move. I still believe we are in a consolidation phase after last March's high. If my theory is right, then we should get another pullback soon, ahead of another big move for gold later in the year.

(Many thanks to Sitca Pacific from whose newsletter I have borrowed the above chart). In fact, from a longer-term perspective I would like to see a pullback to, say, the $840 an ounce area and a further period of consolidation. That would be in the long-term, structural interests of the bull market. Further upside here and we could easily run out of steam at $1,000 and put in a nasty double top. Of course, there is always the uber-bullish case that we rally on through $1,000 to infinity and beyond.

Enjoying this article? Sign up for our free daily email, Money Morning, to receive intelligent investment advice every weekday. Sign up to Money Morning.

It is worth noting, by the way, that in recent weeks gold has been rallying with the dollar not inverted, as some believe is the only way gold ever trades. Gold is rising against all currencies and is at all-time highs in virtually all, except the dollar and yen. Gold is proving itself the best performing asset class during a crisis of credit.

But we have enjoyed a superb run since the autumn. Gold is up almost 40% against the dollar from its October lows way more vs sterling - while gold stocks have doubled. It surely makes sense to take something off the table.

The mainstream is getting too excited about gold

Another source of jitters is the fact that I am starting to get emails from friends who had previously branded me as some insane eccentric for buying gold. They're now asking me how they go about buying the stuff. That suggests to me gold fever is spreading too far into the mainstream for now.

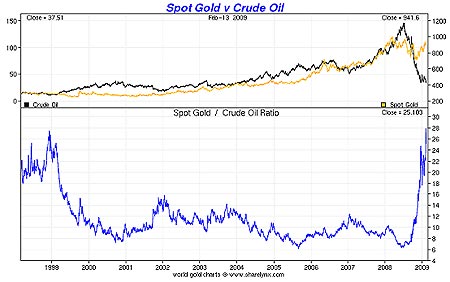

Meanwhile, as I pointed out in last week's Money Morning (See: The best asset class for the next few years gold miners), the gold to oil ratio has reached almost unprecedentedly extreme levels (see blue line below). It's at the same levels it was at the bottom of the oil market in 1999. Either gold has to pull back here or oil has to rally or, the most likely, both. At the moment oil is the better buy of the two. (In fact, one trade might be long oil, short gold).

And another contrarian indicator is Hulbert's Financial Digest which tracks recommended gold market exposure among newsletter writers. The average is about 32%, but it currently rests at over 60%. Hulbert found an inverse correlation exists between his index and the short-term market direction of gold. In other words, if the index is high, as it is just at the moment, the implication is that gold is about to head south.

Finally, one last indicator, which is our friend the COT report. This details the positions taken by traders in the futures exchanges. Broadly speaking, the more open interest there is the more bearish the outlook. The more the large speculators (green line at the bottom of the chart) are long, and the more the professional traders are short (blue line), the more bearish the short-term outlook. At the moment interest is not at extreme levels, but it does suggest we are nearer a top than a bottom.

But gold is still in a long-term bull market

Just to emphasise, I remain of the view that gold is in a long-term bull market. Gold and gold shares have a proven success record during crises of credit, just the environment we are in now, and I believe that gold shares will continue to be the asset class of the next few years. And always remember that attempting to trade gold is a highly difficult business, described by some as a fast way to the poor house. I do not recommend it.

But we gold bugs can get a bit religious in our fervour for gold and sometimes it's a good exercise to sell some if, if only to prove you can. And if we do get Evans-Pritchard's meltdown, gold will sell off just as it did in the autumn, providing us with another buying opportunity later in the year.

Our recommended article for today

Gilts could still be worth a look

An over-supply of government bonds, say many people, will inevitably lead to a fall in the value of gilts. But nobody has told the market that, and values are holding up. So what is the potential for investors?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how