Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"As goes tech, so goes the S&P 500." This US market maxim has cropped up regularly over the past few days as the major technology names have reported profits. The tech sector is the biggest contributor to the index's overall earnings, with heavyweight Apple the second-biggest stock. Before its slide last week, it was the S&P's (and the world's) top company by market capitalisation.

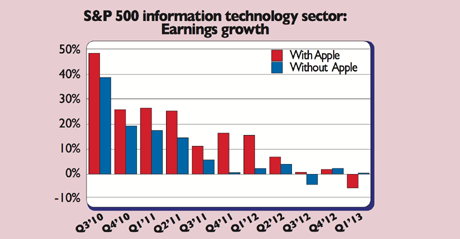

Apple has often given the sector's earnings a hefty fillip (see chart). This year, its shaky performance is expected to turn the industry's annual earnings growth negative in the first quarter (-4%). Without Apple, earnings would be marginally positive. S&P 500 earnings as a whole are set to decline slightly in the first quarter.

Tech is also an economic bellwether, "sensitive to both corporate and consumer demand", says Kathleen Brooks of Forex.com. And while the picture is obscured slightly by company-specific problems, the bad news is that the results we've seen point to a "sluggish recovery", she reckons.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Source: Business Insider

Microsoft reported flat sales of its Windows program, "which is concerning" as it has just launched Windows 8. Google reported that its profit margins are starting to tighten. IBM has had trouble closing big software and hardware deals, notes The Wall Street Journal. Intel's report is a reminder of how weak the demand for personal computers has become as people increasingly use handheld devices to surf the internet.

The lacklustre economic backdrop hinted at by the tech reports is backed up by recent data. In the ten biggest economies, the ratio of positive to negative data surprises compared to forecasts has fallen steeply of late. China's GDP growth for the first quarter underwhelmed and Europe remains in recession. The US also seems to be stuttering again now, as the latest poor payroll growth figure earlier this month suggested.

No wonder stocks have been so jittery in recent days, says Albert Edwards of Socit Gnrale. Investors have woken up to what the commodities markets have been worried about for ages the global slowdown. Stocks seem unlikely to fall too far if growth does slow, as central banks would be likely to throw yet more printed money at them. But this looks a good time to take some profits in the more overvalued markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson