Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

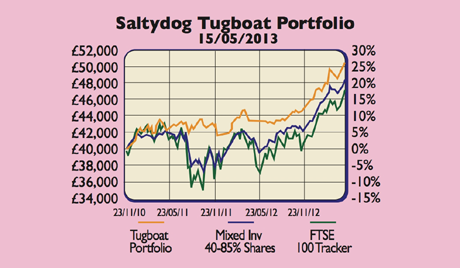

Saltydog Investor aims to boost fund investors' returns via a simple strategy: buy what's rising, and avoid what's falling. Read more at here.Saltydog's Richard Webb updates us on its cautious portfolio, Tugboat'.

Looking at the average performance of the top funds in each sector (using Investment Management Association definitions), most sectors rose for the third week in a row, with the exception of sterling corporate bonds, gilts, and index-linked gilts. In the lead were China and North America, with Japan not far behind.

So this week we've reviewed our sterling corporate-bond exposure. We've halved our holding in the Henderson Long Dated Credit fund, and put £5,000 in the CF Odey UK Absolute Returns fund. The absolute-returns sector is moving up our Slow Ahead' group of cautious' funds. This fund is up 5.8% in the last four weeks. The overall value of the Tugboat has grown by 0.7% since lastweek.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Looking ahead, the North American sectors are rising up the Full Steam Ahead' group of most volatile funds, although they still lag Japan and Europe. The shale oil and gas revolution means fuel prices continue to fall.

This will leave consumers with more disposable income, make US manufacturing more competitive, and generate many skilled jobs as the infrastructure is developed to recover this fuel. Another driver is the housing market recovery. The top US funds have risen by more than 3% in the last four weeks. We'll watch to see if this trend develops.

Sign up for Saltydog's free trial at Saltydoginvestor.com.

| Safe Haven | Cash | 26% | 27% |

| Slow Ahead | CF Odey UK Absolute Return | 10% | 0% |

| Slow Ahead | Fidelity MoneyBuilder Income (Acc) | 20% | 20% |

| Slow Ahead | Henderson Long Dated Credit | 8% | 16% |

| Steady As She Goes | Chelverton UK Equity Income | 7% | 7% |

| Steady As She Goes | Cazenove UK Equity Income | 10% | 10% |

| Full Steam Ahead | Legg Mason Japan Equity | 13% | 14% |

| Full Steam Ahead | Neptune Japan Opportunities | 7% | 14% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how