Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In 1985, I was lucky enough to sell my flat-pack furniture manufacturing business, the Furniture Factory. I invested some of the proceeds in two investment bonds. For many years, I was blissfully unaware of the non-performance of these bonds, having assumed that my financial adviser had everything under control.

When the light finally dawned, I was astounded to learn that my money had been sitting in the same two funds for the whole period, regardless of market conditions and sector performance. I decided that from then on I would make my own call on which funds to hold. After all, who better to look after your own money than yourself?

Each month, I reviewed the performance of the 40-odd funds available to me. It rapidly became clear that not all areas of the market moved at the same time or rate. That may sound obvious. Yet the financial industry largely advocates buy and hold': you stick your money in your chosen funds, then ride out the ups and downs, hoping the gains outweigh the losses in the long run.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I could not see the point of this. By instead switching sectors as appropriate, and spending more time on the ladders and less time on the snakes, the improvement in the performance of my investments was dramatic.

So a couple of years ago, I joined up with Richard Webb, the former sales director of the Furniture Factory, and David McCrae, the former technical director. Our aim was to give investors the data they needed actively to run their self-invested personal pensions (Sipps), individual savings accounts (Isas) and other investments.

Richard wrote the algorithms to track the performance of individual sectors and funds and David managed the data. The Saltydog Investor was born.

We now track over 30,000 funds (unit trusts, investment trusts, and exchange-traded funds(ETFs)) that are easy to access for British investors. With a nod to my early life as an officer in the Merchant Navy, the sectors are divided, based on their historic volatility (in other words, how wildly they swing around), into the following groups:

Safe Haven: this group consists of money-market funds and cash never forget that cash is a perfectly valid asset class.

Slow Ahead: bonds and gilts. Historically these are the least volatile funds.

Steady As She Goes: managed mixed-asset and income funds. These offer potentially better returns when the markets are stable.

Full Steam Ahead: this category is split into developed- and emerging-market equities. These are the most volatile funds, but can be the most rewarding.

Each week, the algorithm highlights the top-performing funds from within each group. As far as using this data goes, you simply want to have your money in sectors that are either safe' (as safe as is possible), or on the rise. In short, we are momentum investors' we buy what's going up, and avoid what's going down.

So when markets are weak or falling, increase exposure to Slow Ahead' funds. When times are good, favour the Full Steam Ahead' group. The exact make-up of your portfolio depends on your own appetite for risk. And don't be afraid to switch between funds many fund supermarkets and platforms make little or no charge for switching.

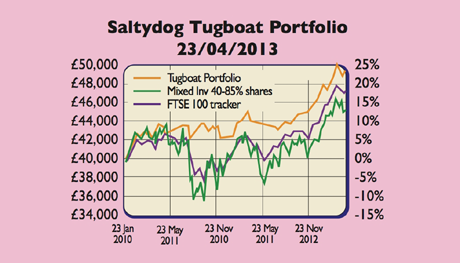

But does it work? In November 2010, we put £40,000 of our own money into a portfolio of unit trusts. The aim was to build a cautious portfolio that would avoid major market falls, but also profit when they rose. We named it the Tugboat'.

Since launching, it has avoided the crashes of August 2011 and May 2012, and achieved an annualised return of 9.7% not bad for a cautious portfolio (see chart on the above). Its current holdings (as of 3 May) are in the table below. As you can see, the portfolio is certainly cautious, with cash accounting for nearly half its holdings. Yet it is also benefiting from the upsurge in equities by being invested in today's hottest sector Japanese stocks.

The Saltydog Tugboat

| Safe Haven | Cash | 43% |

| Slow Ahead | Fidelity Moneybuilder Income | 20% |

| Slow Ahead | Henderson Long Dated Credit | 16% |

| Steady As She Goes | Chelverton UK Equity Income | 7% |

| Full Steam Ahead | Legg Mason Japan Equity | 7% |

| Full Steam Ahead | Neptune Japan Opportunities | 6% |

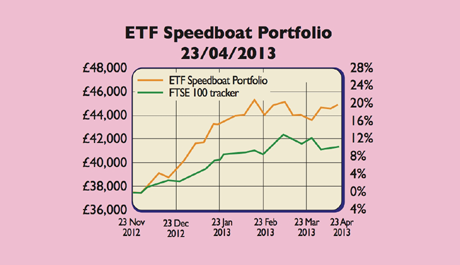

In November 2012, meanwhile, we invested £38,000 in another portfolio the Speedboat' which was designed to operate at the other end of the risk spectrum. We invested £38,000, mainly in ETFs. After five months, it's up by more than 20% (see chart below).

We report back to Saltydog subscribers on the latest fund moves each week, and issue a summary in our monthly newsletter (see www.saltydoginvestor.com). From next week, we'll be updating on the latest moves in our Tugboat portfolio in MoneyWeek, so you can see for yourself how the strategy works in practise.

Douglas Chadwick is the chairman of Saltydog Investor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.