Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Is inflation or deflation the greater danger over the next few years? Will inflation take off now that central banks have cranked up the printing presses? Or, as the deflationists expect, will the credit squeeze bear down on growth and prices for years to come?

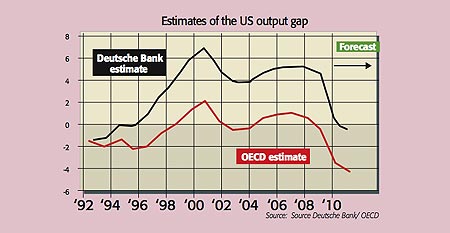

The most common argument against inflation flaring up is the so-called output gap, says Morgan Stanley. The "Great Recession" has created a gulf between actual and potential GDP, and all this spare capacity will take years to absorb. For example, the US Congressional Budget Office estimated that the output gap in the US was -6.2% of GDP in the first quarter. This implies that GDP could grow solidly for years before demand exceeds supply in the economy and it begins to overheat.

But estimating the current output gap is hardly an exact science, says Edward Chancellor in the FT. Economists can't agree on how to measure it, for one thing, and estimates of potential growth can be wrong. Take the 1970s. The Federal Reserve thought the output gap was -10% during the recession that followed the oil crisis, and so kept monetary policy loose.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But it later became clear that the oil crisis was a "supply shock", which resulted in a great deal of spare capacity being rendered obsolete (effectively destroyed) as businesses began to adjust to much higher oil prices. So overall levels of spare capacity, and potential GDP, were lower than assumed. Indeed, it was later estimated that the economy had been operating at full capacity as it entered the oil shock, so loose monetary policy caused inflation.

It could be a similar story this time round. Deutsche Bank says that US growth over the past few years was artificially ramped up by cheap credit. Potential growth was thus overstated. The unsustainable growth of recent years led to large amounts of capacity being built up notably in the residential construction and financial sectors. This is now obsolete because the unsustainable credit-driven demand underpinning it has evaporated.

With this capacity gone forever, overall capacity and hence the output gap are smaller than assumed. Deutsche calculates that the US output gap in 2010 will be a mere -0.7%; and in the eurozone, it could be -2.4% next year, compared to the OECD's estimate of -6.6%. So the risk of inflation, it concludes, is higher than investors think.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.