Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The late Milton Friedman was an American economist and recipient of the Nobel Memorial Prize in Economic Sciences. He is famous for saying "Inflation is always and everywhere a monetary phenomenon." He said that inflation was caused by excess money supply and the velocity of money.

The question we ask is "Is it possible, if money velocity remains low, that inflation might not arise even if the government printed money?" To the best of our knowledge that's pretty well what happened in Japan from 1990 huge amounts of money creation but no velocity. Deflation happened because the Japanese banks hoarded the money.

According to the economist, Arthur B Laffer, Ben Bernanke, in early 2008, did an about-turn; from fearing inflation he was suddenly scared witless by the possibility of debt deflation overwhelming the US economy. As a consequence, the percentage increase in the monetary base was the largest in the past 50 years by a factor of 10 times. But here it gets even more interesting. He says that the currency-in-circulation component of the monetary base, which prior to the expansion had comprised 95% of the monetary base, had risen by little less than 10% and, wait for it, bank reserves increased 20-fold.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It is our view that, unless economic conditions improve very significantly, banks will continue to be unwilling lenders and money hoarders. They know only too well the consequences of renewed imprudent lending policies and they know better than anybody else what demons are still lurking in their balance sheets. Taking a leaf out of Japan's book, what they will probably do is use the money to buy government bonds and with the current steep yield curve, enjoy a half-decent profit.

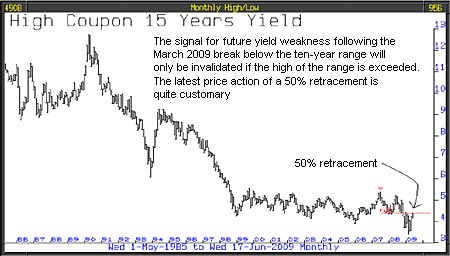

Look at the 15-year gilt yield chart. For ten years, it had been in a tight trading range. The end of such a range invariably determines the next significant move and its direction. The end in December 2008 was to the downside. The negative implications of the break below the trading range still applies - the direction of the market is determined. Although not written in stone, the odds are very much in favour of a further steep decline in 15-year gilt yields.

This insight comes from the fact that the break to the downside occurred when the consensus was widely predicting that yields would rise and inflation would get out of control. The scene seems to be set for a decline in UK yields, not an increase. If markets are forecasting-machines, what is this chart indicating? A deflationary risk and big asset price failures.

Although we have talked of selling the long dated gilts held in the model portfolio, we haven't done that yet. The chart for the Treasury 2055s below is such a tempting chart we can't bear not to own it. You will see a well established base at 92.5 and, since January 2009, declining volatility. The price of this investment only needs to get above 96 for a signal to buy, with a tight stop loss at 92.5. If we are right about the stock markets failing from here, expect gilts to soar and the fear of inflation to suddenly be replaced by the fear of deflation.

Our understanding is that the consensus fear of the MPC is deflation. That fear should not come as any surprise because readers will remember that in 2007 the Bank of England moved their final salary pension scheme investments out of assets such as equities and property into gilts.

This article was written by Full Circle Asset Management, as published in the threesixty Newsletter on 19 June 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.