Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

With Ben Bernanke, chairman of the US Federal Reserve, on record as saying that he won't raise interest rates until 2015, the current low savings rate environment is "here to stay", says Mark Dampier on Fundweb.co.uk. By contrast, yields from shares can look increasingly attractive.

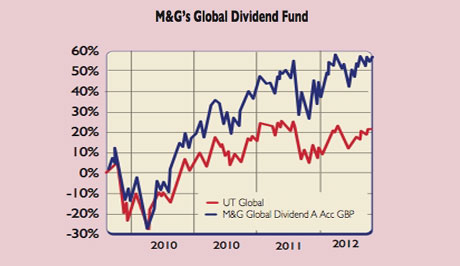

Enter M&G's Global Dividend Fund, run by Stuart Rhodes. It aims to generate an above-average dividend yield by targeting global firms with a progressive dividend policy. A high dividend yield can signal a very low share price and hence a firm in trouble, so Rhodes stresses that he does not "chase high dividend yield alone".

Instead, he looks for well-run firms that can deliver long-term growth. So far his approach is paying off launched in 2008, the fund has delivered a return of 12.4% over one year and 30.2% over three years. What's more, it has almost doubled in size since 2011 from £1.7bn to £3.6bn. That, says Ruli Viljoen, head of fund research at Morningstar, is "testament to the ever-increasing popularity of... investors' desire to diversify... and go global".

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Rhodes keeps up to 60% of his portfolio invested in "quality companies", such as Sanofi and McDonald's, 20%-30% in cyclicals and 10%-20% in fast-growing firms, says Dampier. Just over 40% of the fund, which charges an annual fee of 1.5%, is invested in north America, with 26% in Europe and 14% in Britain.

Recent purchases include iron-ore producer Vale. Rhodes also favours financials and consumer staples, but is more bearish on utility and telecoms companies. With 5% estimated dividend growth for 2012/2013, this remains a solid fund for income-seekers.

Contact: 0800-389 8600.

M&G Global Dividend Fund top ten holdings

| Novartis AG | 3.7% |

| Johnson & Johnson | 3.4% |

| Chubb Corp | 3.3% |

| Prosafe SE | 3.1% |

| Prudential | 3.0% |

| Compass Group | 3.0% |

| Sanofi | 2.9% |

| Mattel Inc | 2.8% |

| Methanex Corp | 2.8% |

| DSM NV | 2.8% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge