Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Time and again, history has shown that small-cap companies traditionally outperform their larger-cap peers in the wake of a recession. It's happened in every single one of the past ten recessions.

And we can now extend that winning streak to 11.

Since the market bottomed out, the average small-cap stock has soared 74%, outpacing the gains of the average large-cap by a full 15 percentage points.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And history is sending another loud and clear message about what lies ahead for another sector, too.

In 2010, we can expect mergers and acquisitions (M&A) activity to return in a big way. Here's why - and the three best ways to play the imminent rebound...

M&A activity: deep in the valley... but set to emerge

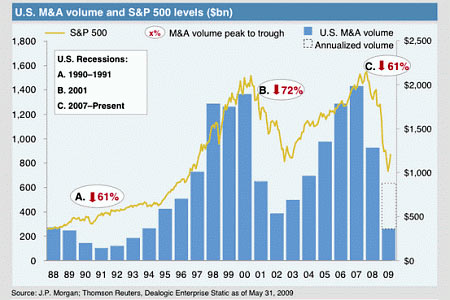

Not since the early 1990s have we witnessed such a meagre market for M&A activity...

Worldwide deal volume is expected to slump by 56% this year, according to the Organisation for Economic Cooperation and Development.

The United States has already matched the 61% drop in M&A activity that followed the 1990-1991 recession. We're not far from the 72% drop that followed the 2001 recession.

But everybody knows the M&A market is notoriously cyclical. Since we're clearly in the valley, it's only a matter of time before activity picks back up. And history is crystal clear about the timing of the turning point...

A positive macro picture for M&A

Other signs point to this M&A recession coming to an end very soon, too.

For example, the Conference Board released its latest survey of leading economic indicators last week. They rose for the eighth straight month - a clear indication that the recovery is gaining momentum.

And while unemployment remains uncomfortably high, remember that this is a lagging indicator, so we can't rely on it to signal the end of a recession. By the time the employment picture improves, the recession will be long gone - and the M&A market will be back in full swing.

In other words, the time to position our portfolios to profit from a resurgent M&A market is now.

The key fundamentals that should trigger an M&A rebound

However, I'd never base a predication solely on history, or bank on a rebound just because a chart suggests one is imminent. We need to dig deeper - which means making sure the fundamentals line up, too.

And when it comes to signaling an uptick in M&A activity in 2010, they certainly do...

Cash is everywhere

The amount of cash on corporate balance sheets hasn't been this high since 1951. In fact, Fortune 1000 companies alone are sitting on $1.8 trillion, according to Ernst & Young.

Not only that, there's at least another $400 billion in dry powder parked in private equity funds, too.

With interest rates so low, there's little incentive to hold onto cash for long. And every other time cash balances have soared, an uptick in M&A activity quickly followed. This time should be no different.

Banks are willing to lend again

In addition to record cash balances fueling deals, banks are ready to get in the mix again, too.

High-yield credit spreads - an indicator of banks' willingness to lend - continue to fall. The spread now rests below 700 basis points - within spitting distance of the historical average of 590 basis points.

Build up by buying out

While some corporations managed to increase earnings throughout the downturn, much of it came as a result of aggressive cost-cutting measures. But you can't cut costs indefinitely.

The lack of revenue growth for most corporations indicates that it will be some time before organic growth rates pick back up. To keep growing earnings then, it's natural for companies to consider strategic acquisitions - especially since countless acquisition candidates still trade at depressed levels.

So now that we've covered the reasons behind an imminent rebound in M&A activity, let's get to the most compelling investments...

The top three M&A sectors... and the best stocks within them

If you're ready to push some chips in and bet on potential takeover targets, I'd focus on three sectors in particular.

Technology

Having entered the downturn in the best financial shape, tech firms are well positioned to go on the offensive coming out of the recession. And they've got plenty of cash to do so. The titans of technology - like Oracle, Cisco, Microsoft, Google and IBM - are sitting on close to $200 billion in cash and very little debt. Plus, deal volume has been rising here already.

I'd keep an eye on Compellent Technologies (NYSE: CML). It taps into the $21 billion market for data storage with a niche focus on small- to medium-sized businesses. Some of its top competitors have already been acquired (at sizeable premiums, no less) and CML is the most compelling target left in the space.

Biotechnology

With drug pipeline woes continuing for big pharmaceutical companies, the quickest remedy is to buy compelling biotech firms.

Although no credible rumors have surfaced and management hasn't indicated that it's even interested in a deal, I'd put Northwest Biotherapeutics (OTC BB: NWBO.OB) on my shortlist of takeover targets in this area.

As I wrote back in November, the company's DCVax treatments for prostate cancer, plus the most lethal type of brain cancer - Glioblastoma multiforme - have demonstrated significant promise.

For instance, the median survival time for patients receiving Northwest's DCVax-Brain treatment checked in at 36.4 months, more than double the standard of care (surgery, plus radiation and chemotherapy).

The results prompted Dr. Ronald Warnick, Chairman of the Mayfield Clinic and Director of the Brain Tumor Center at the UC Neuroscience Institute to declare, "DCVax has real potential to become a standard therapy for glioblastoma."

In addition, Northwest's recent success in raising $2.1 million in funding (per its September 28, 8-k filing) shows that investors also believe the company's treatments hold promise. Receipt of a US patent for its automated manufacturing process could also attract potential suitors, as mainstream interest in immunotherapies picks up and big pharmaceutical companies look to secure key intellectual property.

Again, this is a small company that still has to complete large clinical trials. But for a potential suitor, the early results could be promising enough to entice them to make an offer.

Energy

As oil tycoon T. Boone Pickens famously observed, it's often cheaper to drill for oil on the floor of the New York Stock Exchange than in the ground. That's especially true now, with oil prices still well below their 2008 highs.

M&A activity is already heating up here, as Exxon's plunked down $30 billion to buy XTO Energy last week. I expect Anadarko Petroleum (NYSE: APC) to be a leading energy sector acquisition target, thanks to its steadily increasing reserves and major discoveries off the coast of Sierra Leone.

The bottom line here is that we're already seeing signs of a legitimate rebound in M&A activity. Even Warren Buffett is getting involved, as his $26 billion purchase of the Burlington Northern Santa Ferailroad firms shows.

With history and the fundamentals pointing to even brisker activity in the year ahead, I encourage you to take my prediction seriously.

This article was writen by Louis Basenese for the free daily investment email Investment U

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge