Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The majority of UK civil engineers, such as Balfour Beatty, Carillion and Costain, are in the doldrums despite huge order books and solid balance sheets. This reflects investor concerns about what will happen to infrastructure spending after the next general election.

It is certainly likely to be cut, but I don't think we'll see the Armageddon-type scenarios that are currently factored into some lowly share prices. After all, many planned investments in areas such as nuclear power, the 2012 Olympics, building for schools, water treatment plants and high-speed rail links, are key components of Britain's long-term future.

Although Galliford Try is perhaps more famous for its social and residential homebuilding activities, more than 85% of its profits are generated from its civil engineering division, Morrison Construction. At the last count it had a whopping £1.75bn order book, providing cover for 80% of its targeted revenues for the year ending June 2010.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

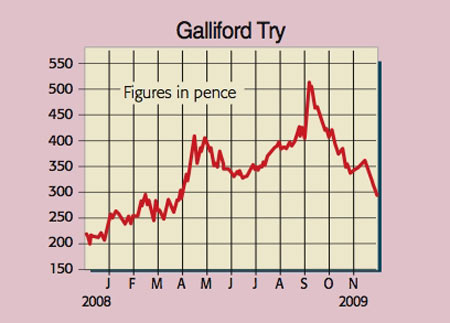

Galliford Try (LSE: GFRD)

Furthermore, this coveted division has won a raft of new contracts over the past six months, including prestigious work within the water, rail, education, prison, healthcare and hotel industries. Financially, the group is in fine shape too, after raising £119m in a seven-for-six rights issue at 285p in October. That leaves it with net funds (spare cash after deducting debt) of £153m, equivalent to 186p per share. Additionally, analysts are forecasting 2010 sales and underlying operating profits of £1.4bn and £20m respectively.

After adjusting for the firm's cash pile, that puts the stock on a miserly enterprise value to earnings before interest and amortisation (EV/ebita) multiple of less than five far too low for a quality firm that also offers a 3.4% dividend yield. As for risks, one of the biggest is that management will fritter away the proceeds from the rights issue when buying more land for its house-building arm. That's possible, particularly if we see a second downturn for the property market.

However, I believe the board is fully aware of this danger and will instead play a waiting game patiently picking up real-estate as distressed sellers are forced to bail out at rock-bottom prices. The firm is also exposed to the regulatory risks associated with managing long-term public sector contracts. For example, it was fined £8.3m (which it has appealed) by the Office of Fair Trading in September following a crackdown on price-fixing. But given the severity of the recent sell-off, Galliford still rates as a buy for more adventurous investors.

Recommendation: Speculative BUY at 306p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?