Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

For a fairly low-risk, small-cap stock, look no further than NWF Group. The firm was originally formed in 1871 and since then has withstood two world wars and numerous recessions.

The secret of its resilience is that it distributes and manufactures products in Britain that are essential for everyday life. Its largest division (46% of profits), with 13 depots and a fleet of 56 tankers, transports heating oils, diesel and other fuels to households, industrial customers and petrol stations around the country.

Demand may have declined marginally in the downturn, but its importance is highlighted whenever there is a petrol strike. The group's other two divisions make and sell animal feed to dairy farmers (32% of profits). Here, it is the number-two player behind BOCM.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

NWF also provides warehousing and haulage services (22%) to 200-odd businesses (eg, Princes, Pataks and Typhoo Tea) that supply non-perishable products to British grocery chains, such as Tesco.

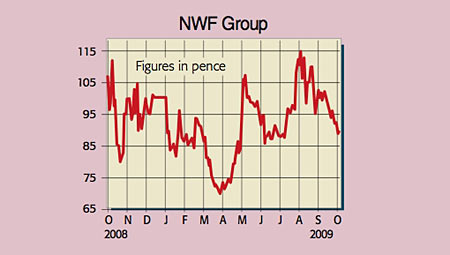

NWF Group (Aim: NWF)

Because NWF's services are vital (it provides milk, cheese and other staple goods to British families), demand is pretty consistent. Indeed, for the period ending May 2009, the company delivered record results on the back of a cold winter that boosted heating-oil demand the firm worked at full capacity.

Reassuringly, current trading is in line with expectations, boosted by continued efficiency gains and robust demand in its grocery unit. That offsets lower animal-feed volumes after an excellent grass growing season. House broker Charles Stanley is forecasting 2009/2010 revenues and underlying earnings per share of £393m and 8.9p respectively, ticking up to £404m and 10p in 2010/2011. Consequently, the shares trade on lean p/e ratios of 9.1 and 10.3, while also paying a dividend yield of 4.2%.

However, no stock is risk-free. The supermarkets will continue to tighten the screws on NWF's customers and a few could go to the wall. Commodity volatility could also hit profits, although in 2008 NWF managed to hedge this exposure. Lastly, there's net debt of £19.3m, along with the £6.7m pension deficit. But these dangers are factored into the price. I value the stock on a nine-times Ebita multiple, which, assuming sustainable 2.5% profit margins, generates a valuation of about 130p a share.

Recommendation: speculative BUY at 97.5p (market capitalisation £46m)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club