Profit as drug giants farm out testing

Bringing a new drug to market isn't cheap. So now, pharmaceutical firms are contracting research out to China in a bid to cut costs. A whole new industry has already sprung up to support drug testing. Eoin Gleeson looks at what's going on, and picks the best bet in the sector.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Big pharma is knackered. Drug makers have been doing all they can to keep churning out expensive drugs. But it's looking like their hearts are no longer in it. And who can blame them? They routinely spend billions on developing would-be blockbuster drugs, only to see the authorities fail them in safety trials. Even if they do get their drug to market, they have just a few years to recoup their money before their sales are savaged by cheap generic versions.

So it's little wonder, says Turner Investment analyst Heather McMeekin, that the number of new applications for approval submitted by drug-makers has fallen by more than 20%. Nor that the industry is slashing spending on drug research. The credit crunch saw small biotechs shutting labs and turfing out scientists. And now the pharma majors are upping sticks and moving to China to cut costs, says Sam Cage on Reuters. Novartis plans to spend $1bn on drug research in China, while Glaxo is to increase its sales in developing markets by slashing prices on its drugs by a third. In short, the big players increasingly want to make and sell cheap drugs in bulk, and not have to fret about satisfying the demands of the US Food and Drug Administration.

So is the era of costly blockbuster drugs ending? Not yet. There is a solution to big pharma's drug nightmare offload the research. Just as the car industry did in the 1970s, it's possible it can save itself a fortune by outsourcing costly tasks to specialists. A whole industry has already sprung up to support drug testing, with 500 research groups competing for contracts. There are early-stage developers conducting chemistry and animal testing in their labs before drugs are tested on humans. These are short contracts, typically bringing in less than $2m.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Then there late-stage developers recruiting human volunteers and managing the demands of the drug authorities. These contracts can add up to $100m in total and last for years. Altogether, by the end of last year, these contract researchers had taken on around $18bn worth (or 26%) of the annual $70bn spent on research in the industry.

This year, there haven't been as many contracts to fight for. As the recession bit, big pharma was quick to call off early-stage projects and direct spending into those close to commercialisation instead, says Morningstar analyst Lauren Migliore. Pre-clinical work was hit hardest early-stage specialist Kendle International had a 45% cancellation rate in the first three months of this year.

But the industry will soon thrive again. Over the next two years, nearly $70bn in sales will be lost as patents on branded drugs expire. So the big drug groups must step up the drug discovery process next year to refill their pipelines, which means outsourcing more research. Also, it will be a while before emerging markets' sales and profits can make up for lost sales at home. Even if Glaxo slashes the price of its drugs, they still won't be that affordable (the average worker in China still lives off a salary of $2,000 a year). So cutting costs at the research end to feed through to consumers is important.

Finally, we're living in an era of medical breakthroughs. We've decoded the human genome and realised the potential of stem cells. These fields alone will keep drug groups and pharma services firms busy for decades. Pharma outsourcing will exceed $26bn by 2011, says market research firm Kalorama. That's 8% growth a year. We look below at one contract research group set to rebound.

Making big profits from drug research

Contract research leader Covance (NYSE: CVD) has held up strongly this year, thanks to a surge in late-stage testing contracts, which has more than made up for the drop-off in early-stage activities. It has now risen 53% since we tipped it in March. Given that it is trading on a rich forward p/e of 17.6, now looks a good time to take profits and redeploy them into a recovery play in the industry.

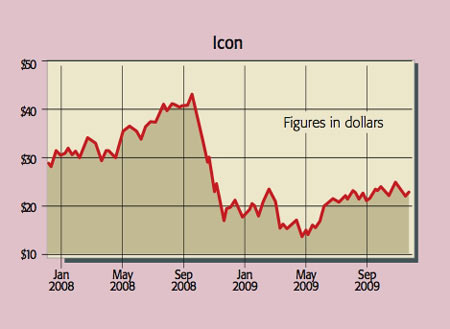

Icon (Nasdaq: ICLR) has had a tougher year, with sales dropping 2.3% in the last quarter as both its early- and late-stage contracts took a hit. Research and development spending by its clients has fallen 7% over the past four quarters, says Goodbody Stockbrokers. However, the group managed to grow its operating margins by 13.8%, as it slashed staff and administration costs. Icon takes on development work over all clinical trial phases, operating in 68 locations across 38 countries.

Employing scientists located across the world allows research groups to source cheap scientific expertise and keep projects operating around the clock. Roughly 40% of its $880m annual revenues comes from outside the US, and it has a strong competitive position in Japan. It trades on a forward p/e of 13.9, and is expecting to enjoy earnings growth of 11% next year. The group has $173m cash and total debt of $28m.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.