Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Almost a decade after the dotcom bubble burst, it seems we're close to the tipping point when internet demand finally exceeds supply. Indeed, according to experts at Nemertes Research, an American think-tank, traffic is surging by more than 60% a year, and will soon swamp existing infrastructure.

Demand is being driven primarily by the soaring popularity of bandwidth-hungry websites such as YouTube and the BBC's iPlayer. So web surfers could face regular 'brownouts' where slow connections cause PCs to freeze.

Sure, new capacity is becoming available, but not fast enough. And laying cables and buying new broadband kit is not cheap, particularly at a time when most Internet Service Providers (ISPs) are being forced to cut back. So broadband prices will have to rise in order to ration demand, especially for customers on £20 per month unlimited-use tariffs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's great news for a company such as Colt Telecom. It already owns an extensive pan-European fibre optic network including 18 centres which supply data, voice and managed IT services to business and government customers.

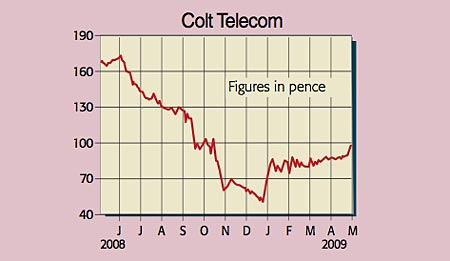

Colt Telecom (LSE:COLT)

Although prices are still depressed, Colt is already profitable and cash generative. At last Friday's first-quarter results, underlying EBITDA rose an impressive 94% to €78.9m, and net funds were a healthy €195.9m. Near-term forecasts are tricky, but the company should achieve sales and EBITDA of €2.0bn and €400m respectively by 2011. This reflects a profit margin of just 20% (up from 19% today) compared with BT's 25%.

This could be further boosted if its low-margin wholesale business is replaced by more lucrative direct sales. So I value Colt on five times its through-cycle EBITA. After adding back its cash pile, and applying a discount rate (defined on page 40) of 12% to express the numbers in today's terms, I get an intrinsic value of around 180p a share, or around 80% above the current price.

As for key risks, there are the usual twin pitfalls of a fast-changing environment and the constant threat from giants such as Telefonica and Deutsche Telecom. Small shareholders are also somewhat at the mercy of Fidelity which owns 70% of Colt. But with broadband prices set to harden, it's time to jump on board.

Recommendation: speculative BUY at 101.5p (market cap £905m)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.