Is Morrisons running out of steam?

Morrisons' latest results beat City expectations. And while there's certainly a lot to like about the supermarket chain, Phil Oakley foresees problems ahead. So should you buy Morrisons shares now?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Supermarket chain Morrisons (LSE: MRW) just managed to beat City hopes with its full-year results.

That looks like good news for shareholders. But in fact, it's not really important; what matters is growth. Can Morrisons keep growing its profits in a cutthroat supermarket sector against the backdrop of a weak UK economy?

And the bad news is that while there's a lot to like about Morrisons' business model growth seems to be grinding to a halt.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

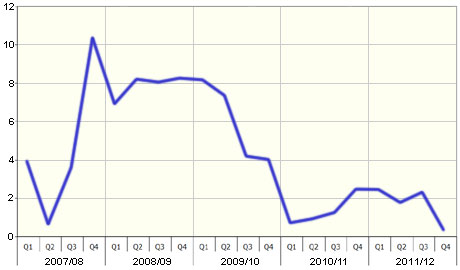

Morrisons' sales growth isn't looking healthy

Have a look at the chart below. It shows the sales growth from Morrisons branches that have been open more than a year - like-for-like (LFL) sales, as the retailer jargon calls it.

You can see that during the recession in 2008, Morrisons did very well. Its offer of good fresh food at keen prices with lots of promotions wooed customers to its stores. It took market share from its rivals.

Morrisons like for like sales excluding VAT and fuel

But during the last quarter of 2011, my calculations suggest that LFL sales grew by only 0.4%. What's changed?

All supermarkets are seeing lower sales growth indeed, Tesco's underlying sales are falling as job losses and high inflation leave consumers with less money in their pockets.

But given its value bias, why isn't Morrisons taking market share? Recent data from Kantar Worldpanel shows that the company is losing ground while rivals Asda, Sainsbury's and Waitrose are gaining market share. Discount retailers such as Aldi, Lidl and Iceland are doing even better.

And competition looks to become even more intense this year. A wounded Tesco is a dangerous beast and will probably invest money in cutting prices. WalMart is becoming much more proactive with Asda, and is doing well. Sainsbury's is promising to match lots of prices with Tesco and Asda.

It all adds up to an awful lot to worry about. So what can Morrisons do about it?

How can Morrisons grow?

Morrisons is spending lots of money on expanding its business. It added 643,000 square feet of selling space (5.2% addition to total space) in 2011 and plans to add another 700,000 sq ft in 2012. Given that it plans to open 2.5 million sq ft between 2011 and 2013/14, this suggests over 1 million sq ft will be added next year.

But if consumers aren't spending as much money, does this make sense? Can these investments make good returns for shareholders? There has to be a risk that returns fall.

Increased exposure to the south east of England where it is under-represented would be a good start. However, Morrisons' presence in areas where the grocery market is actually growing strongly convenience stores and online is virtually non-existent.

The company is trying to address that. Morrisons has been experimenting with three 'M-local' convenience stores in the north of England and plans to open another ten in 2012. The initial results are encouraging.

It's trying to do something different from the competition. It is supplying the stores from its bigger supermarkets nearby, but more importantly, it is charging customers the same prices as at its larger stores. Other convenience store operators usually charge much more. This could be a very profitable area for Morrisons.

Then there is the issue of online retailing. We agree with Morrisons that it is very difficult to run an online grocery business that pleases both customers and shareholders at the same time. However, online grocery is a £6bn market growing at 19%. It may not be profitable, but more and more UK customers are making the switch. If Morrisons doesn't offer it, grocery sales may go to others that do.

Morrisons' strategy of selling selected general merchandise online looks sensible, but this is a crowded market. Kiiddicare, Morrisons' online baby retail business, could do well but is unlikely to make a big difference to profits in the short term.

A good reason to hold the stock dividends should keep growing

So what should you do if you're an investor in Morrisons? Well, profits growth might be hard to come by for now, but Morrisons has plenty of scope to increase dividends.

The 2011 dividend rose by 11% to 10.7p per share with the company promising increases of at least 10% a year for the next two years. This leads to a dividend per share of at 12.95p in 2013. At 292p that would give a prospective yield of 4.4%, which looks quite appetising.

Morrisons remains a good business. It has some work to do, but the shares are not expensive and offer a decent dividend return. Further efficiency gains and share buy backs should support profits and the share price.

We wouldn't buy the shares now, but we wouldn't sell them either.

Disclosure: Phil Oakley own shares in Morrisons

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how