Marks & Spencer: nice yield, shame about the growth

Marks & Spencer's latest trading statement was downbeat. The company has a decent dividend yield, but growth is proving hard to come by. So is it a share to buy now? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Most pundits expected Marks & Spencer's (LSE: MKS) trading statement to be quite downbeat. And it didn't disappoint on that score.

You might think this is no great surprise - the economic backdrop is pretty miserable, after all.

But looking further out, we are starting to wonder whether the company has the right assets and business model to thrive. Can it lift it profits to a higher level and keep them there?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

History suggests that this will be difficult.

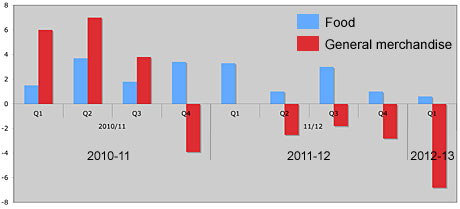

As you can see from the chart below, general merchandise continues to be a problem for M&S. Like-for-like sales fell by 6.8% during the first quarter of this financial year. Bad weather and a recession haven't helped matters, nor has its self-inflicted buying problems in womenswear.

M&S like-for-like sales (%)

But this business has been losing momentum for over a year now, while competitors such as John Lewis have fared a lot better. Until M&S can fix this part of the business, it will continue to hold the company back.

Trouble is, putting things right will not be easy. For example, trying to work out what clothes will be a hit with customers every year is tough, if not impossible. The marketplace remains fiercely competitive with lots of price-cutting and promotions. Even companies that get it right have to work hard to make money in these sorts of conditions.

M&S has identified that its stores are difficult to shop in and is spending lots of money to make them more appealing. But it needs to do more than this. It needs to broaden its appeal beyond its typical 30 to 70-year-old customers. How it does this is another matter.

Food is M&S's great strength but can it exploit it?

The company's food business is still doing well. At a time when sales at the likes of Tesco and Morrisons are falling, M&S's reputation for high quality food is intact. It looks sensible for it to devote more space in its stores to selling foods.

But this is where M&S runs into difficulties. Does it have the right type of stores to grow strongly?

It has nearly 400 Simply Food stores that are great if you want to buy a sandwich at lunchtime or just a few items, but a lot of its 243 high street stores don't lend themselves to big shopping trips.

The town centre locations mean that it's not easy to buy a trolley full of food and take it back to the car. Waitrose or Sainsbury's are much better suited to this.

The management team at M&S knows all of this. They seem to be doing their best to make things better. But they can only work with the assets that they have. Investing in places such as India and China should help profits, but the UK business looks like it's stuck in a rut.

Last year M&S's profits didn't grow, and City analysts expect no change this year either. But their expectations of 8.7% growth next year might be too optimistic as well.

The dividend yield on M&S still looks good

So with rampant growth looking unlikely over the next few years, that leaves the dividend yield of 5.3% as the main attraction. This yield is covered twice by profits and looks safe, as long as general merchandise sales don't collapse. Its substantial freehold property portfolio also means that it doesn't face the problem of paying large rents that some struggling retailers face.

However, don't expect dividends to grow much, unless the company finds a recipe for profits growth.

The shares have been drifting towards their 52-week low of just over 300p and trade on just over nine times projected earnings. If you're looking for a solid share with a decent yield, then the downside risk from here looks quite low (although of course, that's no guarantee the shares won't fall further).

But if you're looking for growth, you might be better to put your money elsewhere. I looked at some solid British companies to put on your watchlistin a recent issue of MoneyWeek magazine.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.