Does Microsoft have a future?

Revenue is up this year at Microsoft, but the software giant has been forced to confront threats from cloud computing and tablets. So should you invest? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What is Microsoft?

Microsoft is synonymous with the personal computer (PC), its Windows PC operating system and its Office software suite. On the web, the company's presence includes the Internet Explorer browser, search engine Bing and the MSN portal. It also has a dominant position in the business server market (via Windows Server and Microsoft SQL) and offers the Xbox 360 console for gaming purposes.

What is the company's history?

Founded by Bill Gates and Paul Allen in 1975, Microsoft came to prominence in the early 1980s with its disk-operating system (DOS), used on IBM computers. The first version of Windows was launched in 1985; MS Office followed in 1990. The mid-1990s saw the launch of Internet Explorer, and in 2001, the Xbox. In recent years, Microsoft has been criticised for failing to innovate, lagging rivals such as Apple, Google and Facebook, who have led the markets in tablet computers, internet search engines, smartphones and social networks.

Who runs Microsoft?

Bill Gates has stepped aside from day-to-day operations but still remains chairman. Steve Ballmer joined in 1980 and was appointed chief executive in 2000. He was paid $1.3m in 2010. Paul Klein is the chief financial officer.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How's trading?

Pretty good: the year to June 2011 saw record results for the company. Revenue rose by 11.9% to $69.94bn; operating profits grew by 12.7% to $27.16bn. Earnings per share came in at $2.69. Over the year the company paid out $5.2bn in dividends and bought $11.6bn of its own shares. Very strong sales of MS Office 2010, growth in server and tool revenues, and buoyant Xbox sales all helped. Online services continue to lose money as Bing has yet to deliver profitable sales. The core Windows business declined slightly amid weak consumer PC markets.

What's the outlook?

Microsoft expects 3%-5% growth in operating profits in 2012. The longer term is a tougher call. Microsoft's demise has been predicted many times, yet even the development of open office software hasn't ended the dominance of MS Office. The threat from cloud computing (using the internet more and PCs less), tablet devices and social networks concerns investors. In response Microsoft has set up partnerships with Nokia and Facebook and is investing in its Windows Azure cloud platform.

The analysts

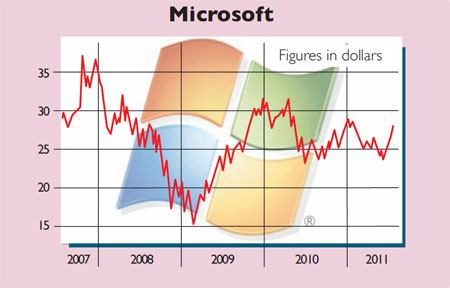

Of the 35 analysts surveyed by Bloomberg, 68% say "buy", 29% "hold" and 3% "sell". The average price target is $32.87 18% above the current share price. Most bearish is Robert Jakobsen of Jyske Bank with a $25 target. Tim Klasell of Stifel Nicolaus has the highest target of $37. Our view: cheap on a 2012 p/e of around ten times. With its strong market positions, squeaky-clean balance sheet, a policy of returning large amounts of cash to shareholders and a possible break-up that could release lots of value, Microsoft is worth tucking away.

The numbers

Stockmarket code: MSFT

Share price: $27.80

Market cap: $235bn

Net assets (June 2011): $57.1bn

Net cash (June 2011): $40.9bn

P/e (current year estimate): 10.0

Yield (prospective): 2.50%

Directors' dealings

Both Bill Gates and Steve Ballmer have sold large amounts of stock during the last year. Total sales were over 150 million shares (see chart, above) as Gates raised funds for his charities. But both retain hugely valuable holdings as the table shows. And Microsoft has strong corporate governance guidelines on share ownership. The CEO must hold tentimes base pay in stock while divisional presidents and the chief operating officer must hold five times base pay.

Director and shares held

Bill Gates: 560,977,595

Steve Ballmer: 333,252,990

Steven Sinofsky: 737,951

Peter Klein: 180,240

Stephen Elop: 261,302

Brian Turner: 714,801

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how