How to 'stress test' your shares

Tim Bennett explains six tests which you should perform on stocks before you consider adding them to your portfolio, and picks four shares that pass the tests.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The US authorities have 'stress tested' US banks to see how they'll cope with the slump. The tests weren't nearly stressful enough (unemployment is already higher than the tests estimated), but the concept is good. So here are six tests for potential stocks before you consider adding them to your portfolio.

1. Is the dividend vulnerable?

Dividends are key to good long-term returns. So you should look for a solid forecast dividend yield (the annual dividend as a percentage of the share price). But the dividend must also be sustainable no point in going for hefty payouts if they're a mirage.

To check how well this is covered, take profit before dividends as a multiple of the annual dividend. A number below two suggests the dividend could be under threat.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

2. Is the share a debt trap?

A firm struggling to generate cash flow might be able to cut capital expenditure, staff costs and slash the dividend, but it must still pay its lenders, or it'll go bust. This is a real threat today the number of company insolvencies rose 56% in the first three months of this year alone.

The solution is to seek out stocks with low 'gearing' (the ratio of debt to equity finance as a percentage) with zero being the ideal in today's climate.

3. Has fair value been forgotten?

The recent rally has seen many stocks surge from record lows. To check whether a share has been swept beyond its fair value, look at the price-to-book ratio.

This compares the current share price to book value per share (essentially a firm's balance sheet valuation). The lower the better below one technically means that you could buy the firm, sell off its assets, and still make a profit.

Right now a value of around two to three or less is a good sign. Bear in mind that this works best on firms that have lots of tangible assets, but is less effective on financial firms.

4. Check the Altman Z score

The Altman Z score looks at the chances of a company going bust. It takes five key ratios:

earnings before interest and tax (EBIT) to total assets (the company's productivity relative to size);

retained earnings to total assets (cumulative profitability relative to size);

working capital to total assets (a snapshot of a firm's ability to pay debts);

sales to total assets (how efficiently assets are being used);

market capitalisation to total liabilities (a guage of overall solvency).

It then gives each a relative weighting (EBIT to total assets gets the heaviest) and spits out a number the higher the better.

Any firm with a Z score much below two has a heightened risk of suffering financial distress in the next two years.

5. It might be solvent, but is it liquid?

Investors pay a high price for confusing solvency with liquidity. If I have a £500 watch, but no cash in my pocket, I am solvent but not liquid I'm not broke, but I can't buy a round unless I sell or pawn the watch. Similarly, solvent, asset-rich firms can hit cash-flow problems.

So, the 'quick' ratio looks at the ratio of 'current' (short-term, excluding stock for resale) balance-sheet assets to short-term liabilities. The higher the better less than one is a red flag for certain sectors such as manufacturing. Again, it's less useful in sectors such as financial services.

6. Watch for hidden nasties

Financial statements can be dry reading, but often contain valuable warning signs. First, check the audit report (it's usually just before the profit-and-loss account).

If the auditors have raised issues, particularly doubts over whether the firm can survive (this is called a 'going concern emphasis of matter paragraph'), steer clear.

Next, flick to the back for the 'contingent liabilities' note. Here lie clues about current issues that could lead to large future payouts litigation, for example.

Third, check for big asset write-downs. If a firm has paid top dollar for property or other assets in recent years, these will have fallen in value and will be recorded as an 'impairment'. You'll find details in the 'fixed asset note' further back. Even if this looks acceptable, remember that the first big hit to profits may not be the last as the books are combed for other toxic assets. (For annual reports see londonstockexchange.ar.wilink.com.)

Four stocks that pass the tests

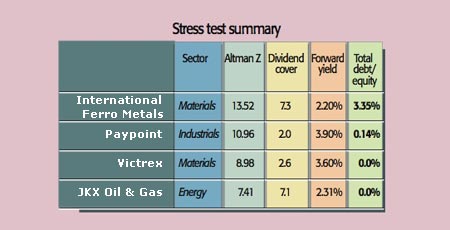

With the economic outlook still grim, Tim Price of PFP Wealth Management reckons it's better to go for "beaten-down" stocks that still pass these stress tests (see table), rather than speculative plays dependent on the market's appetite for risk.

Among the stocks he likes are International Ferro Metals (LSE: IFL), a South African miner of chromite, used to produce ferrochrome, which is a core component of stainless steel; Paypoint (LSE: PAY), which operates over-the-counter payment systems used at supermarkets, newsagents and garages; Victrex (LSE: VCT), which makes and sells a thermoplastic used in a range of industries, under the brand name PEEK; and finally, oil and gas group JKX Oil (LSE: JKX) which has operations in eastern Europe and Russia.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?