Calling the rally top could mean big profits – and this is how I hope to do it

As the euro rallies against the dollar, spread betting expert John C Burford looks to the charts to pinpoint the top.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There was a famous New Yorker cartoon a few years back that had two cavemen huddled over a fire. A third was hunched over in the back of the cave looking disconsolate.

Caveman 1: "You know since Ug invented the wheel, he just hasn't been the same".

Caveman 2: " Yeah that's all very well, but what has he done for us lately?"

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I'm sure many traders feel that way sometimes. Just after completing a very successful campaign and banking our profits, the landscape can look bare. The inspiration is gone.

But experience teaches us that the best policy is often to just take a breather from the markets at these times. The temptation is to go hunting for the next ten-bagger and feel disconsolate if we do not find one right away. This is the time when the temptation to over-trade is highest. We are hungry for more we want action!

This focus on constant action is a by-product of our life with the hourly charts. Some traders even watch every tick as if the next tick is the signal to trade. The temptation is to just jump back in an emotional decision that often backfires.

Finding the wave 2 high is the key to my next position

So, with the euro now rallying against the dollar, just as I had forecast, what is the sensible policy? After all, my remaining open position is losing its gains.

Of course, it is to do nothing and let the market do its thing. If it rallies to take me out at break even, I am happy with the profit on my short term trade. And if it turns back down, I am still happy (although more so).

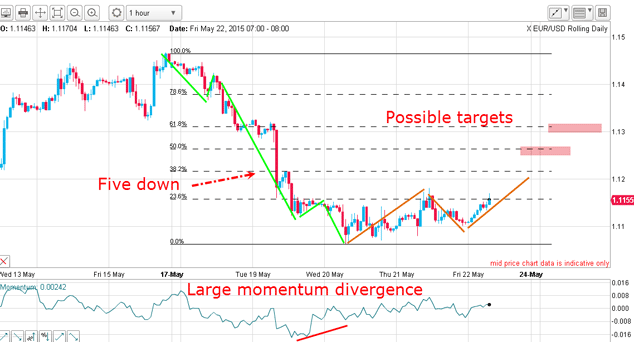

So let's take a look at the daily EUR/USD chart this morning. The market is following my longstanding red Elliott wave labels precisely so far. Since the high of last Friday, the market has declined in wave 1 (purple) and is currently rallying in wave 2.

At this point, I am uncertain how high wave 2 will reach (my chart is not necessarily to scale). But when it does turn, we shall be in wave 3 (purple) down and in the most persistent part of the large wave 5 decline.

That means I shall be anticipating the wave 2 high very keenly! Remember, moves in third waves are usually the longest and strongest. We already have a strong wave 1 down, and if this is a prelude to forthcoming attractions, the wave 3 should be spectacular.

That is why I am focusing on identifying the wave 2 high.

I think we'll see a rally (and I think it'll be big)

The market made its low on a large momentum divergence, heralding a probable big rebound.

That puts the Fibonacci 50% and 62% levels as possible upside targets. Recall, these levels are the most commonly found turning points.

Also, if we get the typical A-B-C pattern to wave 2 (marked in brown), we are currently in the final C wave.

However, because markets do not always follow my precisely detailed road map, I must allow for the possibility that the rally could be shallow and so far, it has only reached the Fibonacci 23% level. It could turn around here.

If it does, that will indicate the wave 3 down will very likely be stronger than otherwise. It would indicate extreme weakness.

One further point the current decline could be another A-B-C and not a five down. In that case, I will be looking for a wave B high prior to wave C down. But in either scenario, I am still looking for a rally high before a move down to below this week's 1.1060 low.

Either way, if I can identify the current rally top and get on board, further profits beckon.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.