Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

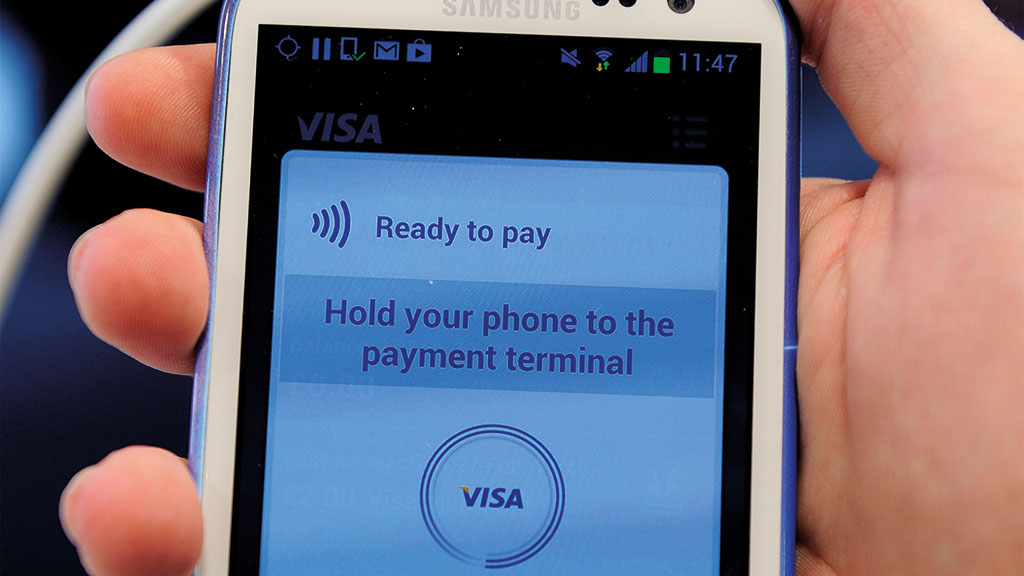

Visa has bought fintech start-up Plaid for a “whopping” $5.3bn, says Rey Mashayekhi in Fortune Magazine. Plaid has become an “indispensable piece of the fintech ecosystem”, helping connect one in four people with a US bank account to thousands of apps and services, including Venmo and Robinhood.

Visa hopes that Plaid’s technology will help flesh out its “non-card and [real-time] payments” services and this acquisition follows on from last year’s purchase of cross-border payments company Earthport.

Visa’s bet on Plaid is definitely “expensive”, but expensive “doesn’t mean wrong”, says Telis Demos in The Wall Street Journal. After all, while the use of credit and debit cards is growing, there is also a future “that doesn’t look so card-centric”, or in which “non-card payments grow even faster, especially globally”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In any case, buying Plaid can help Visa “push its existing payment tools to more customers, but also tap into growth of other networks and movements of money”.

Visa may be right to be worried by the fact that direct transfers between bank accounts using fintech apps “can bypass the traditional payments infrastructure and might over time pose a threat to Visa”, says Liam Proud on Breakingviews.

Still, its decision to pay billions for a firm that will only boost revenue by $100m a year suggests that “profiting from the fears of rich behemoths can be good business”. The big winners from all of this are likely to be Plaid’s rivals, such as PayPal’s Tink, who can now expect to command a “high valuation” from other firms worried about the future of finance.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.