Foreign exchange: where to place your bets in the world's biggest casino

No other market is as big or liquid as foreign exchange. And in recent years, it has become easier for small investors to play. Tim Bennet reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

No other market is as big or liquid as foreign exchange. And in recent years, it has become easier for small investors to play. Tim Bennet reports

Most investors only deal in currencies when they're about to go on holiday. But they could be missing a chance to profit from the most liquid market around. The foreign exchange (forex, or FX) market is by far the world's biggest. The top 20 banks in Euromoney's 2009 FX poll recorded forex deals worth $175.3trn last year. No other securities market comes close: average daily forex turnover is regularly ten times that of the equity market.

Sure, forex trading isn't for widows and orphans. But the basic rules can be mastered quickly, and spreadbetting has opened the market up to retail investors. And even if you don't fancy trading, it's worth at least understanding what drives the markets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The main difference between forex and equity markets is that forex is a zero-sum game. Currencies are all directly linked to one another. As one rises, another, or several others, fall. That means you place currency bets in pairs. Take the US dollar, for example. If you think it will rise, you must decide not only for how long, but against what yen, sterling, the euro? A basket of other currencies? You can trade around 60 currency pairs at a typical online broker these days.

The currencies tend to be split into 'major' (covering the US, UK, eurozone, Japanese, Australian, Canadian and Swiss currencies) and 'minor', or 'exotic'. The trading principles are identical, but you'll pay a bit more to trade a rarer pair the 'bid to offer' spread between the price at which you can buy and sell the currency will typically be slightly wider.

Three of the most heavily traded pairs are euro/dollar, dollar/yen and sterling/dollar. Each currency has a three-letter acronym, not dissimilar to a stock ticker. The US dollar becomes USD, sterling becomes GBP, the Hungarian forint HUF, and so on. So a bet on the sterling/dollar pair becomes a bet on GBP/USD (also known as 'cable' for historical reasons). The key point to note is that when you ask to buy or sell, your instruction refers to the currency on the left of the quote. So 'buy GBP/USD' is a bet that the pound will do well against the US dollar.

What affects exchange rates?

A currency acts as a bellwether for its country's economy. Forex traders watch economic data for clues as to how one country's fortunes are doing against another's. The most obvious factor that moves an exchange rate is central-bank interest-rate announcements. So the GBP/USD rate will incorporate the market's view on where UK and US rates are headed.

For example, if the Bank of England (BoE) is expected to raise interest rates, this will tend to be good for sterling as it will tempt those with, say, dollars, euro and yen to swap them for sterling to earn a higher rate of interest. So if you believe the next move for the UK base rate is up (by, say, 25 basis points, or 0.25%), when most others expect no change, or even a cut, you would place a trade to buy, for example, the GBP/USD, or perhaps GBP/EUR pair.

But it's not just about spotting rate trends. Growth (GDP), employment, and inflation rates all influence exchange rates. Then there are political risks. For instance, the threat of a Labour Party rebellion against Gordon Brown (see page 21) has hit sterling.

Quantitative easing (QE), or printing money, also plays havoc with expectations. On the one hand, the laws of supply and demand suggest that as more money is printed, the price of a currency will fall against others.

But signs that QE might lead to a recovery in the US, for example, have boosted the dollar, in the short-term at least, as some traders bet that the Federal Reserve will have to raise interest rates to prevent inflation from taking off (see below).

Opportunities in the major currencies

The easiest way for retail investors to play the forex markets is via spreadbetting (see below for how to go about it). But what trades look good now? Here are our views on the opportunities available in the majors.

1. Dollar/sterling: too much uncertainty

The world's reserve currency the US dollar has suffered badly since the credit crunch. The Fed's response slashing rates and printing more greenbacks has not helped the dollar. Nor have doubts about how much longer America's global economic dominance might last in the face of China's seemingly unstoppable growth. However, bulls point to recent signs of economic recovery the latest non-farm payroll figures were better than expected. Some even think that US interest rates might have to rise to quell inflation, although Pimco's Andrew Ball tells Bloomberg that any rise will be "some time coming", given the outlook for "weaker global growth". As such, the shorter-term picture for the dollar is mixed.

Much the same is true of sterling many of the policy responses are the same. The pound has enjoyed something of a recent rally on the back of better housing and consumer confidence data. But the downgrading of Ireland by credit ratings agency Standard & Poor's for a second time flags worries over sovereign debt that are equally applicable to Britain, while that unstable political situation is also bad news for sterling. So in trading terms, while both the USD and GBP are likely to be volatile, there is little clear ground between the bull and bear cases. But that's not true elsewhere.

2. The Baltic powder keg

Latvia looks set to become a major headache for Europe. Last week the Latvian government tried to sell 50 million lati ($101m) worth of Treasury bills, and failed to offload a single one. Why? Because investors have no faith in the currency, despite what The Daily Telegraph calls "staggering sums" spent by Latvia's central bank to support it.

Latvia is now an EU member, but like the other small Baltic states it has yet to join the single currency. Instead, the lat is pegged to the euro. But once the country's boom (which rested too heavily on the willingness of foreign banks to fund real-estate development and provide Latvians with large foreign-currency mortgages) ended, the peg became a problem.

In effect the lat is too expensive, so exports are crumbling, causing the nation's GDP to shrink at an annualised rate of 18% in the first quarter of this year. Unemployment has soared to 16% and is still rising. Latvia even faces another credit downgrade from S&P, despite already being rated at BB+, below 'investment grade'.

Although the government is desperate to avoid it, a devaluation of the lat is on the cards. Latvia may be tiny, but this could have "vast repercussions for the region", says strategist Bartosz Pawlowski of BNP Paribas. First off, it would trigger big losses at external banks. According to Bloomberg, the two largest banks in the Baltics, Swedebank AB and SEB AB, have a combined exposure of 366bn Swedish kronor (SEK) in Latvia, Estonia and Lithuania.

The added fear is that if Latvia unhooks its currency from the euro, its neighbours may follow. The resulting losses to external investors could put banks in Sweden and other exposed countries under serious pressure. Ambrose Evans-Pritchard in The Daily Telegraph notes that Latvia is being urged to maintain the peg, no matter what the cost is to its economy.

But, says the FT's Lex, for external investors it may not matter. Write-downs from unrecovered foreign loans to locals, caused by an overly strong currency, could wipe 35% off balance-sheet assets without a devaluation. As for the Swedish krona, it has already suffered big falls and in GDP terms Sweden's exposure to Latvia is low. So a contrarian might try selling USD/SEK, or perhaps better EUR/SEK, betting that it won't fall further. The latter trade is a play on a short-term krona rally and on the mounting troubles facing a much bigger currency the euro.

3. The Euro: under siege

"There is a clear concern over contagion risks," says Ashley Davies of UBS of Latvia's problems. Given that a string of eastern European economies enjoyed a credit and housing boom before the credit crunch, Latvia's woes could be repeated in Bulgaria and Romania. That, says Evans-Pritchard, means "a string of western European countries could face similar fallout from rising defaults in the former Communist bloc". Western banks are estimated to have lent around $1.6trn to eastern Europe. Austria's exposure accounts for $246bn of that, or 70% of its GDP.

The International Monetary Fund (IMF) is certainly worried. "There are lots of things that still have to be disclosed," says IMF head Dominique Strauss-Kahn. Indeed, the IMF reckons eurozone banks may need to raise a further $375bn, compared to $250bn for US banks. Germany in particular is suspected of hiding losses by keeping zombie banks alive with its "bad bank" scheme. Elsewhere, Spain could be facing an unemployment rate of 21.5% in 2010, according to Spanish bank FUNCAS. This adds up to a bleak short-term outlook for the euro. Short EUR/JPY looks good to us and this is also a way to profit from better news coming from the Far East.

4. The Yen: carry on climbing

Having fallen nearly 9% against the US dollar in just the past three months, the yen seems to have turned a corner. The Japanese currency hit an eight-month high this week and rose against 14 of the 16 most-active currencies tracked by Bloomberg. We think it has further to go. That's because a downturn in global stock prices increasingly likely following the recent surge "always triggers buying back of the yen", according to Takao Yahata of Mitsubishi UFJ. While further short-term lows for the yen are possible, "it is tough to see the JPY much weaker from here". In particular the bank notes that the EUR/JPY rate, at 139, and the AUD/JPY rate, at 79, look pretty "lofty". So an investor could sell both.

5. Be wary of Aussies and loonies

The Australian and Canadian dollars (known as 'loonies') have enjoyed something of a mini-boom, due primarily to surging commodity prices. The Canadian currency in particular has been on something of a "moonshot", says Saxo Bank. Canada's banks are thought largely to have avoided the worst of the subprime crisis, so a bout of money printing by the central bank is unlikely. Meanwhile, the Aussie dollar has been "on top of the world", thanks to the country's exposure to China. Beijing has been on a commodities shopping spree, while the US dollar has remained weak (most commodities are priced in the greenback). That's presented a lifeline to the export-dependent Aussies.

However, a short-term correction is overdue for both currencies. A drop in energy prices, as speculators take profits and China snaps its purse shut, could drag both down. Investors looking to take advantage could sell AUD/JPY, as noted earlier, and also CAD/JPY, or buy USD/CAD.

The best minor forex plays

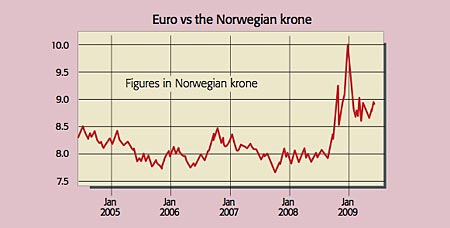

"We are very positive on the Norwegian krone (NOK) almost regardless of what happens in the broader market, as the currency is simply undervalued," says Saxobank. Recent warnings from the Norges Bank about banking losses have unnerved some analysts, but the country's economy still looks relatively strong.

As Barron's notes, Norway enjoys both a current account and fiscal surplus and has a very low credit default swap spread a measure, in effect, of national bankruptcy risk. And the strong oil price is good for the Norwegian economy too. A short EUR/NOK position looks like a good way to profit.

Meanwhile, Morgan Stanley sees potential for the South African rand, via a short USD/ZAR or EUR/ZAR position. That's because 28% of South Africa's exports head for Asia. China's growth may slow short-term as the effect of a huge fiscal stimulus wears off, but this exposure, coupled with "the unexpected resilience of the platinum price" (40% of exports), should continue to boost the economy. Net inward investment to South Africa has risen by R16.4bn since the start of the year, higher than many analysts expected.

This reveals a degree of renewed confidence among external investors who may (somewhat oddly) be encouraged by the 1.8% slump in economic output for the fourth quarter of 2008. That was a rather better performance than Britain, America, or the eurozone. Industrial output rose 8.6% in February, notes What Investment, during a period when it fell 12.5% in Britain. South Africa remains a high-risk emerging market, but right now those risks lie to the upside.

How to play the forex markets

You can open a currency trading account with a bank or broker, but minimum deal sizes tend to be large $50,000 or even $100,000 is common. So for most investors by far the easiest way to play currencies is via an online spreadbetting account.

Let's say you're bearish on the short-term outlook for the UK economy versus America. You decide to sell GBP/USD. Your online dealing screen (or phone-based) quote is 16134/16137.

This tells you that the current offer price is 16134 'pips' or 'ticks', while the bid price is 16137. Each pip or tick is $0.0001 (currencies are usually five-figure quotes). So 16134 equates to $1.6134. The three pip gap between the bid and offer price is the broker's spread.

Next, decide what to bet per pip. For example, at IG Index you can choose between the standard contract where one pip is worth $10, or a mini version, where one pip is $1. Your broker will want a deposit paid upfront into an account, with the size depending on the volatility of the pair you've chosen and whether you go with the full, or mini, contract. On the GBP/USD pair it's either £1,000, or £100 for the mini.

You should set a stop-loss to limit losses should a trade backfire in this case, if sterling strengthens rather than weakens. This will raise the cost of a trade, usually by widening the spread slightly, but also limits the damage should sterling move against you. Remember, this is spreadbetting, and you can lose a lot. Be aware that your broker may impose a 'minimum stop distance' of, say, five pips, so on the maxi contract you stand to lose $25 (about £15) even if your stop is activated.

Let's say your bet pays off, and political turmoil causes the GBP/USD spread to move to 15650/15653. You close out for an overall profit for 16134-15653, or 481 pips. At $1 each that's $481 (just under £300) all tax-free. Assuming that was your only open trade, you will also get your initial deposit back.

Most spreadbetting providers offer a 'practice' account where you can trade with virtual money, and it is well worth doing so before you commit real cash.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.