Dollar will rise against weak euro and pound

The dollar looks like it might be on the way back up after its best performance for three and a half years. But the real reason behind the rise is not that the dollar is strong – it's that the euro and sterling suddenly look even more fragile than the greenback.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

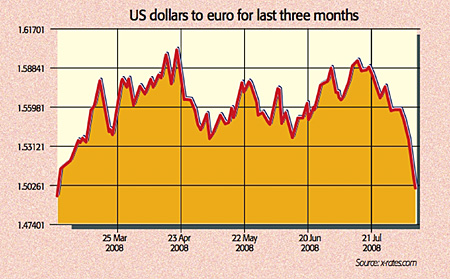

"Sentiment has turned 180 degrees," says Commerzbank's Ulrich Leuchtmann of the recent surge in the US currency. Last week the dollar index, which measures its value against a basket of currencies, put in its best performance in more than three and a half years. On Friday alone the greenback recorded its strongest 24-hour rise against the euro since 1999 and had climbed to a six-month high by the start of this week. Meanwhile, the pound tumbled to a 21-month low, close to $1.90. It seems that "following almost six years of straight decline, the greenback is making a vigorous beginning to what may prove a jittery recovery", commented Ian Campbell on Breakingviews.

What's behind the rise? "Talk and numbers," says Campbell. Part of the dollar's turnaround is down to a change of tone from Federal Reserve chairman Ben Bernanke. Having slashed the federal funds interest rate by a total of 3.25% over seven meetings between September 2007 and April this year, the rate has since been held at 2%. However, his recent comment that US inflation is "too high" consumer prices jumped 1.1% in June, the second-highest rise since 1982 raises the prospect of a US rate hike. Then there was encouraging American manufacturing data suggesting the economy may not be in freefall. As Rosemary Righter put it in The Times, "the PMI (Purchasing Managers Index) has held remarkably steady the sector is adding jobs and export orders are healthy". A falling oil price down around 20% from its July peak should also ease input costs.

The eurozone, until recently a beacon of strength, is now "heading into a recession from which it will struggle to recover" amid a "torrent of appalling data". Last month's eurozone PMI came in at 47.8 below 50 is considered a contraction the lowest reading since November 2001. Meanwhile, the confidence indicator fell at a faster rate than anytime since September 2001, dropping from 94.8 to 89.5 between June and July. While several eurozone countries are known to be in trouble, such as Italy and Spain, it is previously rock-solid Germany that has caused most of the latest concerns for the European Central Bank (ECB). Monthly retail sales, in a market that accounts for 28% of the eurozone, were down more than 1%. As Peter Garnham says in the FT, the data "quashes expectations of higher interest rates... the euro's recent joyride is over".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The outlook for sterling, which hit a 26-year high above $2.10 last spring, is also grim. On Monday, a survey of 1,000 business leaders showed that a third expect redundancies at their firms; the CEO of the FSA recently warned the financial services industry to prepare for a downturn similar to the early 1990s recession. So while CPI (consumer price inflation) is well above the 2% target at 4.4%, "the Bank of England will feel happier cutting rates sooner rather than later" to try to protect growth, says Paul Robson at RBS. As BNP Paribas analyst Alan Clarke notes, swap rates already suggest a 50 basis point cut by the middle of 2009. With the recent gloom that has enveloped the dollar now shifting to the euro and sterling, "the dollar is in a genuine recovery", says Stephen Jen of Morgan Stanley. Its rise against both currencies "could run much further".

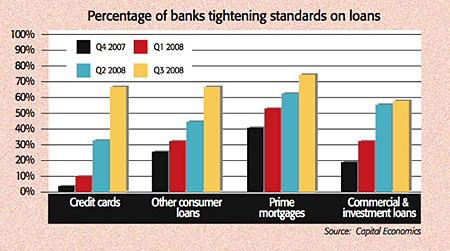

The big picture: the worst lies ahead

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King