Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

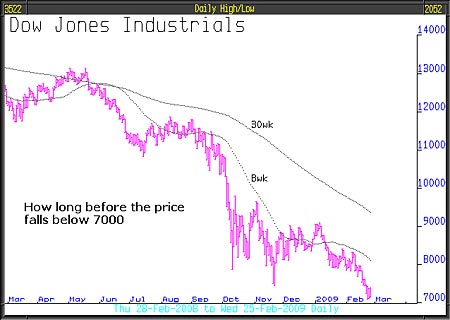

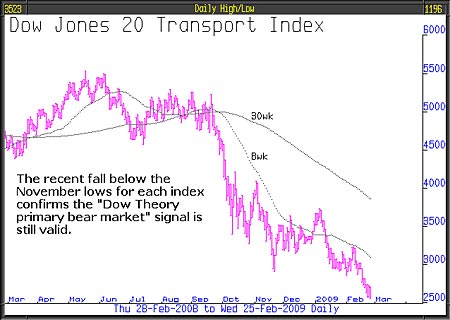

These past two weeks have been of considerable importance. The ongoing optimism that the stock markets had bottomed, and that it was only upside from here, has given way to the reality that those lows, seen by the consensus to be secure, have broken down. Psychologically, nothing worse can happen; it's the kind of condition which, if it develops further - as we expect it to - will cause many investors to abandon all hope. And so it will lead into the third and last phase of the "primary" bear market which could take major stock markets of the world down as much as another 50% - a view that we have long held and often repeated.

In the previous issue of the threesixty newsletter, number 589, we published the Dow Jones Industrial Average and the Dow Jones Transport Index, demonstrating Dow Theory. We said then "One or two more bad days could lead to a breach of the support levels which will deliver a new Dow Theory primary bear market signal." We said the two levels were 7,800 and 2,867. Both levels have gone, and so we do have a new primary bear market signal of considerable merit.

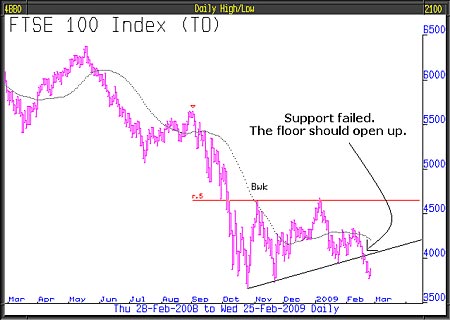

Similarly, the FTSE key support level of 3,900, which we publish regularly, has also given way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If we are right about this, and the next leg of the bear market is genuinely under way, then our bear note investment should continue to move strongly higher. Since its issue on the 6th November 2008, it's up 34%.

We make this simple observation: what is under way here is a primary bear market of historic proportions. Nothing anybody does will prevent it from completing its journey. It's a natural force, it's the tide going out actions by the authorities around the world will have very little effect upon that natural force and at best will only delay its progress. More likely than not, any such delay will be followed by a ferocious period of weakness.

On Tuesday, 24th February, Ben Bernanke gave one of his bi-annual testimonies to the Congress Banking Committee which had a positive effect on the market, the S&P 500 rose 4% and the Bank of America and Citi each rose 21%. They were encouraged by statements such as this "The Treasury will buy convertible preferred stock in the 19 largest US banks if stress tests determine they need more capital to weather a deeper-than- forecast recession. The shares would be converted to common ordinary shares only as extraordinary losses materialise." It's one of those 'sounds good but means nothing' statements that authorities like to dish out. Market optimism makes no sense because the probability is that extraordinary losses will materialise and so the preference shares will be converted to ordinary stock and the banks end up nationalised. For a day or so, it is enough to prompt some short covering by those who were short bank stocks and give the market a relief rally, following what had been quite a few days of negative price action.

We generally have separate headings for the Housing Market, Unemployment, Consumer Spending and Corporate Earnings. We will probably return to these as and when there is evidence of improvement, but in this issue, will only write about "unilateral retrenchment" which has been a regular feature of our comments over recent issues of threesixty. Of all the prevailing conditions in today's scary marketplace, "unilateral retrenchment" is the kiss of death for both the economy and asset values. To explain; what follows is from the Financial Times. "UK business investment for the fourth quarter 2008 was sharply down. Credit restrictions and slumping demand prompted companies to slash expenditure plans and business investment which is estimated to have fallen 3.9% compared to the third quarter 2008 and 7.7% compared to a year ago". We have said all this before, but it has to be repeated, employment levels will continue to fall, spending will continue to decline and house prices will continue to lose value until companies and consumers return to borrowing and spending.

The optimist will say the problem is the banks lack of willingness to lend; however, there is also a lack of willingness to borrow because to be over-leveraged in a marketplace of depleting revenues and squeezed margins, is to add to the possibility of one's own collapse. This was highlighted by the Financial Times, who on the 25th February, reported that companies' need to preserve cash is magnifying, not reducing, because it has been forecast that corporate bankruptcies will reach levels not seen since the 1930s.

So there is an unstoppable process underway. As virtually all companies cut back, all companies become more vulnerable to failure. If one company decides to go in the opposite direction and borrow and invest, that action, unless supported by all other companies, will hasten their own demise. The inevitable ongoing global economic contraction and stock market failure is therefore likely to drive mercilessly on.

We have reported before that the conscientious study of charts will invariably provide an early signal of a change in the direction of the primary market from bull to bear and from bear to bull. We know of no historic example where this has happened when technical analysis would not have delivered the answer.

So we will continue to hold our view until either or both of the fundamentals and the technicals give us cause to think differently and absolutely nothing that is going on today suggests such a likelihood.

This article waswritten by Full Circle Asset Management,and published in the threesixty Newsletteron 27 February 2009.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King