Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

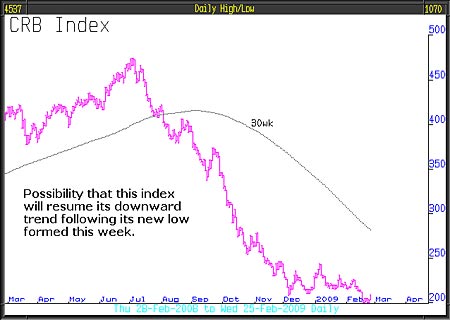

Anyone with doubts about the voracity of the collapsing global economy, only needs to look at the CRB Index, an index of commodities, to see that something truly important and very serious has happened.

Since December last year, a base formed as commodity prices stopped falling. That base has now been violated and unless it recovers quickly, is almost certainly a harbinger of further global economic decline. Of all the charts we look at, for the time being we think this is key.

We print again the chart for crude oil. This, unlike the CRB Index, continues to consolidate at its December levels but now has a bias, to our eye, to the downside.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We think, looking at the chart and understanding the economic conditions, that a break below $32.40 is more likely than a break to the upside above $50. We look, in the model portfolio, to invest in an ETF that benefits from a declining oil price if the low is violated. Such a move for the oil price will also give added support to our macro view.

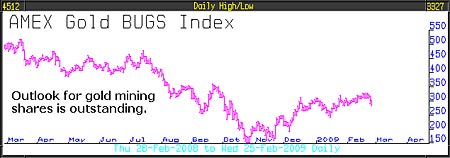

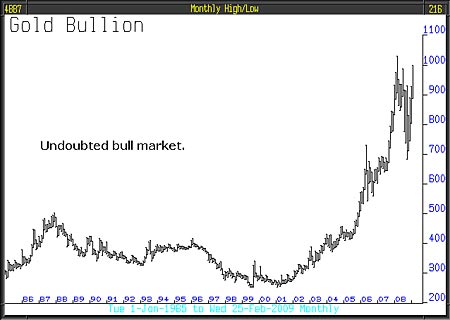

Since two weeks ago, gold has yet again hit $1,000/oz but this time gold mining shares, as illustrated by the Gold Bugs Index, are at a significant discount to the gold price compared to March 2008 when gold last exceeded $1,000/oz.

The strong gold price is driven by sound fundamental reasons and the lower oil price makes the mining of gold much more profitable, given that energy represents 25% of gold mining costs. Discounted gold mining share prices and a weak oil price equals a great investment opportunity we think that is an important message and reason to be very optimistic about the future performance of gold mining shares.

There have been a number of news items of particular interest, not least the report that the Russian central bank is to increase its gold holdings. It has said that it wants 10% of its reserves in gold which would be 1,200 tonnes, up from 495 tonnes.

We believe that gold might have entered its third, most profitable and crucial final bull market stage of euphoria. The one indisputable fact is that the long-term chart for gold gives evidence that gold is a primary bull market that, as yet, is unfinished.

This article was written by Full Circle Asset Management, and published in the threesixty Newsletter on 27 February 2009.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how