The charts that matter: a new hope?

The gap between yields on short and long-dated US bonds turned positive this week, after having briefly turned negative. John Stepek looks at how this affects the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Merryn and I won't have a chance to record a new podcast until early next week, but if you missed last week's, we talked all about negative bond yields and the end of the monetary system as we know it (among other things that are now out of date, such as shutting down Parliament). Check it out here.

Please don't miss the MoneyWeek Wealth Summit in November. With the state of the world right now, it promises to be one of the most informative and valuable ways to spend a Friday you could hope to have this year, and Merryn and I would like to see you there. It's in London on 22 November find out more here.

If you missed any of this week's Money Mornings, here are the links you need:

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: Here's why the idea of a bubble in passive investing is flawed

Tuesday: It looks as though we're heading for another general election

Wednesday: Gold is back here's the key price it needs to break through next

Thursday: Three important events you missed while Parliament squabbled yesterday

Friday: Believe it or not, markets have had a pretty good week

Currency Corner: What's next for the US dollar?

Subscribe: Get your first 12 issues of MoneyWeek for £12

Have you been watching our Money Minute videos? Let us know what you think. Drop us a line at editor@moneyweek.com (put "Money Minute" in the subject line) or contact me on Twitter at @John_Stepek.

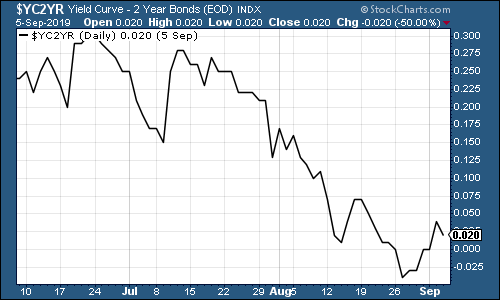

Onto the charts. The yield curve isn't inverted any more (for a reminder on why the yield curve matters, here you go). In short, the gap between the yield on the ten-year US government bond and the yield on the two-year has gone back to being positive having briefly turned negative (in other words, it costs the US government more to borrow for ten years than for two, which is the normal course of things).

Trouble is, once the reversion has happened, it doesn't matter if it un-inverts. You've still got a pretty reliable indicator that a recession is coming. What does that mean? Well, again unfortunately, while it's a reliable indicator (as far as these things go, which is not terribly far), the recession can happen anything up to two years later. And meanwhile, the stockmarket may continue to rise for some time.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

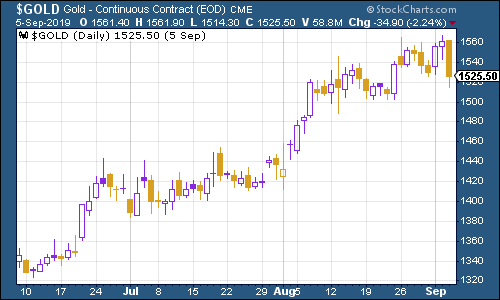

Gold (measured in dollar terms) fell back towards the end of the week as hopes for new trade talks between China and the US, plus pretty solid US economic data, boosted investors' hopes that a recession might not happen as early as they think.

(Gold: three months)

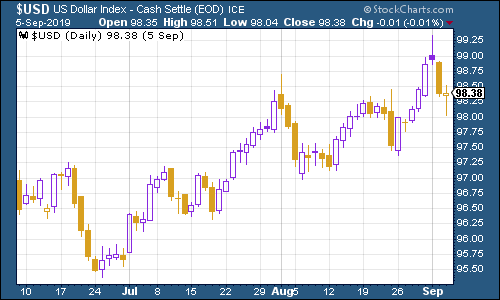

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners surged then weakened. Again this is probably a "risk-on" trade (people buy US dollars when they're nervous, but they're happy to sell and invest in riskier climes when they're not).

(DXY: three months)

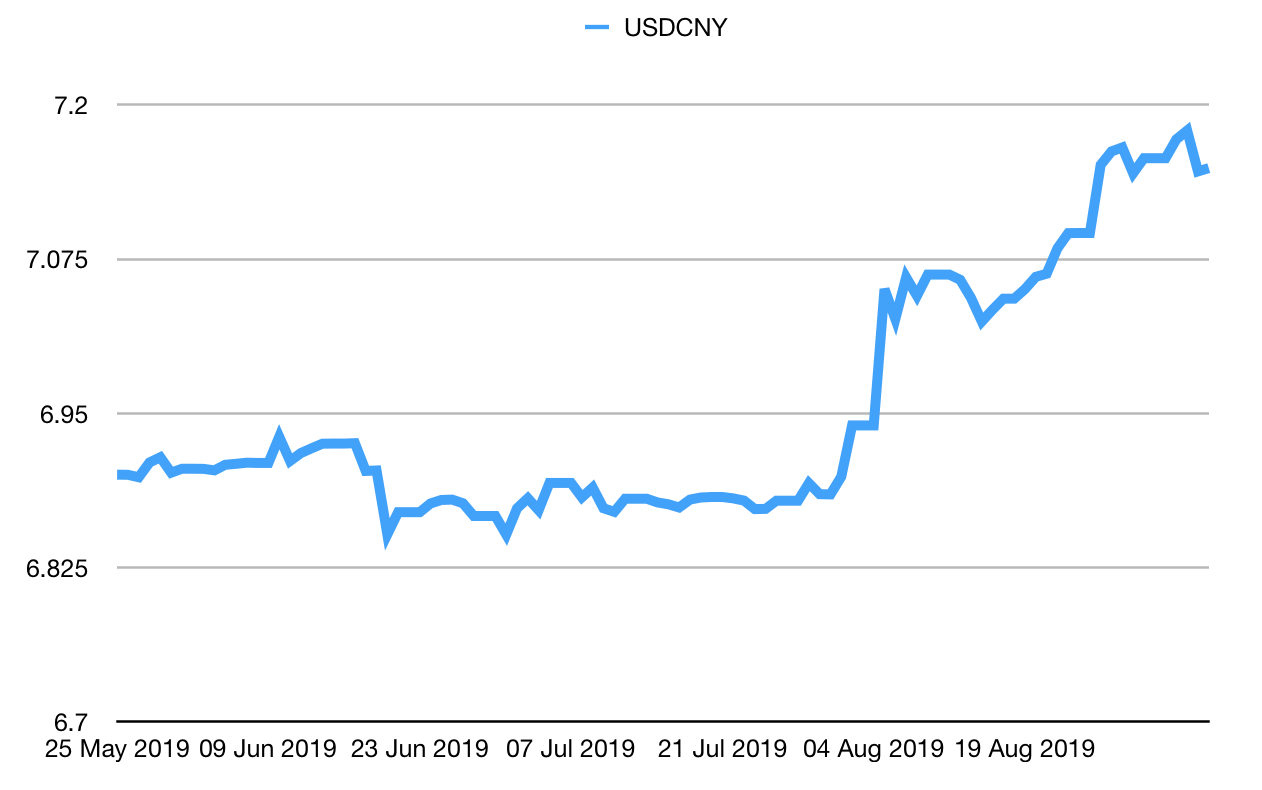

Meanwhile, the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) remained above the 7.0 level but fell towards the end of the week as the US currency weakened a little.

(Chinese yuan to the US dollar: three months)

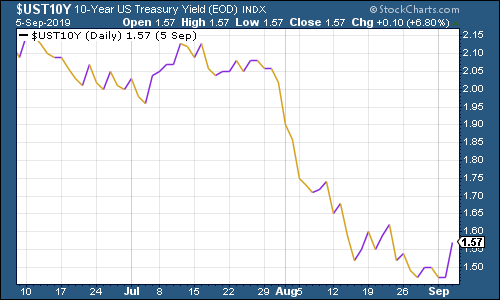

As for ten-year yields on major developed-market bonds yields rose as bond prices fell, which is again, typical of "risk-on". Here's the US ten-year yield:

(Ten-year US Treasury yield: three months)

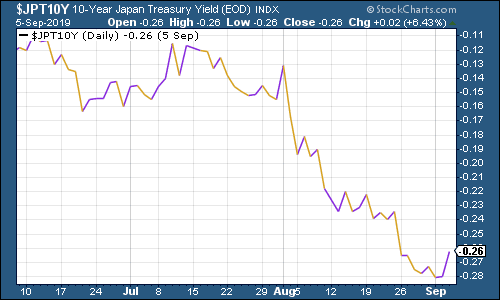

And Japan:

(Ten-year Japanese government bond yield: three months)

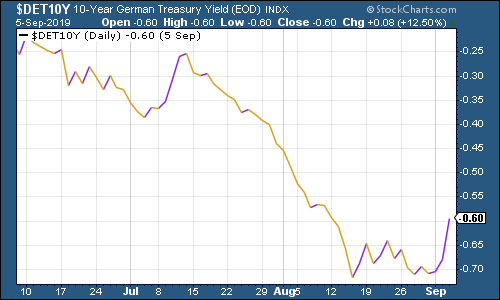

And even Germany managed a rally (finally)...

(Ten-year Bund yield: three months)

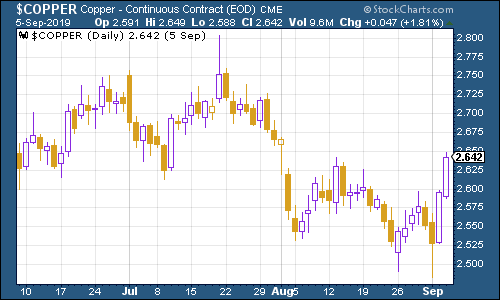

Copper rebounded along with hopes of a trade deal.

(Copper: three months)

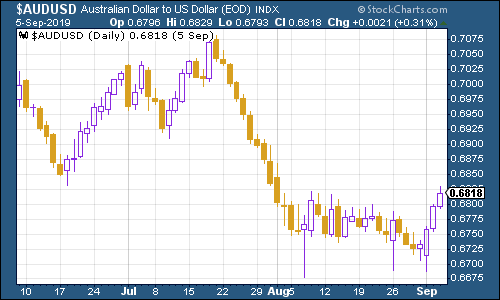

The trade deal was also good for the Aussie dollar which rallied sharply, helped by the drop in the US dollar. News that house prices are rallying after a prolonged slump (due to lower interest rates) probably helped sentiment too.

(Aussie dollar vs US dollar exchange rate: three months)

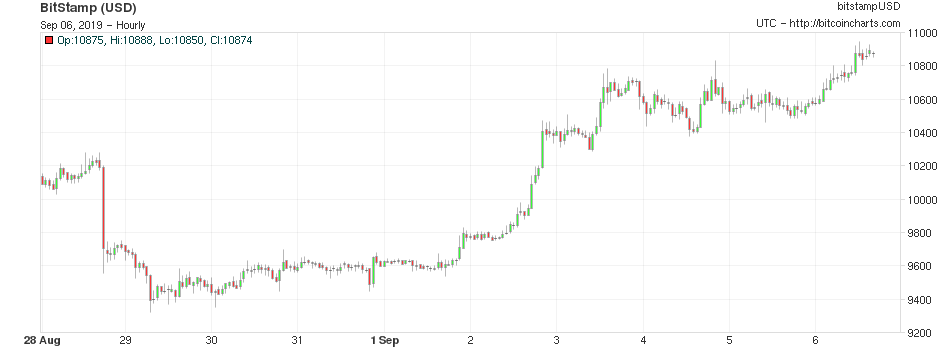

Cryptocurrency bitcoin had a good week too which does rather suggest it's not the digital gold substitute that lots of people are trying to bracket it as.

(Bitcoin: ten days)

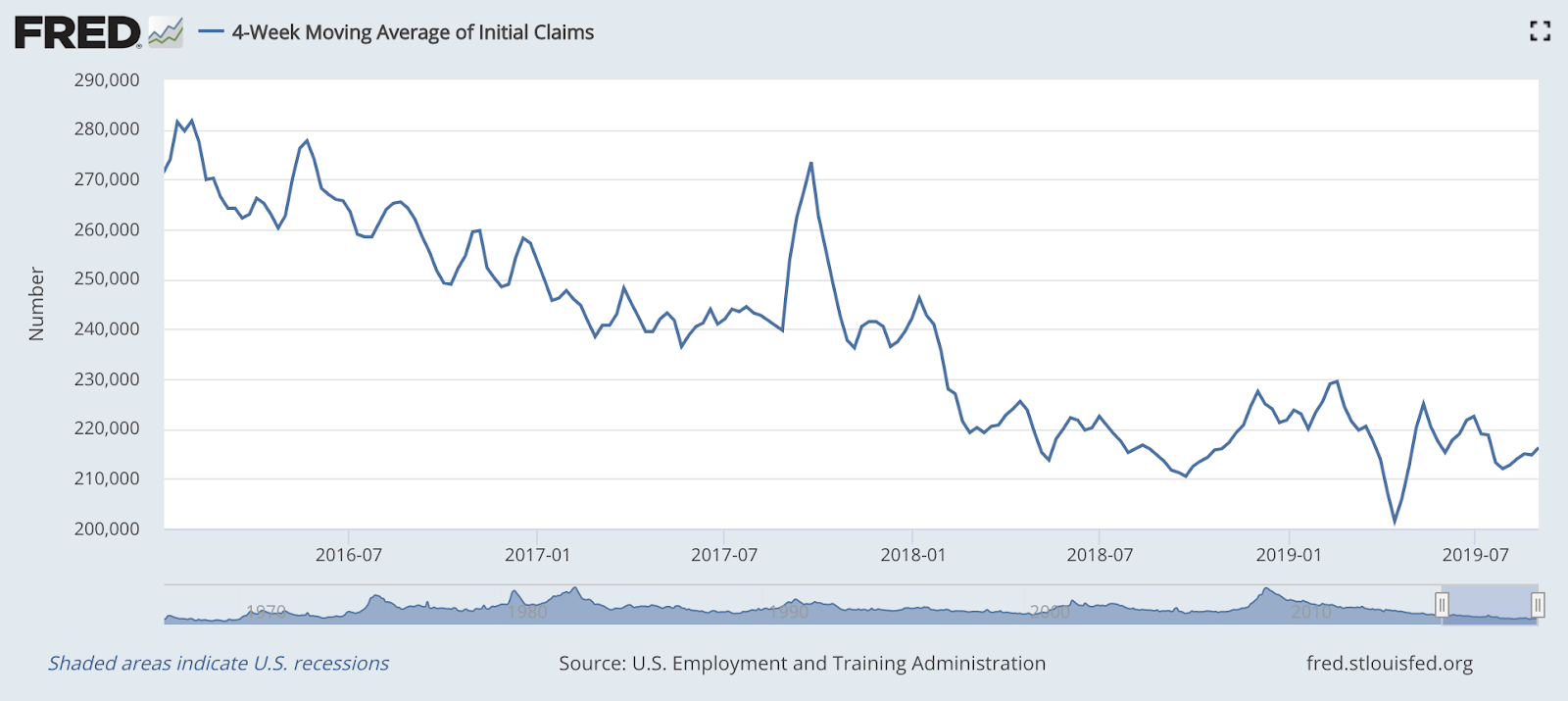

US weekly jobless claims came in at 217,000. The four-week moving average edged higher to 216,250.

US stocks typically don't peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (remember that this again, is from a tiny sample size, originally highlighted by David Rosenberg at Gluskin Sheff). The last low came about three months ago, at around 201,000.

This week's non-farm payrolls report sent out a few mixed signals. On the one hand, fewer jobs were added than expected. However, the percentage of people with jobs rose and wage inflation was also higher than expected. The combination of higher wages and fewer hires might suggest that the labour market is simply now so tight that employers are having real trouble filling positions.

(US jobless claims, four-week moving average: since January 2016)

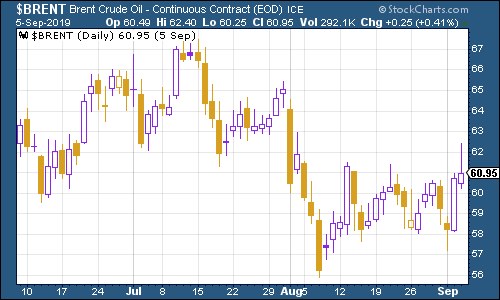

The oil price (as measured by Brent crude, the international/European benchmark) rallied along with other risk assets.

(Brent crude oil: three months)

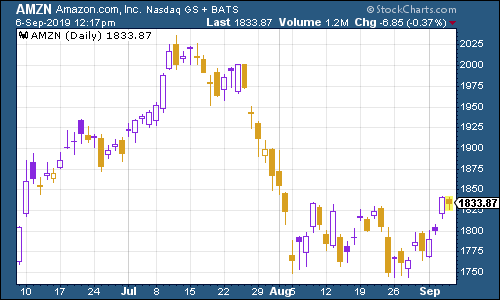

Internet giant Amazon rallied strongly this week along with the wider market.

(Amazon: three months)

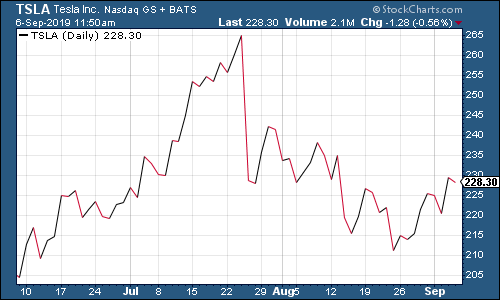

Electric car group Tesla was little changed.

(Tesla: three months)

Have a great weekend. (And if you haven't bought The Sceptical Investor yet, there's no time like the present).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King