More good news from the UK property market – house prices aren’t going anywhere

House prices in the UK are stagnating. Far from a disaster, that's very good news for everyone, says John Stepek. Here's why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We haven't looked at UK house prices for over a week now, so I know you'll be getting withdrawal symptoms.

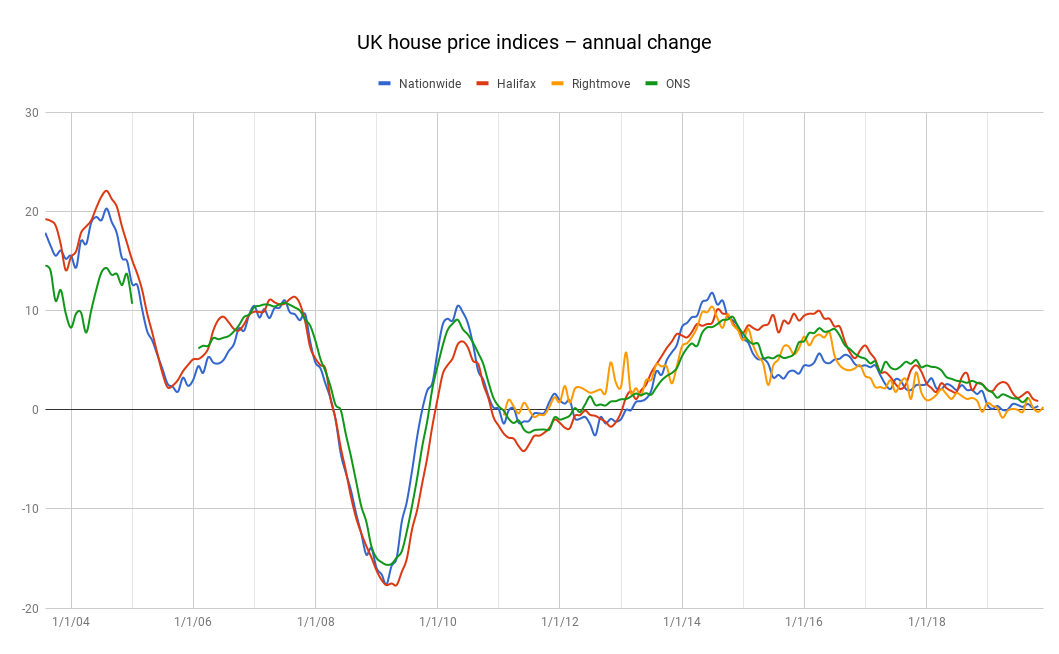

So let's rectify that today. The latest figures from the Nationwide are out. They show that house prices are, basically, flat across the UK.

That's very good news, for reasons we shall now explain.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The British housing market is ticking along nicely

The average house price in the UK rose by 0.6% year-on-year in August, according to Nationwide.

Obviously, that hides a lot of regional variation. Broadly speaking, if you look at other surveys and data, prices are falling in London and the southeast of England. The further out you go from there, the stronger the growth gets.

But nowhere is booming, and outside the very top end of the market, it's hard to argue that anywhere is crashing either.

What's also notable is that the mortgage market seems to be ticking along nicely. Mortgage lending saw a solid rise in July, in terms of both the amount loaned out, and the number of loans written.

In other words, "despite Brexit", buyers are buying and sellers are selling they're just doing so at slightly lower prices.

We've said it before and we'll keep saying it: this is a good thing.

I sympathise with frustrated would-be buyers, but a house price crash would hurt

A house price crash although satisfying for some frustrated would-be buyers is a very disruptive form of bust. For a start, to have the conditions for a house price crash, you need to have rising unemployment or surging interest rates or both.

This creates a group of unfortunate people who can no longer afford to pay their mortgages, and so become forced sellers, or victims of repossession. These then feed on each other forced sellers drive down prices across the market, buyers see prices coming down and hold off buying for more falls, and so on.

On top of that, banks' balance sheets tend to be heavily exposed to property. So when property prices tumble, banks rein in lending on a wider basis. When banks stop lending, it makes it harder for companies to raise money, over-exposed companies go out of business, unemployment rises, and so on.

In short, a house price crash might be good for people who don't already own a house, but it creates a great deal of collateral damage in the process. It's certainly not the ideal way to go about dealing with affordability problems.

(The ideal way, of course, would be to avoid leveraging your economy so dramatically to the residential housing market, but we don't have a time machine, so that's not currently an option.)

What we have just now is the closest we're going to get to an ideal way of getting back to some sort of equilibrium. Prices in most areas are flat. Meanwhile, the UK is as close to full employment as it's ever been. And the gap between wage growth (at just under 4%) and house price growth (roughly 0%) is now really quite wide.

How to make house prices more affordable without crashing the economy

This is good. People can still pay their mortgages. No recent buyer is panicking about the fact that their house is "only" worth roughly what they paid for it, and home equity release stopped being a big driver of UK consumption before the 2008 financial crisis. (So it doesn't matter as much these days if houses are no longer "earning" more than the annual salary every year, because people aren't "unlocking" and spending that equity to the same extent as they once were.)

At the same time, because wages are rising faster than house prices, affordability is gradually improving. Going by the Nationwide data at least, affordability in the UK (in terms of average house price to average earnings) was at its worst in 2007, just ahead of the crash, at just under 6.5 times.

It got back up above six times or so around 2015, but the tightening of rules around buy-to-let really does appear to have had the desired effect. Affordability has been gradually improving over the last 18 months or so, and, fingers crossed, it will continue.

It would be nice if wages went up a bit faster. And it would be nice if house prices declined a little if you can get that gap (or "spread") between wage inflation and house price growth up to 5%-10% rather than the current 3%, then you might be surprised by just how rapidly affordability improved.

Of course, there may be an element of wishful thinking here. For this to continue, you're looking at another couple of years of solid employment levels and weak house price growth. That doesn't seem impossible. But equally, there are a lot of things that could disrupt it recession, of course, being the big one.

That's why it would probably be a good idea now that everyone is growing rather more used to the idea that a house will not inevitably throw off buckets of cash every year to look at ways of reducing our economy's overall vulnerability to a volatile housing market.

Unfortunately, that would point to a level of political long-sightedness that I won't be holding my breath for. But we can always hope.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King