Passive funds beat active funds yet again

Investors are racing to ditch active funds for passive funds. When you compare performance, it’s clear why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

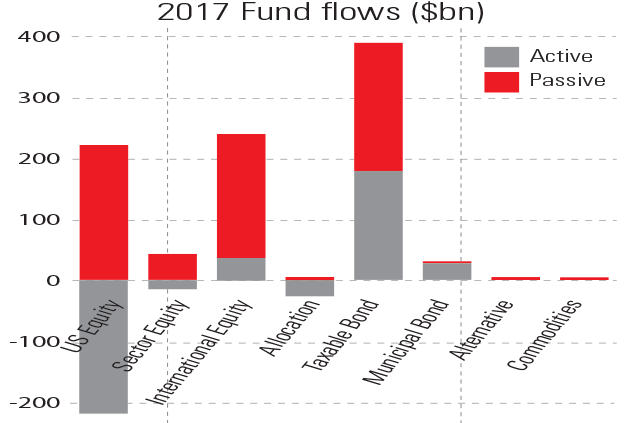

Passive funds those which aim to track the market rather than beat it are currently trouncing active funds (which do try to beat the market) when it comes to popularity with investors. Last year, in the US, $692bn flowed into passive funds, while roughly $7bn flowed out of actively-managed funds. In other words, active funds are losing investors overall.

This has resulted in something of a backlash from active managers. We keep hearing tales of how passive funds might be distorting the market, or complaints that they won't look after investors when the next bear market arrives. Yet, when you compare the results that active managers achieve over time with those of index trackers and other passive funds, it's very clear why passive investing has become so popular. The simple truth is that it's very difficult for an active fund manager to beat the market, and we now have yet another in a long line of studies that rather proves the point.

Data provider Morningstar looked at nearly 9,500 European active and passive funds over the ten years from June 2008 to June 2018, notes Attracta Mooney in the Financial Times. Morningstar split these into 49 different categories (some of which are fairly niche, as Financial News point out, such as investing in Canadian or Korean stocks). Of the 49, there were only two where the majority of active managers managed to beat their passive peers. Incidentally, those two categories were UK mid-cap equity funds (where more than 75% of active funds both survived and managed to beat the average passive fund) and Norwegian equities (where the figure was just under 60%). The worst performer, by contrast, was US large-cap "growth" equity funds, where less than 1% of active funds lasted for ten years and also managed to beat the average passive fund. And lest you imagine that the bond market is any different, just 3.4% of active funds investing in US diversified bonds managed to win out over ten years.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

When faced with odds like that, you can see why investors increasingly favour passive funds. Why pay more for active management if the odds are that you'll underperform a cheap passive alternative? We're not saying that all active management is a waste of money. And we are particularly keen on investment trusts, whose structure is more conducive to long-term investment (and which tend to do better than traditional unit trusts). But if you are going to pick an active fund over a passive one, then you need good reasons for doing so. If you can't explain why you think an active fund will do a better job than a passive tracking the same benchmark, stick with the passive every time.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how