The charts that matter: is dollar pressure starting to ease off?

The US dollar fallen back a fair bit since mid-August. John Stepek looks at what that means for the global economy, plus all the other charts that matter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back if you missed any of this week's Money Mornings, here are the links you need.

Monday: The 2008 financial crisis upturned politics and it's not done yet

Tuesday: How bad will things get for emerging markets? And will the pain spread?

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wednesday: If you missed out on bitcoin, you might want to read this

Thursday: Don't panic! Stagnant house prices are great news for us all

Friday: Why the US dollar is key to the fate of global markets

The podcast will be back soon with (hopefully) improved sound quality I'll let you know when the next one's up.

And as ever, don't miss this week's issue of MoneyWeek magazine! If you're not already a subscriber, sign up here now.

And now over to this week's charts.

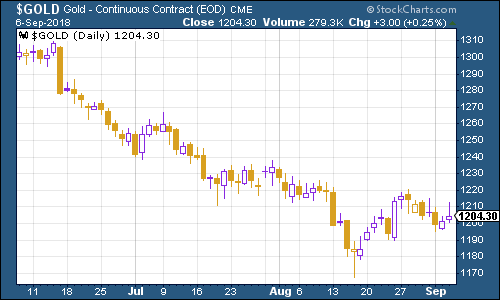

Gold (measured in dollar terms) has recovered a little since I last took the temperature of the markets in mid-August (it was trading around $1,180 an ounce). The rebound is largely due to the Federal Reserve coming across as a tiny bit more dovish than expected during the Jackson Hole conference at the end of last month.

(Gold: three months)

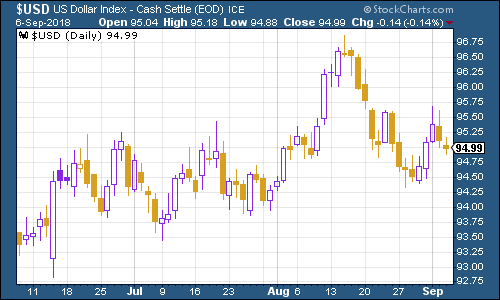

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners has, as you can see, fallen back a fair bit since mid-August too. Again, that's down to the Fed.

(DXY: three months)

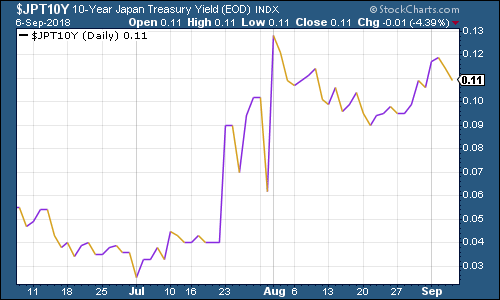

The Japanese government bond (JGB) yield is still floating around the 0.1% level after the Bank of Japan's recent decision to let it move around a little more.

(Ten-year Japanese government bond yield: three months)

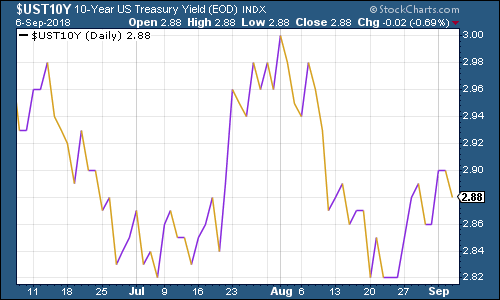

The yield on the ten-year US Treasury bond remained little changed over the week.

(Ten-year US Treasury yield: three months)

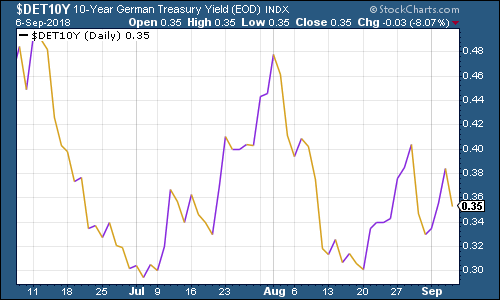

Meanwhile, the yield on the ten-year German bund (the borrowing cost of Germany's government, Europe's "risk-free" rate) has picked up a little as concerns over the Italian government's potential intransigence on EU budget constraints receded.

(Ten-year bund yield: three months)

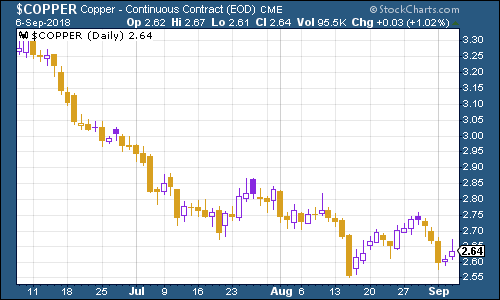

I don't want to speak too soon but it looks as though copper might have found a bottom. If this holds then that would be a promising sign perhaps the dollar strength might ease off and give the commodity sector a bit of a break.

However, ongoing talk of yet more trade tariffs won't help matters China accounts for about half of global copper demand so anything that threatens Chinese growth is bad news for the price of the metal.

(Copper: three months)

Cryptocurrency bitcoin has been languishing in the $6,000 to $7,000 mark for quite some time now. It had clawed its way back up to $7,500 this week but then took a couple of serious whacks all the way back down to $6,400. As ever with bitcoin, it's not easy to explain the price movements but some suggested that the shift was down to suggestions that Goldman Sachs is no longer as interested in the digital currency sector.

(Bitcoin: three months)

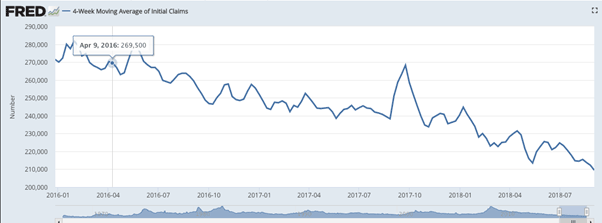

On US employment, the four-week moving average of weekly US jobless claims fell back to a new cycle low of 209,500 this week (and the lowest level since December 1969), while weekly claims fell to 203,000.

David Rosenberg of Gluskin Sheff has noted in the past, that when US jobless claims hit a fresh cyclical trough (as measured by the four-week moving average) as they have now, then a stockmarket peak is not far behind (on average 14 weeks although bear in mind this is an average of a very small number of fairly varied cycles), and a recession follows about a year later.

So we've now hit a new trough and, in line with Rosenberg's observations, we have seen the stockmarket continue to hit new highs. The S&P 500 is now above 2,900, above the previous all-time high it set in January this year, of 2,872.

(US jobless claims, four-week moving average: since January 2016)

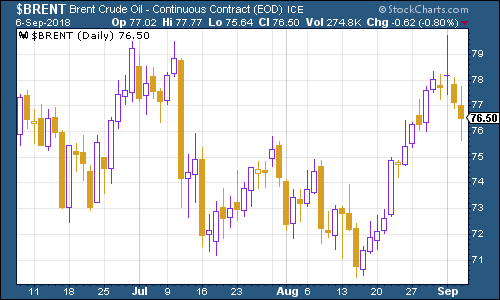

The oil price (as measured by Brent crude, the international/European benchmark) has rebounded sharply since mid-August again this is partly because the dollar has weakened.

(Brent crude oil: three months)

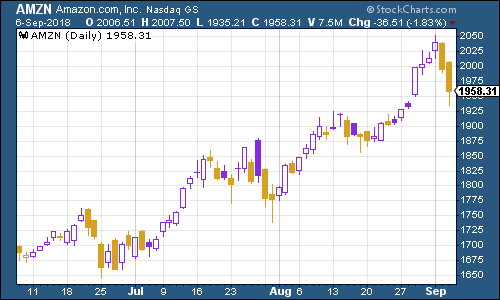

Internet giant Amazon remains the stock that everyone loves, and this week it became the second $1 trillion stock (Apple was the first).

(Amazon: three months)

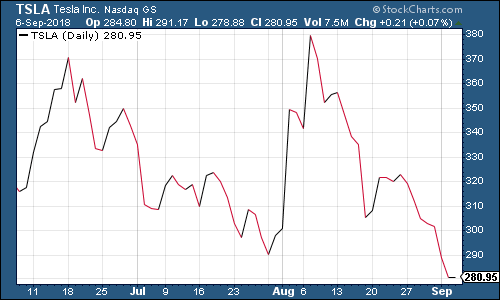

And electric car group Tesla really has taken a hammering in recent weeks after it turned out that Elon Musk's aspiration to take the company private really was just an aspiration rather than a plan.

Musk's increasingly flakey management style is becoming a real problem, but the question does arise: what would be left of Tesla if "the Musk effect" wasn't there?

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge