The charts that matter: the strong dollar causes havoc

John Stepek looks at what the charts that matter most to the global economy make of the week's events, including the pressure the dollar is putting emerging markets under.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Quick thing if you're in Edinburgh this coming week, there are still a few tickets left for Merryn's show at Panmure House Adam Smith's only surviving residence. She'll be debating all the big issues of the day with a Smith-ian slant, with a wide mix of guests from comedians to politicians to fund managers.

(Oh, and I'll be making my "Edinburgh debut" on the Thursday and Friday shows. Don't let that put you off.)

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Back to this week if you missed any of this week's Money Mornings, here are the links you need.

Monday: Turkey is just the canary in the coal mine

Tuesday: What do Turkey, Italian debt and falling global house prices have in common?

Wednesday: What are the odds on the ideal outcome for UK house prices?

Thursday: How much lower can bitcoin and the crypto sector fall?

Friday: Is the Turkish crisis a buying opportunity?

The podcast returned this week Merryn and I talk about Turkey and how to protect your portfolio from the fall out; and we also muse on house prices in the UK, and whether they can have a soft landing or not. Have a listen here it's only 15 minutes long or so, ideal for a quick lunchtime stroll.

And don't miss this week's issue of MoneyWeek magazine! If you're not already a subscriber, sign up here now.

And now over to this week's charts.

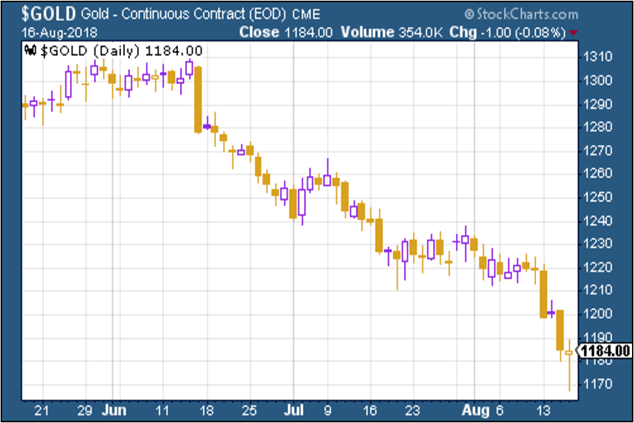

Gold (measured in dollar terms) got slammed alongside all the other metals this week.

(Gold: three months)

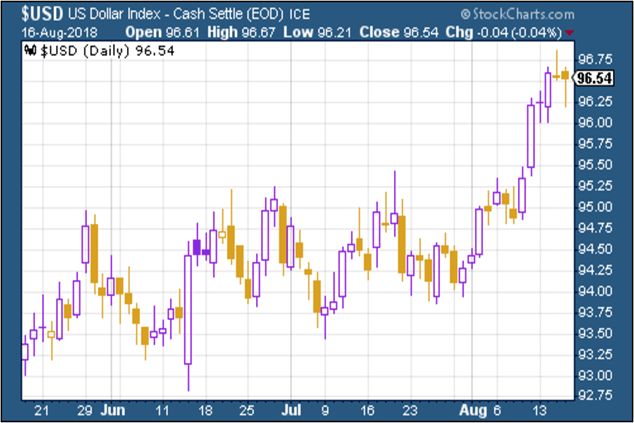

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners just keeps getting stronger. It's small wonder that emerging markets are feeling the squeeze.

(DXY: three months)

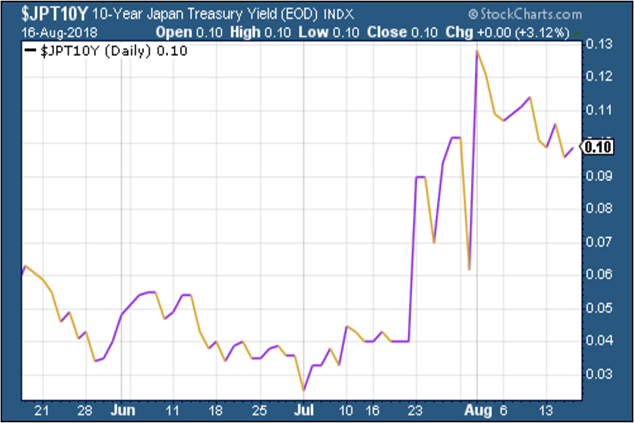

The Japanese government bond (JGB) yield remains close to the 0.1% level after the Bank of Japan's recent decision to let it move around a little more. Amid the general "risk-off" tone, the Bank hasn't come under much pressure to defend that level.

(Ten-year Japanese government bond yield: three months)

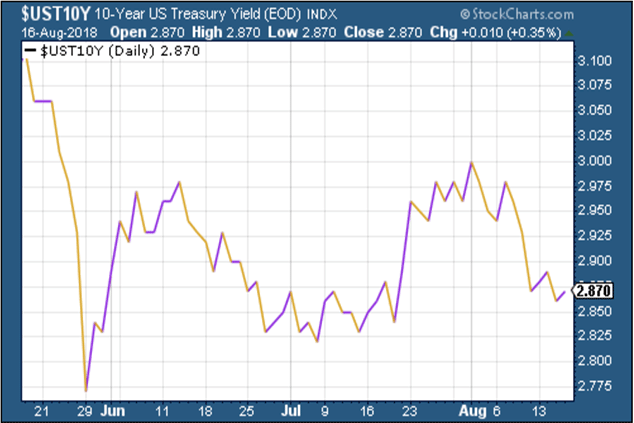

The yield on the ten-year US Treasury bond continued to fall as investors piled into "safe" US government IOUs.

(Ten-year US Treasury yield: three months)

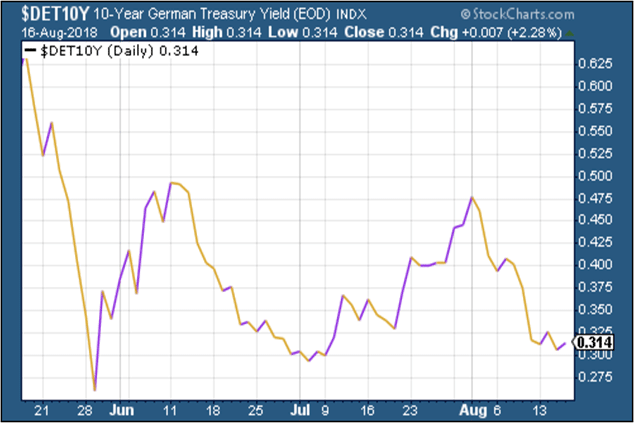

Meanwhile, the yield on the ten-year German bund (the borrowing cost of Germany's government, Europe's "risk-free" rate) fell too.

(Ten-year bund yield: three months)

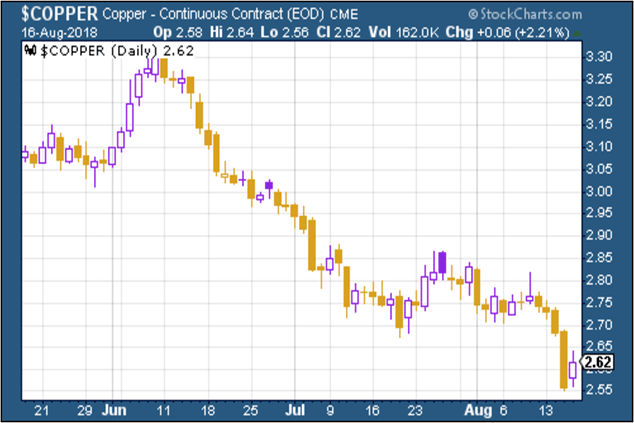

It looked for a short while there as though copper had found a bottom. Not this week the metal slid even further as fears over the knock-on impact of Turkey's woes hit the commodity sector in general. Much of this is due to weaker-than-hoped economic data from China.

Technically, copper is now trading in bear-market territory, which is certainly not a good sign for the global economy, although the metal is not infallible (despite the nickname, Dr Copper).

(Copper: three months)

It's been another tough week for cryptocurrency bitcoin, although its peers have fared even worse. Dominic discussed the latest slide in Money Morning this week.

(Bitcoin: three months)

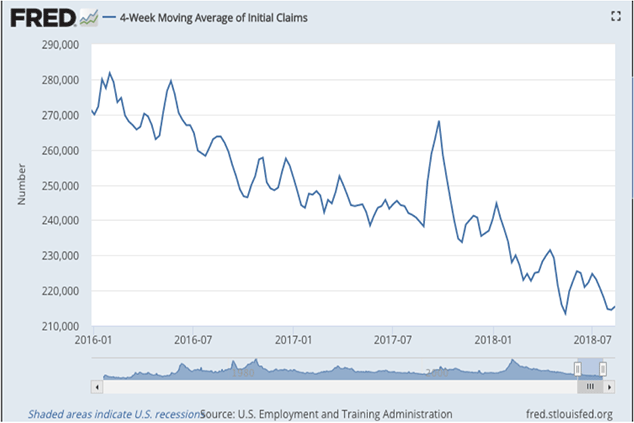

On US employment, the four-week moving average of weekly US jobless claims rose a little to 215,500 this week very close to a new low for this cycle while weekly claims fell to 212,000.

David Rosenberg of Gluskin Sheff has noted in the past, that when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), then a stockmarket peak is not far behind (on average 14 weeks although bear in mind this is an average of a very small number of fairly varied cycles), and a recession follows about a year later.

We hit a new trough of 213,500 back in May, roughly 13 weeks ago. So if there's anything to Rosenberg's observations, then we should still see the stockmarket hit new highs before this cycle is out. The S&P 500 is currently at 2,840 or so. The closing all-time high was set in January this year, at 2,872.

So it's not far off. Perhaps more to the point, though, we could also set a new jobless trough soon, and thus set the clock running again. Definitely an indicator to keep an eye on.

(US jobless claims, four-week moving average: since January 2016)

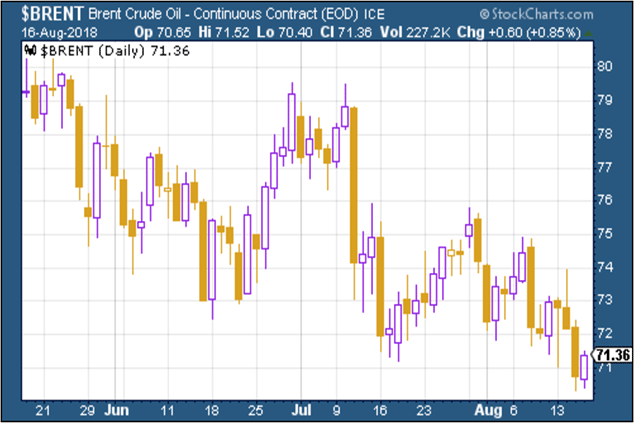

The oil price (as measured by Brent crude, the international/European benchmark) has slipped lower towards $70 a barrel this week, mainly due to nerves over the sturdiness of the global economy, given trade wars and Turkey, among all the other things to fret about.

(Brent crude oil: three months)

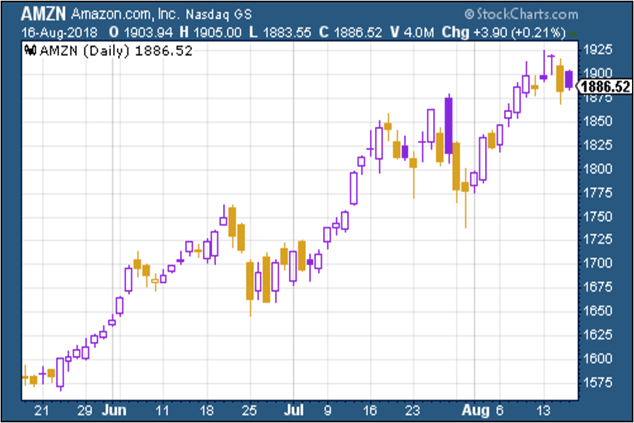

Internet giant Amazon remains the stock that everyone loves. The most disruptive company in the world is now apparently looking at buying a cinema chain in the US. It's also thinking of setting up an insurance comparison website in Britain.

Hmm, Amazon disrupting financial services. It's an interesting idea and one that the fund management industry has always dreaded. We'll see if Jeff Bezos can be bothered tackling the regulatory side, but this could be a straightforward way to dip a toe in the water.

(Amazon: three months)

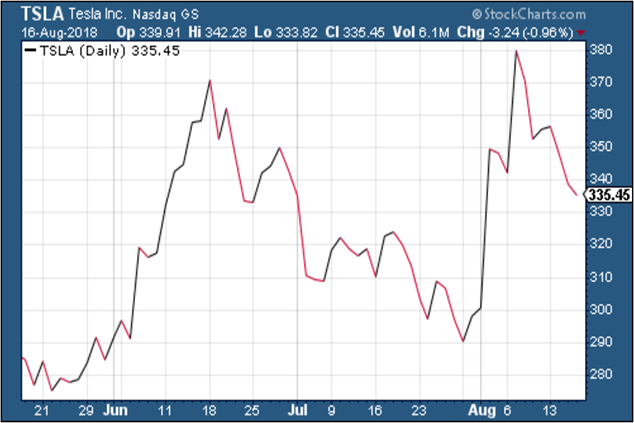

Electric car group Tesla was on the slide this week as the SEC (the US regulator) started looking into founder and CEO Elon Musk's loose words on Twitter about planning to take the company private at $420 a share.

The problem is that it does sound rather as though Musk's desire to take Tesla private is more aspiration than "funding secured" level of reality.

The fact is that if this happened, it would be the biggest deal ever, regardless of how it's funded. Like I said, if it happens, it'll be the top of the market. The fact that people are even entertaining the idea that it might, shows you that we must be close either way...

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?