Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

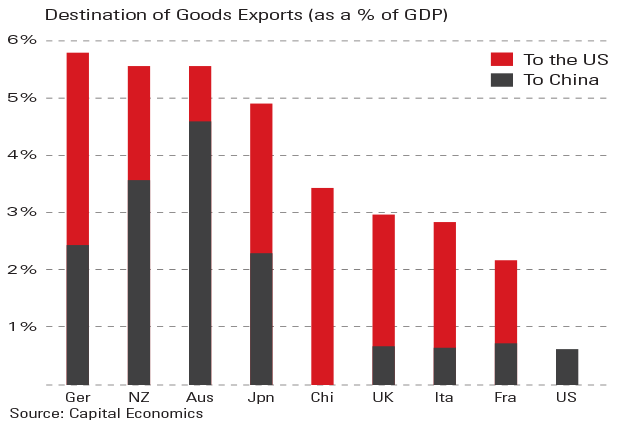

If the trade spat between the US and China worsens, both countries' growth will suffer as they raise barriers against a wider range of goods and make it harder for foreign companies to gain footholds. That would be especially bad news for Germany, where goods exports to the US and China jointly comprise almost 6% of GDP, says Capital Economics. The next most-exposed countries are Australia and New Zealand, which both export 5.5% of their GDP to the US and China. This is a bigger percentage than China and America's direct export exposure to each other. Thirty-three per cent of Australian and 22% of New Zealand goods exports respectively go to China; 3% and 16% to the US.

Viewpoint

"British shares languish in the bargain basement Uncertainty about Brexit, plus the possibility of a Marxist chancellor have [hit] the FTSE 100... the UK stockmarket is trading on a [cyclically adjusted price-earnings ratio] of just over 15, compared with 20 in Germany, 27 in Japan and 30 in America. the global average for emerging markets such as Brazil, Russia, India and China is 17 Ritu Vohora, investment director at the fund manager M&G, calculates that, on one measure, UK shares are now the cheapest they have been since World War II. She bases her view on valuation by dividends or the income that shares pay investors relative to government bond or gilt yields. While the short-term outlook is challenging with elevated risks and international sentiment extremely negative, UK equities or shares are on sale with uncertainty discounted in prices,' she said."

Ian Cowie, The Sunday Times

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how