The biggest lesson that 2007 can teach investors

Almost exactly a decade ago, the FTSE closed near its peak for the year. Then things deteriorated – rapidly. John Stepek looks at what lessons investors can draw from the crisis that ensued.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We've been looking at financial crashes from history in Money Morning each week. So far we've run through the crash of 1987, the South Sea Bubble, and the 1920/21 crash, among several others.

But this week, there's a rather more recent one to take a look at.

As it's now just over ten years ago since the FTSE 100 hit its 2007 peak, I thought we'd take a look at how that one unfolded.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The last bull gasp for the FTSE 100

On 12 October 2007 just over a decade ago the FTSE 100 closed at 6,730.

Now, that wasn't quite the top of the market. On 17 June that year, it had in fact managed to close at 6,732.

And it was not, in fact, an all-time high for the FTSE either. The all-time high remained the level of 6,930, which was hit on 30 December 1999.

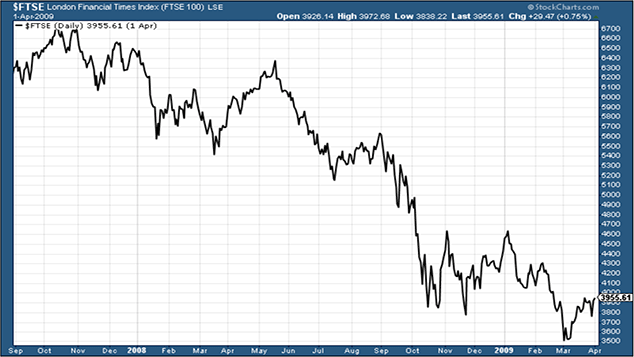

Yet it was the last bull gasp before the financial crisis. From that point, as the chart below shows, it was downhill all the way, until the market finally hit a closing low of 3,512 on 3 March 2009.

I don't want to re-tread the financial crisis itself here. I'll discuss subprime mortgages and the nature of the banking crisis another day (you can read about it as it unfolded in real time if you delve back far enough on the website).

Instead I'm just going to focus on 2007 today, rather than traipsing through the whole crisis.

Here's broadly how things happened that year. In June 2007, two Bear Stearns hedge funds warned of losses, and a month later had to be bailed out by their parent company.

Bear in mind that US house prices had been falling for over a year by now, and that subprime brokers were already in trouble. HSBC had issued its first ever profit warning in February that year because of losses at its US subprime lending arm.

Yet in "big picture" terms, this was still "bubbling under". Look no further than the fact that in July 2007, the Bank of England raised interest rates by a quarter point, from 5.5% to 5.75%. (Consumer price index inflation had peaked at 3.1% in March, and the Bank was still in tightening mode).

In August 2007, the fact that this was a burgeoning credit crisis rather than a contained problem became more apparent as French bank BNP Paribas froze three of its funds, due to concerns over the indeterminate value of their subprime mortgage holdings. At that point, the market panicked quite badly.

On 14 September 2007, Northern Rock had to admit to going to the Bank of England for help, and the queues built up outside. Yet the market was already bouncing back from the Paribas shock.

The rebound was also helped by central bank action over in the US. The Federal Reserve cut interest rates by half a percentage point to 4.75%. It was a pretty dramatic decision. As the BBC reported at the time, "the move, the first US rate cut in four years, is aimed at restoring confidence in the housing market and preventing the turmoil from denting the economy".

Global stocks liked that. Arguably more than anything else, it was that rate cut that helped power the rebound to the October high.

The Fed would then cut rates at its October meeting to 4.5%, then in December again, to 4.25%. Meanwhile, in December 2007, the Bank of England cut rates by a quarter point to 5.5%.

Disaster was staring us all in the face

This is just the beginning of the financial crisis. By 31 December 2007, we've already had the world's central banks make coordinated announcements that they will provide liquidity to the banking system to help it out over the year-end period.

We've also started to hear from the bond insurers (the ones who were on the hook for all those subprime losses), and to get an inkling of the sheer scale of the subprime problem.

In short, by the end of 2007, there really was no excuse not to be worried about how things were panning out.

Yet, fascinatingly, the FTSE 100 closed that year out at 6,456. It was barely off its peak. It's true that it was about to experience a painful dose of reality in January 2008, when we saw a sharp slide.

But it's still interesting to see just how much the equity market was constantly looking on the bright side. We talk about the "Greenspan put" (the idea that central banks will always be able to bail out the market), and how the market always expects the Fed to come to the rescue.

It's extraordinarily clear just how reliant the markets are, all through this period, on the old adage, "Don't fight the Fed". Britain experiences a Mary Poppins-style banking run something we all associated with ancient history at the time but markets were already rallying because they thought: the Fed is "on it".

That remains true throughout the crisis until Lehman Brothers blows up every fresh disaster that happens is going to be the last.

We'll be revisiting this particular crash in a lot more detail in the future of this series (as it's recent history, there are a lot of elements that are much easier to delve into).

But I think one of the biggest lessons from 2007 is that you should never doubt that markets can sometimes be very, very wrong in quite obvious ways.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how