Central banks are creeping closer to a post-QE world

There’s been a lot of movement from central banks this week. John Stepek looks at what s been going on and how it affects you.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I'm going to step away from politics this week to look at the people who really run the financial world (well, for now at least the pendulum is swinging) central banks.

There's been a lot of movement from central banks this week the US Federal Reserve, the Bank of England and the Bank of Japan have all given their views on interest rates.

The Fed was a little more hawkish than expected (ie more inclined to raise rates); the Bank of England a lot more hawkish (in that it nearly voted to raise rates); and the Bank of Japan seemed content to meander on with quantitative easing despite being fairly pleased with the way the economy is going.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The overall tone is one of optimism, which is pretty much the direct opposite of our current political tone.

So how has that had an impact on our six charts that matter?

Gold

The more hawkish tone from the Fed had the expected effect on gold, which has failed to breach the $1,300 mark and slipped on the week back to $1,255.

Gold likes it when "real" interest rates (ie interest rates after inflation) are falling. Now, people are getting worried again that inflation is weak (in the US; not the UK, obviously), reflecting weak economic growth, and yet the Fed is still keen to raise interest rates on schedule.

That means that real interest rates are rising rather than falling. In turn, that's bad news for gold because it doesn't yield anything.

In the longer run I firmly expect the Fed to fall behind inflation and I'd hold on to your gold regardless of what it says, pretty much. But it shows you how the thinking in the market is swinging. And that's important because that's also what helps you to understand which events the market might end up being surprised by.

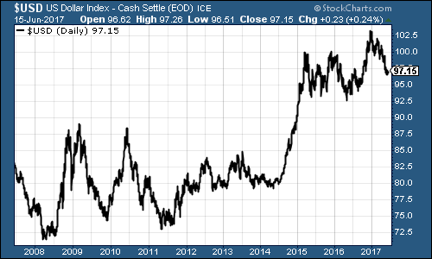

US dollar index

This picked up a little this week, helped by the Fed, but it's not much higher than it was last week. It'll be interesting to see if this could be a (temporary) turning point for the dollar though. If it is, expect Donald Trump to try to talk it down, as that's one of his only options for boosting the economy at the moment.

US Treasury bonds

Interestingly, ten-year US Treasury bonds continued to fall despite the Fed threatening higher interest rates. That's probably because right now the market is more worried about the Fed being too trigger-happy than about it waiting for too long.

Copper

Copper is continuing to wander aimlessly. The market can't quite figure out if reflation is still on or if we're on the edge of another deflationary scare (or a full-blown deflationary panic).

Bitcoin

The crypto currency suffered a rare down week, but the volatility is only to be expected when something looks this frothy. The wider crypto-currency field is also becoming more interesting, in that bitcoin is no longer the full picture. We'll talk more about this in a future issue of MWU.

Source:bitcoincharts.com

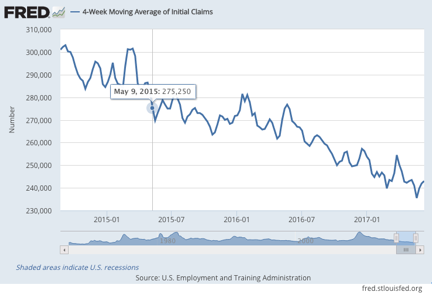

US jobless claims

This isn't directly affected by the Fed's interest rate decisions it's more like the other way around. Strong employment growth points to strong wage growth. At the moment we've got one strong employment but not the other, although there's an interesting gauge from the Atlanta Fed that suggests US wage inflation might be healthier than it looks, running at about 3.5% a year and climbing. I'm not sure on how much to trust that one yet but I'm certainly keeping an eye on it.

In any case, one of the most timely employment indicators is the weekly US jobless claims total.

David Rosenberg of Gluskin Sheff reckons this is a valuable leading indicator.When the figure hits a "cyclical trough" (as measured by the four-week moving average), a stock market peak is not far behind, and a recession follows about a year later.

This week, claims fell to 237,000. That was lower than expected (in other words, the picture for employment looks healthier than expected) and it'll drag the four-week moving average which is still near its lowestlevel since April 1973 further down.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.