Three defensive investment trusts

The FTSE 100 has had a volatile year, and it is during periods such as these that defensive investment trusts show their worth, says Sarah Moore.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

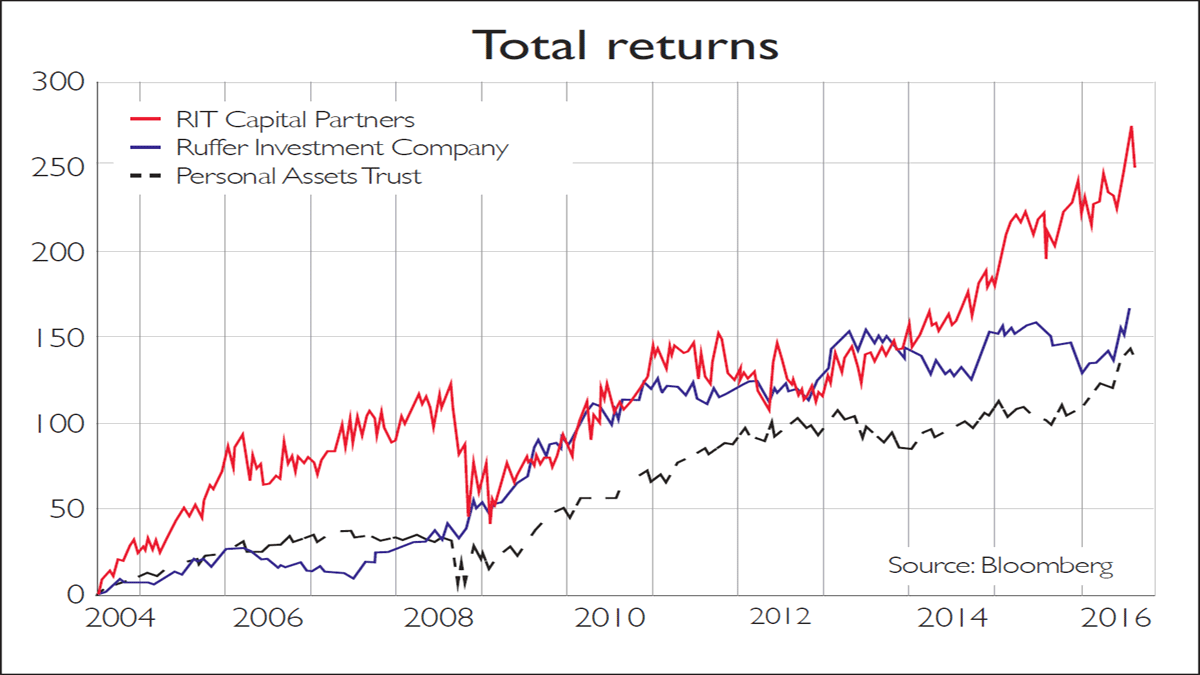

During the global financial crisis, all three of these funds held up better than the stockmarket, although performance varied substantially from fund to fund. RIT and Personal Assets lost 26% and 11% respectively from peak to trough of the market, with RIT recovering more slowly than Personal Assets. Ruffer was one of a small number of funds that actually made money during the crisis, returning a substantial 28% in 2008. Over the longer term the funds have all achieved their stated goal of delivering capital growth. RIT has returned an impressive 257%, including dividend payments, since 2004 (when Ruffer, the least long-running fund, was established). Ruffer has achieved 149%, and Personal Assets 139%.

Historically, RIT has proved the most volatile of all three funds. This reflects a more aggressive portfolio, which is responsible for it having the strongest performance since 2004. Overall, Ruffer seems to be the most defensive of all three funds (as demonstrated during the financial crisis), with Personal Assets shifting to become more defensive in recent years.

So what are the three trusts investing in today? They follow broadly similar strategies in as much as they allocate significant weightings to gold, cash and index-linked bonds and other safe-haven safe assets, although proportions allocated to each vary from fund to fund. For example, Ruffer currently has a 45% allocation to index-linked bonds, while Personal Assets has only allocated 21%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This focus on safe havens is unsurprising in today's low-income environment and uncertain market outlook. For example, Ruffer's exposure to gold and gold equities has increased to 7% in July 2016 from 4% in June 2015. As Robin Angus, executive director at Personal Assets, told investors in the latest quarterly report, "we hold the equities because we want to, and the cash, index-linked bonds and gold bullion because we need to. I look forward to when our equity percentage is at least twice what it is today, but the time has not yet come."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah Emly is co-manager of the JPMorgan Claverhouse Investment Trust.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King