Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week in MoneyWeek magazine, we're back on a favourite topic of ours property. Our cover story examines the state of Britain's housing market; we take a look at the new craze for "commercial buy-to-let"; and we run a critical eye over the return of "equity release" schemes using your house to fund your retirement.

For all that and our usual eclectic mix of features and investment advice, sign up for a subscription here.

The crazy world of UK house prices

Our cover story this week asks the question "Where are house price heading?" As nobody can have failed to notice, Britain's house prices are expensive though perhaps "expensive" is too mild a word for it. The average home now costs 6.1 times the average income almost as high as in 2007, just before the last bubble burst.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Under normal circumstances, things should "revert to the mean", says John Stepek. But if that were to happen, either "house prices would need to fall by up to 40%" or household income would have to rise tenfold. Neither of these things is likely to happen yet.

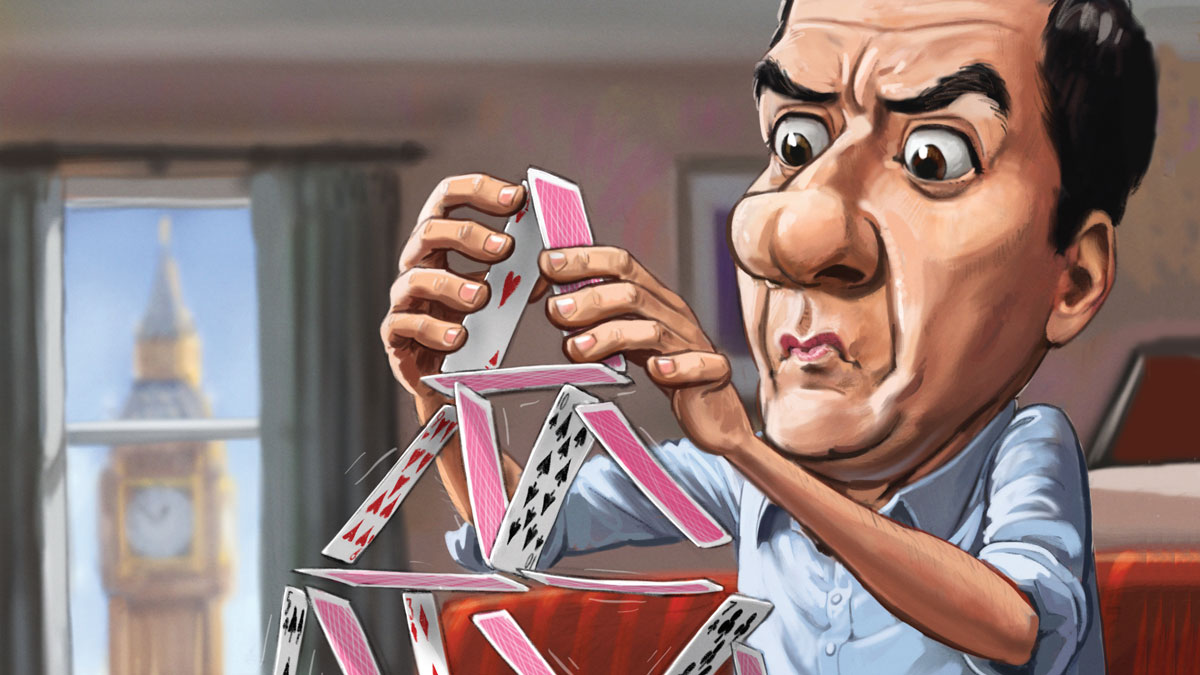

John looks at what's driving our crazy house price inflation. Many people will tell you it's because the supply isn't there. But that's not it, he says. It's "all about credit". Our stubbornly low interest rates have made borrowing money cheap and easy. And half-baked schemes such as the government's "Help to Buy" have only made things worse, says John.

So what could pop the bubble this time? Find out with a subscription to the magazine.

Buy-to-let goes commercial

Natalie Stanton looks at another aspect of the property market buy-to let. The government has had something of a crackdown on second home owners in recent years, with George Osborne taking aim against the sector in the last three Budgets. But "recent changes to commercial property rules have been more favourable to investors", says Natalie.

And so, private investors have been snapping up "semi-commercial" properties with a shop or business on the ground floor, perhaps, and a couple of flats above. The number of people looking at these has doubled in little over six months, says Natalie. This week, she considers the attractions, and sounds a note of caution: "The big question", she says, is how quickly this "blatant loophole" will be closed once investors really start piling in.

Using your home as a piggy bank

Continuing the property theme, Sarah Moore asks "Should you tap your home for cash?" As the population ages, more and more people will need to be cared for in the last years of their lives. That gets very expensive very quickly, and the state won't pay for it all. Even if you enjoy a long, active and healthy retirement, a longer retirement needs a bigger retirement fund. And with interest and annuity rates as low as they are, making that last as long as you do could prove to be a problem.

That's where equity release schemes come in, where you take out a loan against the value of your home. They've had a bad rap in the past. But now, Nationwide is planning to enter the market, which "could be an important step in taking these schemes into the mainstream", says Sarah.

Who wouldn't want money for nothing?

A "universal basic income" sounds simultaneously great and barking mad. Who wouldn't want the state to give them enough money to live on with no expectation of getting out of bed every morning and earning it? At the same time, how on earth would it be funded?

Yet it's something that's coming under increasingly mainstream scrutiny. Many states' welfare systems are hideously complicated and extremely expensive ours included. So perhaps the simplicity of doling out money to everyone regardless would be better?

No, says Matthew Lynn. "These ideas", he says "are dangerous". They destroy incentives to work, destroy the price mechanism so we won't know what we should be "lavishing our resources on" and they are "horrendously expensive".

Elsewhere in the magazine, Edward Chancellor takes up the baton against "helicopter money" the idea that central banks can print as much as they want to buy economies out of trouble.

We also look at art. It's been a "popular and successful investment since the 2008 crisis", but now things are turning ugly. Meanwhile, Sarah Moore looks at low-risk, high return funds, Cris Sholto Heaton explains just how expansive US equities are, and Alex Williams picks at a tasty-looking company from the "lucrative supercar segment" on his shares page.

Plus, Chris Carter on three great train journeys, Matthew Jukes picks a "lip-smacking Bordeaux" for his wine of the week, and we find eight of the best property conversions available on the market now. Sign up now. What are you waiting for?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how