Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Fancy investing like Warren Buffett but unsure how to get started? One solution could be to buy into the Trojan Global Equity Fund. The fund's manager, Gabrielle Boyle, is herself an aficionado of Buffett's stock-picking techniques, writes Moira O'Neill at Investors Chronicle.

Boyle, who joined Troy Asset Management three years ago after 17 years at Lazard's, focuses on companies with strong brands and distribution channels. "We don't own cyclical businesses or companies that are dependent on one or two products," she tells O'Neill. Boyle also thinks buying and selling too many shares is a "tax" on investors, so she is sticking to a 20% annual turnover in the fund's portfolio.

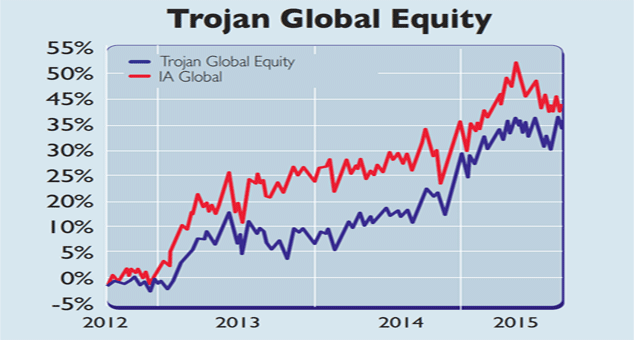

Trojan Global Equity's remit is to deliver capital growth. It has performed well over one and five years, beating its benchmark and delivering a respective return of 17.9% and 70.1%. However, the three-year performance is less inspiring, with a 40.1% return underperforming the benchmark. Boyle says she was initially too cautious but is now comfortable with her 31 holdings, including favourites Colgate-Palmolive, Nestl and Microsoft.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Boyle has increased the fund's exposure to the US, Europe and Asia, notes Gary Jackson at Trustnet. Some 47% of the portfolio is now in the US, 20% in Europe and 5% in Asian stocks (with 20% in the UK). Major holdings include Swiss healthcare stocks Novartis and Roche. A recent strong performer has been US stock Fiserv, which provides electronic transactional services for US banks and had an upbeat investor presentation in June. The fund's ongoing charge is 1.12%.Contact: 020-7499 4030.

| Novartis | 5.7% |

| eBay | 5.1% |

| American Express | 4.9% |

| Becton Dickinson | 4.8% |

| Roche | 4.7% |

| Microsoft | 4.6% |

| Sage | 4.1% |

| Altria | 4.0% |

| Medtronic | 4.0% |

| Wells Fargo | 3.9% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King