Shares in focus: Time to place a bid for eBay?

Auction website eBay is spinning off its payment platform, PayPal. Phil Oakley looks at what investors should do next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Now that it's spinning off PayPal, is the online auctioneer still a buy? Phil Oakley reports.

Online auction site eBay is 20 years old next year. Unlike the fanfare and hot air that came with many internet companies back in the 1990s, eBay has been a resounding success and has made its founders very rich indeed.

When it started out, it allowed people to buy and sell stuff from each other, but it's now morphed into an online marketplace for established retailers. It has more than 150 million active users and helps to sell goods worth more than $85bn a year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The spin-off

The retail part of the business is growing its sales at around 10% per year, but has been overshadowed in recent years by the stellar growth of PayPal, its online and mobile payments business. PayPal has been so successful that some observers think it has been held back by being part of eBay.

The well-known activist investor Carl Icahn is in this camp. For much of the last year, Icahn has been battling eBay's board of directors, demanding that it allows PayPal to become a separate company. Icahn has now got his wish. Next year eBay shareholders will be given separate shares in PayPal.

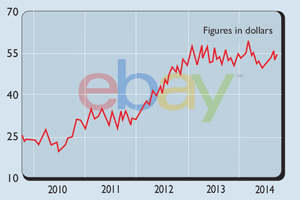

But will these separate shares make shareholders any richer? eBay's shares have trod water for the best part of two years and haven't moved dramatically since the spin off of PayPal was announced last week. Spinning off companies is sometimes a good idea, but this one has raised lots of questions.

Should you own shares in both companies? Will one eBay share plus one PayPal one be worth more than the current price? Or is PayPal's potential already priced into eBay's shares?

Going it alone

For most of this year, eBay chief executive John Donahoe has been arguing that eBay and PayPal are better together, rather than being separated. So why has he changed his mind?

Well, it's certainly true that eBay and PayPal have been very good for each other. When you buy things through eBay, you are pushed towards paying through PayPal.

In fact, it makes perfect sense to do so. It is much more secure because you don't have to hand over your credit-card details to sellers. From eBay's perspective, PayPal has allowed it to learn a great deal about its users' shopping habits and tailor its websites accordingly.

Users will still probably pay with PayPal when the two companies go their separate ways, but it could be that eBay on its own will not be as attractive to investors as it once was. eBay's business is facing very stiff competition from the likes of Amazon and Google. In fact, it seems that these two companies are increasingly the first port of call for buying stuff over the internet.

Whether eBay can thrive and keep its fees and profits from falling in the future remains to be seen. However, a standalone eBay still has a few things going for it. It is great at throwing off lots of free cash flow and has a very large customer base.

This could make it attractive to a private-equity buyer, or a company such as the recently floated Alibaba. The Chinese e-commerce business would love to break into the American market and eBay could be the perfect fit.

The future of PayPal

PayPal looks to have much better prospects than eBay. It is growing at twice the rate of its sister company and should continue to do very well as the mobile-payments market is expected to soar. Freed from eBay, its management may become bolder and more innovative.

They will have to innovate more if PayPal is to compete against Google Wallet and the forthcoming Apple Pay.

Some people reckon that PayPal could be worth a fortune. Back in February, PayPal co-founder Elon Musk stated that the company might eventually have a price tag of more than of $100bn. If he is proved right, then eBay shares are a steal right now.

According to Musk and others, PayPal which already accounts for one in every six dollars spent online could become extremely profitable if it set itself up as a bank. If it did that it would be able to retain more of the fees it charges, rather than paying a large chunk of them back to the credit-card companies that are attached to most PayPal accounts.

Or could PayPal itself become a bid target? Google might be prepared to cough up a small fortune to link it up with its search engine. Alternatively, credit-card companies such as Visa or MasterCard might be interested.

What about the prospects for eBay?

All this might happen. But there's nothing to stop a company bidding for the whole of eBay right now, keeping the bits it wants and selling the ones it doesn't. Wall Street usually gets excited about such prospects, but eBay's lacklustre share price suggests that a lot of the bid prospects are priced in. After all, the shares are hardly trading on a bargain-basement valuation.

That said, I'd still be tempted to buy the shares. PayPal is well placed to be a long-term winner in mobile payments and eBay has not turned into a corporate dinosaur yet. Both companies represent scarce strategic assets that could well be worth a lot more to someone else in the future than they are today.

Verdict: buy

eBay (Nasdaq: EBAY)

Buy: 34

Hold: 21

Sell: 0

Target price: $62

Directors' shareholdings

J Donahoe (CEO): 660,748

R Swan (CFO): 434,492

P Omidyar (Chair): 108,241,308

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King