The scramble to war in Asia

Increasing tension over borders and territory is a worrying sign of approaching conflict, says Jonathan Compton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Increasing tension over borders and territory is a worrying sign of approaching conflict, says Jonathan Compton.

Investors find it hard to anticipate major geopolitical events, even when they've been building over time. As a result, when long-standing problems finally erupt, markets tumble.

Recent examples include the coup in Thailand to oust the Shinawatra clan, and Russia's efforts to rebuild the USSR of late by destabilising Ukraine. And there are many more potential powder kegs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Two unconnected events from the last century offer differing road maps as to how geopolitical surprises can unfold.

In June 1914, Bosnian Serb Gavrilo Princip found himself by accident on the same side street as the stalled car of Archduke Franz Ferdinand, heir to the Austro-Hungarian throne, whom he had hoped to assassinate earlier that day.

Probably unable to believe his luck', he shot and killed the Archduke. At the time, it appeared a minor regional matter. The assassin hoped (perhaps a little naively) to benefit Serbs under Austro-Hungarian rule.

Instead, over the next four years, over the course of World War I, nearly a fifth of Serbia's population was killed, an outstanding example of a small event triggering huge unforeseen consequences.

Meanwhile, in September 1955, Lieutenant-Commander Desmond Scott and three men were winched down by helicopter onto the tiny uninhabited island of Rockall in the North Atlantic, to claim it for the UK, 290 miles away. Britain's invasion' of Rockall came asthe Cold War turned glacial.

In such times, tiny territorial claims can assume national importance, risking an escalation of tension. Yet the USSRdidn't react to the opportunistic seizure of a vast sea area and of sea lanes key to its navy.

As a result, Britain gained at zero cost rights over a large tract of ocean with the potential bonus of fish and mineral resources.

The question today's investor should ask is: are the increasingly bad-tempered territorial disputes across the world, and Asia in particular, similar to Rockall in nature and outcome, and so nothing to worry about? Or do they have more in common with Princip's luck'? And if so, what should they be doing about it?

The return of Asian nationalism

In February, India's minister of external affairs and a special representative of China's government met for the 17th round of talks to resolve their countries' many and long-running border disputes. China was unusually emollient.

Then in May, China and Russia commenced a major joint naval exercise in the East China Sea. China's typically camera-shy leadership was eager to be photographed schmoozing with Russian naval officers.

China has the fewest military friends in the world (it has just one North Korea). Ensuring harmony along its 4,300-mile-long borders with its two largest neighbours implies it is clearing its political decks.

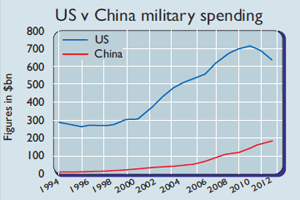

The country's meteoric economic growth has enabled a giant leap in its military spending (see chart). Like all rising empires, it wants to assert what it believes are justifiable claims and address past wrongs.

China still nurtures a deep sense of grievance over foreigners preying on its previous weakness. It resents its dismemberment during the 19th century by treaty ports, of which Hong Kong was the first of over 50.

It also resents Japan's occupation of Manchuria (twice the size of the UK) in 1931, followed by swathes of the rest of the country; not to mention America's continuous support for the nationalist Kuomintang government on the mainland, then in exile in Taiwan.

Within the Communist Party, the new general secretary, Xi Jinping, is busy consolidating his position, using anti-corruption campaigns to bolster his pre-eminence by arresting even close allies of previous leaders.Externally, his approach is bellicose, more willing to pursue China's claims further afield.

His approach coincides with rising populist nationalism in Japan. Japan's 57th prime minister, Shinzo Abe, is the first to be born after World War II, and also the first openly to worship regularly at the controversial Yasukuni Shrine, without even the standard crocodile tears to atone for Japan's war-time atrocities.The shrine commemorates those who died for the Empire attendance is political anathema across the rest of Asia.

Moreover, Abe has rolled back rules that Japanese troops should not actively serve overseas, and is increasing government spending on defence. Elsewhere, South Korea has always been nationalistic to the point of xenophobia.

Indeed, so numerous are nationalist governments in east Asia that it is easier to count those that could be described as liberal democrat: none.

Mischief, Macclesfield, Scarborough

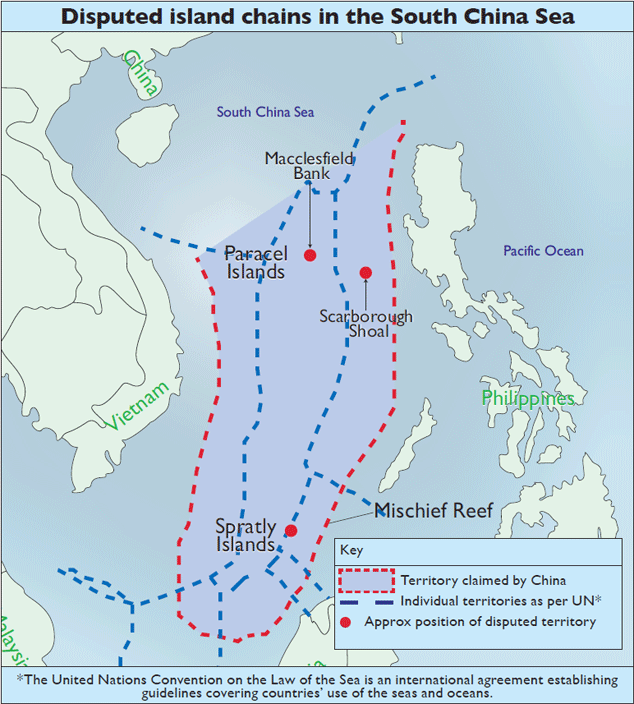

Every so often, alarm bells ring because China's official maps claim large areas of the South China Sea and the Pacific Ocean. (The first I saw was in Canton in 1984 the claims have been consistent since the Communist Party took power.)

Mischief, Macclesfield and Scarborough' may sound like a folk rock group, but in fact they are specks of almost-land in a vast sea.

Mischief Reef is 130 miles off the coast of the large Philippine island of Palawan. Four countries contest ownership, but it was quietly occupied, then fortified, by China in the 1990s.

Macclesfield Bank is one of the largest atolls in the world. Although entirely underwater, it too is subject to conflicting national claims.

Scarborough Shoal is 120 miles west of the Philippine capital Manila. It's another atoll, but a fraction remains six feet above water at high tide. Again, several countries claim ownership. And these claims are mere sparklers to the main firework displays such as the Paracel and Spratly islands in the South China Sea.

The latter has six claimants Vietnam, Brunei, the Philippines, China, Taiwan and Malaysia. Save for Brunei, each regularly occupies a handful of the islands, or occasionally drops off military personnel (or civilians) to look macho (or weep), then plants a flag to keep their territorial rights alive.

These disputes are not confined to the South China Sea. There are many further north. The most significant is over the uninhabited Senkaku island chain running north east from Taiwan, which claims them, as do Japan and China.

However, they're now controlled by Japan, following the government's purchase in 2012 of the three largest islands from a private investor for about £12m. There is much grandstanding from all three nations by land, sea and air.

Less active disputes include those over the Kuril islands north of Japan, occupied by Russia in the last weeks of World War II, and the 46 uninhabited acres of the Dokdo group of islands, owned by South Korea but claimed by Japan.

In total over 1,000 islands, reefs, atolls and submerged rocks are under dispute, from Kamchatka in Russia to various island groups near Singapore.

America dithers; Asia rearms

One reason for Asia's economic success has been (notwithstanding the debacle of the Vietnam war) that America has maintained peace through its naval and air superiority. China was weak. No other force could compete. America's defence umbrella allowed east Asian countries to focus on exports, infrastructure and growth.

Today, America's superiority remains overwhelming. In terms of tonnage, or number of aircraft carriers, its navy is larger than the rest of the world's put together by conventional firepower, over half the world total. But domestically there is no appetite for further foreign ventures.

Congress is counting the cost of its military for the first time, after decades of annual budgets that gave it even more than it requested. Then there is President Barack Obama, a domestic-orientated politician from Chicago a city over 1,000 miles from the nearest ocean. His naval and foreign policies lack consistency or coherence.

This policy vacuum has accelerated Asia's rearmament. It began, slowly at first, in China in 1981. This followed its failed invasion of Vietnam in 1979 where, to its horror, the People's Liberation Army (PLA) was held off by local militias. The idea of victory through numerical superiority was abandoned.

The PLA (which includes the navy and air force) was shrunk from over 4.5 million to 2.3 million (0.2% of the population) while simultaneously modernising, with the process quickening after the fall of the USSR.

Defence spending has doubled since 2004 and consistently rises by more than China's economic growth rate. Sea trials began in 2011 for its first aircraft carrier (ironically bought from Ukraine, where it was only part-completed).

More are planned. China is developing long-range naval capability, to the concern of its neighbours and the horror of America's now impotent neo-cons.

China friend or foe?

Responses to China's military expansion and America's dithering vary across east Asia. Most want international arbitration, which is clearly the best course. But key countries (including China) never signed up to the assorted treaties.

Others are torn between the importance of China as a vital trade partner and source of inward investment, and fear of its intentions. Should they become an ally, rearm, or both?

This confusion is most visible in the ten-nation Association of South East Asian Nations (Asean). Burma is almost a proto-Chinese colony, yet Vietnam is increasingly hostile witness the anti-Chinese riots earlier this year.

Japan's response is more aggressive, perhaps smarting because its navy is already outgunned and its place as number two in the global economy was recently taken by China.

Investors focus on Abe's three arrows' economic-reform policies. But they forget that the original plan from the 1930s that inspired Abe was aimed at recovery and rearmament.

All of the east Asian nations seem to be increasing defence spending and modernising their often feeble armed forces. A few, such as Japan and South Korea, can manufacture world-class equipment domestically, but all want the West's hi-tech armaments.

Strange new alliances are forming: Japan has just donated ten state-of-the-art patrol ships to the Philippines. Vietnam is slowly cosying up to its arch-enemy, America.

Markets are neither interested in, nor understand, these developments. America is notoriously casual about distant foreign disputes until they blow up. Europe has been on a demilitarisation bender that started well before the Cold War ended.

In 1952, the UK spent 9.7% of GDP on defence (over 25% of all government expenditure). By 1990 it was 4.1% and today it's about 2.4%. This pattern prevails across most EU nations. Apart from apostles of Lady Thatcher, Europeans can't believe any country would risk war over a few barren islands.

Yet, they shouldn't take peace for granted. The reasons for east Asia's island disputes vary. Some claims have merit as unfinished business from temporary' expedients after World War II.

Others have no military or economic logic, with neither sea lanes nor minerals at stake. And a few are absurd; one reason given for China's overlordship claim for the South China Sea dates back to the Xia dynasty of 2070-1600 BC.

Worryingly, most of these disputes look less like Rockall', when nothing happened, and more like Princip's luck'. That's because the dominant motive behind them is the most dangerous of all: national pride.

This complacency is one reason armament stocks have generally done poorly for much of the last decade.

They remain out of fashion, especially as foreign involvement in Afghanistan draws to a close and Nato nations eschew new military exploits. Yet buying these stocks (see below) is also an insurance policy for wary investors.

Only the delusional would hope for a war. But only the bone-headed assume human nature has changed for the better, or that the growing number of flashpoints and militarisation in the western Pacific won't result in accidental or deliberate armed conflict.

The five defence stocks to buy now

There are many listed defence companies in the world.Their key customers are governments, whose overall spending has been falling since 2011.

In 2013, global military spending came in at an estimated $1.75trn. America led at $640bn, then China at $188bn (see chart), Russia on $88bn and Saudi Arabia at $67bn. As a result, the largest defence companies tend to be in America, while many of the rest vie for a share of the American pie.

Because orders are lumpy' and depend on government decisions, earnings are volatile. Western defence firms also suffer political scrutiny, both on moral grounds (should they be selling weapons to dictators to suppress their own people?) and due to tighter anti-bribery legislation (in a business where contracts are rarely awarded solely on merit).

With the exceptions of China, Russia and some Middle Eastern countries, most governments continue to spend less on defence, and so the sector needs continuously to rationalise and control costs. As a result, valuations are reasonably attractive.

I've looked at five stocks here, each with healthy-enough balance sheets and a sufficient business range to maintain or grow profits.

Raytheon (NYSE: RTN) is best known for its missile systems, but has other high-tech electronic divisions. The market capitalisation (number of shares multiplied by the share price) is $30bn and the forward price/earnings (p/e) ratio is 13.7.

In Japan, armaments remains a taboo subject so companies play down their war-like attributes. But conglomerate Mitsubishi Heavy Industries (Tokyo: 7011) in which I have a small interest is well placed for higher defence spending.

Best known for its Zero fighter in World War II, it owns businesses ranging from marine vessels to waste equipment and nuclear power and it is also the top provider of fighter aircraft and anti-submarine helicopters to Japan's forces.

New contracts and joint-ventures with American fighter companies are expected. It trades on a forward p/e of 12.8 and has tended to track the index; it should break free given five-year earnings growth of more than 40%.

Singapore Technologies Engineering (Singapore: STE) is Singapore's de-facto government-sponsored national champion in aerospace and aircraft maintenance and repair, both civil and military.

Singapore remains the go-to' regional servicing centre. Revenue and net income have increased steadily over the last five years, resulting in it outperforming the wider index.

In the UK, BAE Systems (LSE: BA) is a global leader. Cash flow and earnings per share have been grim over the last five years: the FTSE 100 is up 62% in that period, while BAE is up just 32% (excluding dividends). But with its bribery scandals seemingly ending, the shares should recover.

Babcock (LSE: BAB) which I also hold personally is a key service supplier to the Ministry of Defence and the major beneficiary of outsourcing. The share price was recently hit by an unexpected rights issue for an overseas acquisition, making for a good entry point.

Jonathan Compton was until recently MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jonathan Compton was MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how