Gamble of the week: Royal Mail's plucky rival

This independent parcel delivery service stands to profit from the growth of online shopping, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The privatisation of Royal Mail continues to take up a lot of column inches. But meanwhile, this smaller rival the country's largest independent postal operator is quietly getting on with making money.

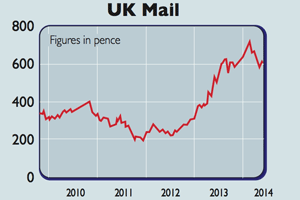

The business has been around since 1971 and up until 2009 was known as Business Post. It just announced a 28% jump in full-year pre-tax profits. Despite a strong run up inthe share price over the last 18 months,I think it could be a good long-term bet.

You won't see any of its posties pounding the streets. It works in partnership with Royal Mail, who deliver its letters for it. UK Mail (LSE: UKM)gets a lot of its letter business from financial, publishing, retail and utility firms, and makes a decent profit from them.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But the real reason to invest in UK Mail is not letters, but parcels, where volumes grew by 19% last year. More of us are doing our shopping online, which is leading to rapid growth in parcel deliveries.

This is a very crowded market, with the likes of Royal Mail, DPD and Yodel throwing a lot of money at it.So, to be a good investment, a business has to have a competitive edge and I think UK Mail has it, in the form of its delivery network.

It all stems from a central hub in the Midlands, spreading out to 50 sites across the UK. By combining its letters and parcels business across the same network, UK Mail is able to get lower unit costs than many of its rivals, better efficiency and better customer service levels. This makes it very profitable.

A new hub and extra sites are being built, adding more capacity. As more of the sorting becomes automated, this shouldfeed through to more efficiency andlower costs, reinforcing its competitiveposition. This should allow UK Mail totake a bigger slice of the parcels market.

The firm is also expanding into nichebusinesses, such as packets delivery anddigital printing, which have the potentialto boost profits. Parcels growth willslow this year because it will be tough toreplicate last year's stellar performance.

UK Mail is also a little short of capacityuntil its new hub is finished in 2015. Theshares are no bargain on nearly 18 timesforecast earnings, but UK Mail lookscapable of growing strongly over thenext few years.

The big risk for investorsis that the new hub disrupts its businessand leads to poor service and a loss ofcustomers but assuming it avoids this,it should be able to takes market sharefrom Royal Mail while benefiting fromgrowth in the parcels market.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how