Japan is due a comeback

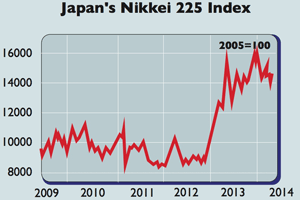

Japanese stocks have had a tough time so far this year. But don't write off a rally.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

2014 has not been kind to Japan bulls. After rocketing by almost 60% in 2013, the Nikkei has slid by over 10% this year. The yen has strengthened amid global market jitters, threatening to undermine the earnings of Japan's major exporters, who dominate the stock markets.

Investors also appear to have lost some confidence in Abenomics', the authorities' attempts to end deflation with money printing and boost growth via structural reforms.

In particular, some worry that a recent rise in Japan's consumption tax (VAT), designed to trim Japan's huge budget deficit of more than 7% of GDP, could choke the recovery, as happened in 1997.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But the fears look overdone. Japan's market seems likely to mount a recovery in the next few months. As for structural reforms, markets have been frustrated by Japan's refusal to force its agricultural sector to become more competitive.

It has refused to trim agricultural tariffs as part of a free trade deal with America. Still, says Andy Mukherjee on Breakingviews, Prime Minister Shinzo Abe "has other ways to demonstrate his reform zeal and he's taking them".

The government has set up special agricultural zones that will abolish local committees controlling farm ownership, one reason why the sector remains inflexible and fragmented. Relaxed labour laws in Tokyo and Osaka will give firms more scope to hire foreign workers. Abe also plans to tackle healthcare costs.

The consumption tax is hitting household spending and the economy may shrink in the second quarter. But as Eric Pfanner says in The Wall Street Journal, sales have not fallen by as much as expected so far. A tightening labour market and widespread wage hikes in contrast to 1997 give reason to expect a rebound in the third quarter.

Finally, with inflation above zero but not likely to hit the central bank's 2% target, more money printing is on the cards, notes Capital Economics. With other central banks unlikely to follow suit, that implies a weaker yen, which is good for stocks.

Valuations remain appealing and the government is promoting Isa-style investment accounts, an extra boost for equities. Investors, says Mukherjee, should soon "realise they have been too pessimistic".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how