America's stock market rally is on borrowed time

Profit warnings in America suggest the rally is running out of steam.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

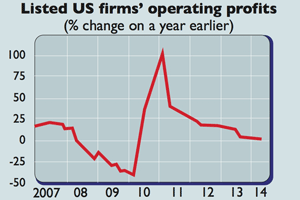

American corporate profits appear to be "running out of steam", says Buttonwood in The Economist. They had recovered after the crisis and are close to a post-war record as a proportion of GDP.

But first-quarter S&P 500 earnings estimates were revised down by more than 4% between January and March, and profit warnings have been unusually plentiful.

Remove the effect of one-off items, such as a big write-downs the year before, and you will see that year-on-year profit growth is falling, according to Morgan Stanley Capital International. And a quick rebound looks unlikely.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While revenue growth has been gradual, profit margins are near record highs and due to fall, says Doug Kass of Seabreeze Partners Management. "We've had years of fixed-cost reductions by corporations and that's basically over, because they've cut to the bone."

There is scant additional scope for bolstering productivity and the labour market should gradually tighten, raising staff costs. The picturein America, which sets the tone forworld markets, isn't offset by especially strong outlooks elsewhere.

In Britainand the eurozone strong currenciesweigh on earnings. In Europe thishelps explain why profits have yet to rebound convincingly despite the economic recovery.

In many stock markets, companies derivea growing proportion of profits fromemerging economies, many of which have been slowing and undermining multinational companies' earnings through falls in their currencies.

All this adds up to a lacklustre future backdrop for global profit growth, which has already disappointed: in 2013, it reached 7%, compared to forecasts of 12% at the beginning of the year; in 2012 it hit just 2%, while the initial estimate was 11%.

Global stock markets have been "remarkably resilient" despite unimpressive earnings, soaring by 13% and 24% in 2012 and 2013 respectively, says Buttonwood.

But lacklustre earnings are now going to become ever harderfor investors to ignore which isanother reason to fear that this rally, already the fourth biggest and fifth longest for the S&P 500 since 1928, ison borrowed time.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how