Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Star fund manager Neil Woodford's departure from Invesco Perpetual has hit his funds hard. His Income and High Income funds saw outflows of £1.4bn in the month to 11 December alone.

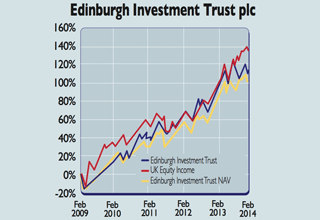

This "mega-sized" £1.1bn investment trusthas also suffered over the uncertainty of who will fill Woodford's shoes, says Kate Morley in the Investors Chronicle.

The good news is that the trust which has, unusually for an investment trust, tended to trade at a premium to net asset value (ie, for more than its underlying portfolio is worth) is now trading at a small discount.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Moreover, the incoming manager of the Edinburgh Investment Trust (LSE: EDIN)has a track record to match Woodford's.

With his Perpetual Income and Growth Investment Trust, Mark Barnett delivered a 130.7% return in the five years to 31 December 2013 not far off Woodford's 135.8% return over the same period with Edinburgh.

The trust invests mainly in UK shares, which account for 83% of its holdings. It aims to beat the performance of the FTSE All-Share index. Just over a third of the portfolio is in healthcare, 22.8% in consumer goods and 19.6% in industrials. Barnett hasn't revealed his strategy in detail, but he believes that equities may well generate lower returns in 2014 than in past years.

Adrian Lowcock of Hargreaves Lansdown thinks he will trim the number of holdings in the trust, and hold fewer large stock positions than Woodford. With an ongoing charge of 0.71%, the trust should suit investors looking to boost their exposure to UK stocks.

| AstraZeneca | 9.3% |

| GlaxoSmithKline | 8.8% |

| BT Group | 7.8% |

| British American Tobacco | 6.2% |

| Roche Holdings | 5.8% |

| Imperial Tobacco | 5.2% |

| BAE Systems | 5.2% |

| Reckitt Benckiser | 4.6% |

| Capita | 4.3% |

| Reynolds American | 4.3% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul