Gamble of the week: A punt on British shale gas

Smaller companies are always risky, says Phil Oakley. But this small-cap energy firm could be a great way to play Britain's fracking revolution.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investing in smaller companies can be fun as long as you are aware that the risks are usually very high. For years the Alternative Investment Market (Aim) has been home to oil and mining companies that have promised great riches, but have often ended up burning investors with big losses.

If you are going to buy the shares of these companies, then you must be prepared to lose a large chunk if not all of your money. However, while there's a large speculative element at play here, not all Aim-quoted oil companies are akin to spinning the roulette wheel.

Take IGas Energy (Aim: IGAS), Britain's largest onshore producer of oil, for example. With reserves of around 20 million barrels, the company is producing and selling oil (and some gas) and is actually profitable, which gives some underpinning to the share price.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The prospects here are very reasonable, as production rates are being boosted by better drilling techniques. The company also has the potential to make money from untapped conventional gas reserves.

Whether shares will see a spike or not depends on the potential of IGas to find and extract lots of shale gas and coal-based methane also known as coal-bed methane, a form of natural gas extracted from coal beds. IGas has exploration licences for shale gas in northwest England, which could transform the value of the company.

Local communitiestend not to want this kind of thing going on in their back yards and so put up stiff resistance.

The government, though, is beginning to put its weight behind the shale gas industry as a way of sorting out Britain's energy problems, and this could help the likes of IGas. The company itself is making an effort to reassure local communities.

It's also positive that big gas companies such as Centrica, GDF Suez and Total are putting money into British shale gas. These companies will be very important to developing shale gas fields if meaningful amounts of it are found.

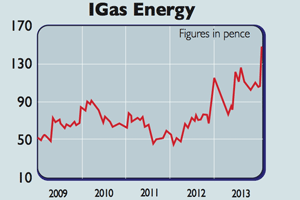

The fact that IGas is generating its own cash means that it's unlikely to need fresh money any time soon. The shares have already had a strong run, but if you are looking for a punt on shale gas being developed in Britain, then IGas is probably your best bet.

Verdict: a speculative buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.