Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A number of people have asked me - how can I be so bullish about gold and be bullish on the dollar? Surely one is the inverse of the other. They can't both rise together, can they?

Also, we've had quite a correction in the gold price since the highs of early December. Gold is off some 15%. So is my price target of $1,400 an ounce for gold this spring still a possibility?

I've had a lot of emails about these questions. So in today's Money Morning, I'd like to take a look at the prospects for gold...

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Largely speaking, gold will fall if the US dollar rises and vice versa. But that's not a hard and fast rule. This chart below shows the fourth quarter of 2005. You can see that, broadly speaking, the two rose and fell together (the red line is the US dollar, the blue line gold).

There was a similar period in early 2009. So being bullish on one doesn't necessarily make me bearish on the other. What I am bearish on, however, is sterling.

Gold and cash look the most attractive places for your money

It's crazy to move all your wealth into one asset class. But when people ask me what to do with their money, it's so hard to answer. Stock markets look like they've turned down. We had a rally yesterday, but I can't help thinking it was no more than a temporary bounce. Commodities look risky at these levels. Real estate that's just a question of when, not if. Corporate bonds we've had the rally. Now's not the time to buy in. And who'd buy government bonds with so much sovereign debt risk?

So that leaves gold and cash, neither of which pay any interest (well, negligible interest in the case of cash). Right now, I think it's wise to own a healthy mix of the two.

But we all know the problems of our debt levels in the UK. Sterling suffered big falls in 2008, but like stock markets I suspect 2008 may have just been the beginning. The UK doesn't have Germany to bail us out.

Special FREE report from MoneyWeek magazine: When will house prices bottom out - and how will you know?

- Why UK property prices are going to fall 50%

- When it will be time to get back in and buy up half price property

Looking at the chart below of sterling vs the US dollar, there is a trend channel in place (lightly falling) and sterling has slipped to the bottom of it. So it could rally here. But if it breaks below that channel ouch. $1.57 was a key low and we have broken below that.

But while sterling looks very risky in the short-term, the euro clearly isn't much better. As for the dollar, I'm medium-term bullish because I expect the next liquidity crisis to result in a rush to the reserve currency. But in the longer term that'll just result in governments printing more money. The yen is also flawed, with the Japanese government hugely indebted. So is it any wonder I advise investors to hold gold?

Will gold still hit $1,400 an ounce by the spring?

So what about my target of $1,400 gold by this spring?

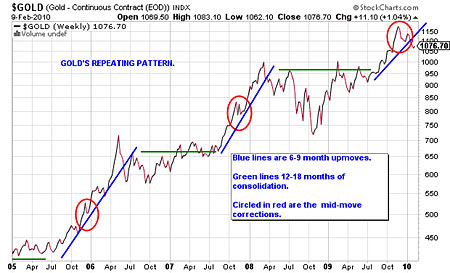

I arrived at this target based on a repeating pattern that gold has made over the past five years or more. Gold makes an up-move of some six to nine months, usually from a summer low, followed by a year to 18 months of consolidation. Then another up-move begins. Roughly halfway through each up-move, we get a correction of around 10%. Below is an illustration of what I'm describing:

We may just have had the mid-move correction. But its rather lengthy duration is of concern. I suggested in a previous Money Morning (How high can gold go?) that an ideal scenario would be for gold to go back, test its old high around $1,030, and bounce off it.

We briefly retested it on Friday and gold bounced off it like a kangaroo. But any subsequent re-test must hold. If my spring target of $1,400 is to be reached, it's imperative that the $1,000 to $1,040 level is not breached.

As well as being the old high, this is the level at which India's central bank bought its 200 metric tonnes. Both technically and fundamentally, there is a great deal of support there. I imagine many traders will cover shorts between $1,030 and $1,050, while many others will have buy orders at those levels. But they will also have stops - i.e. they could sell again - just below $1,000. So the price could fall pretty quickly if $1,000 doesn't hold.

If it does hold, a second up-wave taking us beyond December's highs to around $1,400 is a real possibility, even with a strengthening dollar late 2005 proved that. But if it doesn't, we can forget that spring target for now.

Gold is tied to stock markets for now

Most gold bugs are very pro-free market and anti any sort of government interference. As gold was once a form of money that was to a degree beyond government control, they see it as a contrary investment to suit their own contrary natures. Their ideal scenario is to see gold and gold shares rising, while everything else falls, and currencies lose their purchasing power as inflation strikes.

But that hasn't happened.

Gold, for the time being, has largely been rising and falling with other assets, be they stocks, commodities or real estate. It is the US dollar that has been the contrary trade. Goldbugs are waiting for the time when gold de-couples and does its own thing. They may be waiting a long time.

The big moves in gold stocks in the 1930s came after 1932, when stock markets had finally bottomed and were rising. In 1979, towards the climax of gold's last great run, gold actually fell with stock markets in October and November. Gold made its historic high of $850 when the Dow was rising.

In 2008, it was the same. Gold fell with stock markets. Gold and emerging markets then led the subsequent bounce. The difference is that gold fell by less than stock markets and subsequently rallied by more. This post-credit bubble environment is favourable to gold.

This correlation is worth being aware of. What it means is that if stock markets capitulate here as they could well do then gold could well go down with them. If that's the case, then my $1,400 spring target won't happen. But on the rally out of the subsequent low, it will.

Our recommended article for today

Why sinful stocks can be good for your wealth

With returns 11% higher than the market average, so-called 'unethical' stocks can be real money spinners, says Martin Spring. Here, he picks 18 stocks for the broad-minded investor's portfolio.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how