Three sound reasons to own gold

Gold's bull-run continues. But it's an expensive, largely useless metal and costs money just to hold. So why do people persist in buying the stuff? Adrian Ash explains gold's three principal attractions.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"I know the Government are intent on decimating the country's gold reserves to replace them with a whole series of overseas currencies. [Yet] they are not only selling gold but devaluing our remaining gold supplies by announcing their intention to sell in advance, which leads to a lower price on sale..."

- Nick Gibb MP, debating the UK Finance Bill, 13 May 1999

It was ten years ago that Gordon Brown shocked the gold market (not to mention the newspaper subs) by announcing a huge 400-tonne sale of gold from the UK's reserves.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

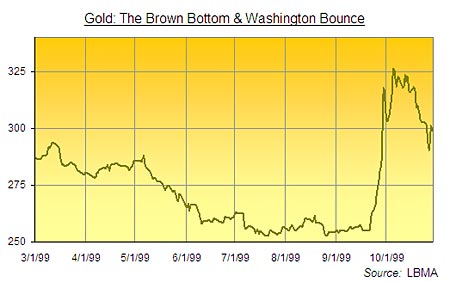

Gold prices fell on the news, losing 2% for the day and dropping one-eighth to fresh 20-year lows by the time the Treasury's auctions actually started that autumn.

And to mark the occasion and mark it almost alone the Financial Timessaid that "Europe's central banks are $40bn poorer than they might have been after they followed the British move."

No, not quite. Because the gold that they sold a total of 3,811 tonnes by all accounts could only become money on sale. Until then, it was just gold to them, and holding it didn't make Europe's central banks any richer. It would simply mean they had 3,811 extra tonnes of gold in the vault.

Which is a very different thing from holding an extra $40 billion.

"What is the rationale for holding gold, a non-interest bearing asset, given that there is no more official role for gold since the collapse of the gold exchange standard?"

So asked Herv Hannoun [pdf] of the Banque de France during the FT's Gold Conference in mid-2000. As you can guess, it was a rhetorical flourish. Because nine months after signing the "Washington Agreement" to cap central-bank gold sales at 400 tonnes per year a pact sparked by Gordon Brown's indiscreet selling and which in turn sparked a sharp rise as the threat of indiscriminate selling fell back the Frenchman in fact had answers aplenty.

"Second, liquidity: in situations of political turmoil or high global inflation, gold's liquidity is unchallenged...Its liquid quality becomes apparent and increases as uncertainty grows. In this regard, the absence of a return on gold can be viewed as the price of its 'option component': contrary to most other assets, Gold Prices go up when things go wrong."

So far, so yellow and shiny. And during that after-dinner speech tellingly arranged by investment-bank Goldman Sachs, a key advisor to Gordon Brown's gold sales in 1999 Hannoun would go on to deny the French central bank had any plans whatsoever to sell gold from its vaults.

Why? Because "Gold is an asset of last resort par excellence and recent market developments [i.e. the 'Brown Bottom' in prices and ensuing central-bank agreement to limit sales in future] have in no way altered its intrinsic qualities. There is still a rationale for central banks to hold gold."

Roll on ten years, however, and those two wonderful attributes of central-bank gold first security, then liquidity amid crisis have so far paled compared to Hannoun's third rationale: diversification.

"Gold is also a very good diversification instrument. Indeed in the long run, the price of gold has shown a very low and even a negative correlation with the dollar (the first-ranking reserve currency) and with US Treasuries. So gold is very useful to build a diversified portfolio as it enables you to improve your risk/return profile."

Odd, but with gold prices rising and rising three-fold and more against both the dollar and euro since the start of 2000 the Banque de France has since sold 520 tonnes of gold bullion over the last half-decade, all announced within "Washington II", the renewed (and expanded) central-bank gold agreement signed in Sept. 2004.

France still has another 60 tonnes slated for sale between now and September, when CBGA II will expire. Whether or not the signatory banks all sign up again remains unclear for now (renewal in 2004 was completed by March.) But private investors trying to judge their own exposure to gold might want to consider the three rationales laid out by M. Hannoun back in 2000.

Security, liquidity and diversification.

This article was written by Adrian Ash, editor of Gold News and head of research at BullionVault

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Adrian has written all things gold related from if it’s worth buying, what the real price of gold should be and what’s the point of gold for MoneyWeek. He has also written for other leading money titles on his gold expertise including Business Insider, Forbes, City A.M, Yahoo Finance and What Investment Magazine. Now Adrian is head of the research desk at BullionVault, a physical market for gold and silver for private investors online.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now