Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There's been quite a slide in the gold price recently. From its high of February 20th, which saw it touching $1,000 an ounce, on Monday we hit $870. That's quite a correction in just six weeks. It's even down 15% against the basket case that is sterling.

So is the bull market in gold over?

Gold is not a hedge against inflation...

Ask any lazy financial journalist or fund manager why you should invest in gold and they will trot out the line: "It's a hedge against inflation". Let's start by laying this poorly-thought-through and, indeed, deceptively inaccurate cliche to rest.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The 1970s was a period of inflation and the gold price rose. Thus, in the minds of many, gold rises in times of inflation. But 1980 to 2000 saw unprecedented growth in the supply of money and credit in other words, more inflation. Yet the gold price fell by 75% from its 1980 high of $850 to $250.

The latter was also a period of asset-price inflation, where the prices of houses and stocks rose with the expansion of credit, while the cost of mass-produced goods (particularly electronic goods) and food (in proportional terms) fell. Gold was no hedge against this. Apart from a Sony Betamax, it was about the worst thing you could have owned. Even plain old depreciating cash was a better place for your money.

...it's a hedge against government

No, gold is a hedge against government more specifically, against incompetent leaders and a malfunctioning state. In the late 1970s, things had got out of control. In the US, Jimmy Carter was floundering. Our own Labour government was on the rocks; even Margaret Thatcher was, initially, the most unpopular prime minister since the WWII. The Russians had invaded Afghanistan. As a consequence, gold was rising. Ignoring the notorious intraday spike to $850 in January 1980, gold's real high was just above $700, where it made a double top. (Of note: this is the same level where gold found support after its capitulation last October).

Its parabolic uptrend was not broken until late 1980 and its longer-term uptrend was not broken until 1981, by which time Ronald Reagan was sitting in the White House and then-US Federal Reserve chief Paul Volcker's defence of the dollar was entrenched. In other words, gold's uptrend was broken when Western leaders started to get things back under control.

Its decline continued throughout the Reagan era, through Thatcher, George Bush Senior, to Bill Clinton and Tony Blair. You might not have liked them or their policies, but, for the most part, their leadership was strong, largely unthreatened and so successful. Readers should note that this latest bull market in gold began in 2001, with rising levels of geopolitical instability and coincidentally, with the arrival of one George W. Bush.

Looking at more recent events, gold's sell-off began with a normal seasonal correction in late February from an obvious point of overhead resistance, $1,000. It made an unsuccessful bounce from $900 to about $960, from where it has rapidly fallen to $870.

This fall coincided with London's G20 summit. There have been suggestions that this fall has been orchestrated. World leaders do not want a soaring gold price undermining their show. But the hardest sell-off has actually come since. What was announced? Inflation, basically, in the form of IMF funds, bail-outs, more spending the usual. Yet gold sold off. Repeat after me: "gold is not a hedge against inflation".

Enjoying this article? Sign up for our free daily email, Money Morning, to receive intelligent investment advice every weekday. Sign up to Money Morning.

Is the bull market in gold over?

The G20 meeting was never going to solve the global economic crisis, but it was largely seen as successful. A believable show of global government unity was made so much so we had to listen to Gordon Brown's New World Order nonsense again. Some might claim the G20 is "not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning." Gold certainly thought so, and sold off. In other words, after this show of competence from global leaders, the markets felt less need for gold.

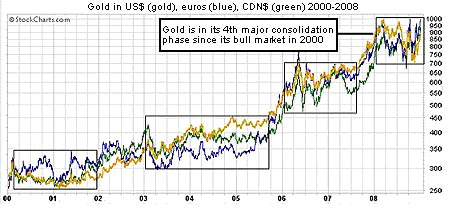

There is a chance that gold has done a double top at $1,000 and this is the end of the bull market. I doubt it, but we cannot rule it out. However, my view hasn't changed. Gold has made a repeating pattern throughout this bull market - it rises for a six-to-nine-month period, then consolidates for a year to 18 months, before its next rise. It does this no matter which currency you measure it in as the chart below from Sitca Pacific shows, the pattern is the same.

That's why I recommended taking profits in gold on February 18th. It's why I said in last week's MoneyWeek cover story(if you're not already a subscriber, subscribe to MoneyWeek magazine), that I remain neutral on gold for the next few months. It's why I said in our new year's predictions that I do not see new highs in gold until the winter.

We have a further period of consolidation to get through. We will most likely find a tradable low, just as everyone is throwing in the towel in frustration, this July or August. For now I see support at $840; if that doesn't hold there is more at just below $800, then at $750 and then, heaven forbid, we re-test the October-November lows around $700.

The G20 might have provided a minor confidence boost at a time when other leading indicators have stopped falling as brutally. But how long can it last? What's changed? We keep hearing about regulation, but what actual reforms of the banking system have been made? Who, apart from Liam Halligan in The Telegraph and Paul Volcker, is calling for a Glass-Steagall equivalent, where investment banks can no longer speculate with tax-payers' bank deposits? Are any leaders talking about spending less than we earn, then saving and investing the difference? Which governments are slashing spending and reducing debt? Who has suggested returning to an asset-backed currency that governments cannot issue, print or 'quease' to oblivion? I can go on.

Leaders will do well to brush up on their Shakespeare. "I can get no remedy against this consumption of the purse," moans Falstaff in Henry IV part II. "Borrowing only lingers and lingers it out, but the disease is incurable". Until the causes and not just the symptoms of the disease are either dealt with or, more likely, naturally burn themselves out, we will have a bull market in gold.

Our recommended article for today

How to profit from tomorrow's tiny technology

The science of nanotechnology - engineering at a molecular level - has enormous potential for the future in almost every facet of life. Here, Jim Stanton looks at one way for investors to get in on the action.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.