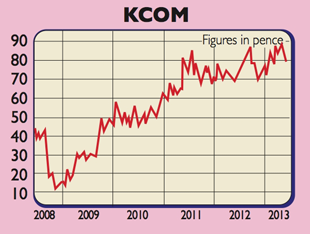

Gamble of the week: A telecoms stock going cheap

Not only does this telecoms network holds one of the few remaining monopolies in Britain, it's also well-placed to grow its dividend. That makes the shares look like a good value buy, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

KCOM Group (LSE: KCOM) is best known for owning and operating the telecom network in Hull and East Yorkshire. This network is one of the few remaining telecom monopolies in Britain and underpins the value of the group.

The near-term outlook for KCOM's telecoms business looks good. A strategy that is working for BT in the rest of Britain, selling super-fast broadband and TV, looks set to work for KCOM in East Yorkshire. Better still, KCOM has one main advantage over BT; it can't win many new customers, but it can't lose many either. Meanwhile, it can sell its customers more services and increase the average revenue per user.

There's plenty of potential to do this via its rollout of fibre optic broadband services and the fact that the number of customers buying bundled services (phone, broadband and TV on one bill) is still quite small. YouView, the fast-growing TV service that has worked well for Talk Talk, should also help KCOM.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

KCOM's telecoms services division competes for business across the whole of Britain. It is finding life tougher at the moment but is winning new business in both the public and private sectors. Its internet services business is also showing strong growth in its order book, where cloud computing products are doing well. This division is a good source of profits and cash-flow growth for the group.

One of the key attractions of KCOM is that it is far less indebted than many other telecom companies. Net borrowings are broadly equivalent to its annual gross cash flow, which is very low, and it does not have a big pension fund deficit. This gives it the potential to invest in fibre-optic broadband without cutting dividends to shareholders.

KCOM's ability to pay growing dividends makes me think that the shares are cheap. It has promised to grow its payout by 10% a year for the next three years. Anyone buying the shares at 82p will have a dividend return on their investment of 7.1% by 2016. Reinvesting those dividends to buy more shares may pay off too.

The big risk with KCOM is that a future government decides to end its East Yorkshire monopoly. This is what makes the shares somewhat of a gamble, but one that could nonetheless pay off.

Verdict: speculative buy at 82p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.