Invest in the future of British gas

Britain currently imports 40% of its gas - much of it from Russia. Soon that will rise to 80%. And unless we invest heavily in energy security, we will be at the mercy of geopolitical whim. Eoin Gleeson examines the gas storage industry, and picks the best bet in the sector.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Vladimir Putin loves to flex his muscles. Every year, as the Arctic cold descends on eastern Europe, he gives Ukraine a show of his strength by threatening to turn off the gas pipelines which keep the country from freezing over. Ukraine protests. The taps are duly shut. And half of Europe then huddles together for warmth.

But Putin's antics now threaten Britain too. When Gazprom turned off the taps in 2006, we were so close to running down gas reserves that the National Grid prepared to cut areas of the country off. Indeed, Britain faces mounting problems. It sources a good deal of gas through contracts with European energy groups and is in desperate need of storage for gas reserves, says The Economist. We only have enough gas storage capacity to satisfy 14 days of average consumption. That compares to the 99 days that France has in reserve and 122 days in Germany.

There are two reasons for the shortfall. Having discovered vast gas reserves in the North Sea three decades ago, Britain felt little need to worry about supply disruptions. Yet we imported about 40% of our gas last year. And as North Sea output declines, Britain is expected to import 80% by 2015. Some of that will be imported from Norway. Much of it will come via temperamental Russia.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The second reason gas reserves are so inadequate is the difficulty in building storage. The majority of the gas that Britain holds in reserve is stored at the Rough facility in the North Sea, 18 miles off the east coast. The gas is found in reservoir formations in the depleting natural gas fields. But gas is also often stored in salt caverns. And local councils get very twitchy about private companies blasting vast underground caves. So securing consent to develop a gas storage facility is a nightmare.

It's also horribly expensive. Gas companies have shied away from spending a fortune building terminals onshore. Not to mention the hundreds of millions more it costs to provide the cushion gas that is needed to make these reservoirs effective. So although five years ago the regulator Ofgem predicted the UK would have built ten billion cubic metres of capacity by the end of the decade, we only have about 4.3bn cubic metres.

Worse, "Britain's plans to increase gas storage run the risk of being left in tatters by the credit crunch", says Mike Major in Oil & Gas Engineer. Major projects are being delayed as companies struggle to find funding. But that could soon change. Last week Portland Gas (see below) started work on the initial stage of a project to develop 14 salt caverns to store 1bn cubic feet of gas off the Isle of Portland in Dorset. The facility will be constructed in a number of stages starting with drilling and construction, followed by laying pipelines and onshore storage. Meanwhile, Stag Energy is seeking funding to construct 19 underground caverns to store 1.5 billion cubic metres of gas beneath the Irish Sea.

There are risks though. Projects will need the backing of government and energy companies. And although the Portland project is scheduled to be at full capacity in 2016 or 2017, the company will need to secure £450m in funding, notes Martin Li in Investors Chronicle. "This is a classic high-risk play." But it wouldn't take too many rolling blackouts in Britain for the government to give Portland and Stag Energy their full and unreserved backing. And if Britain doesn't invest heavily in energy security soon, we should expect to be held to regular ransom by our neighbour to the east.

The best bet in the sector

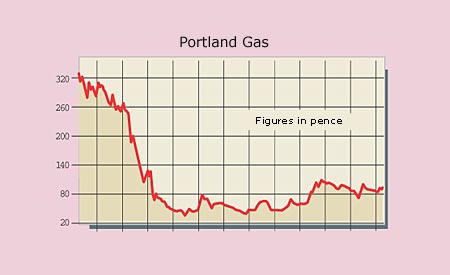

Portland Gas (LSE: PTG) has been fighting to get the Dorset project up and running. A struggle for finance saw the stock drop from a peak of 430p to the 93p it trades today. Indeed, the company has had to adopt a phased approach in order to reduce initial construction costs. For example, it farmed out the initial construction of the project for £300,000 to Hydrock Consulting.

But everything rests on whether it can secure the £450m needed to complete the project. Portland's management has already amended its target for first gas from mid to late 2011 to the first quarter of 2012. The project faces further delay if the company is unable to construct the necessary pipelines across Weymouth Bay before Olympic sailing trials take over the area in 2011.

But having completed the tortuous planning process, progress has been made. The Dorset project would be the UK's largest onshore gas storage facility potentially able to provide 5% of the UK's peak daily gas demand. Portland also has a second project at Larne Lough in Northern Ireland, where it is aiming to secure a planning application later this year. It's quite a gamble. But "Portland's shares could fly should it secure project finance", says Martin Li in Investors Chronicle.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets