Forex Trading

The latest news, updates and opinions on Forex Trading from the expert team here at MoneyWeek

-

Is Wise a trillion-dollar opportunity for investors?

Foreign-exchange transfer service Wise has the potential to become the Amazon of its sector – here's why you should consider buying this stock now

By Jamie Ward Published

-

It's time to back the yen, says Dominic Frisby

The Japanese yen has been weak for a long time, says Dominic Frisby. That may soon change.

By Dominic Frisby Published

-

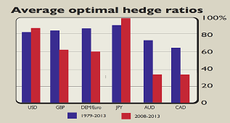

Hedge your bets against forex turmoil

Features Does it make sense to hedge your currency exposure, or is it likely to result in lower returns? Cris Sholto Heaton investigates.

By Cris Sholto Heaton Published

Features -

The FX fixing scandal

Features New allegations suggest that key benchmark rates have been manipulated in the foreign-exchange (FX) markets. Are traders gaming the system? Matthew Partridge reports.

By MoneyWeek Published

Features -

How to trade in the forex markets

Tutorials It's not hard to see why currency trading is so popular. But fail to take the proper precautions, and you could lose more than you bargained for.

By moneyweek Published

Tutorials -

Four ways to play the forex markets

Tutorials Currency markets: Four ways to play the Forex markets.

By moneyweek Published

Tutorials -

What are the best bets in forex now?

Features When it comes to currency trading, it is perception rather than the true economic situation which matters most. Analyst Paul Rodriguez reveals the key trends that are driving the forex markets right now.

By MoneyWeek Published

Features -

The MoneyWeek guide to forex jargon

Features Talk of 'loonies', 'swissies', 'ticks' and 'pips' can be offputting for private investors. But you only need to understand a few key phrases in order to get started.

By moneyweek Published

Features